Exhibit 99.2

Ayr

Wellness Reports Fourth Quarter and Full Year 2020 Results

| · | Q4 Revenue up 48% Y/Y to $47.8 Million; Full Year Revenue up 25%1 Despite Covid-Related Shutdowns in 2Q |

| · | Q4 Adjusted EBITDA up 111% Y/Y to $19.4 Million; Full Year Adjusted EBITDA up 63%1 |

| · | Successfully Raised $110 Million in Debt and $48 Million in Warrant Exercise, Ending 2020 with $127 Million of Cash; Raised Additional $118 Million in Equity Subsequent to Year-End |

| · | Generated Over $7 Million in Cash from Operations in Q4 and $36 Million for the Year |

| · | Closed on its Two Acquisitions in Pennsylvania in Q4; Opened Second Pennsylvania Dispensary in February |

| · | Recently Closed Acquisition of Liberty Health Sciences, Adding 31 Retail Dispensaries, the Fourth Largest Footprint in Florida |

| · | Arizona and Ohio Acquisitions Expected to Close Later this Month |

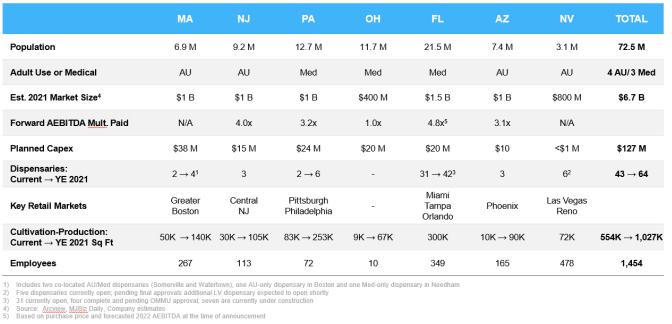

| · | Pending Acquisitions in Arizona, Ohio and New Jersey Will Bring Addressable Market to Over 73 Million in Seven States |

Toronto, Ontario, March 11, 2021 – Ayr Wellness Inc. (CSE: AYR.A, OTCQX: AYRWF) (“Ayr” or the “Company”), a vertically-integrated cannabis multi-state operator (MSO), is reporting financial results for the three months and full-year ended December 31, 2020. Unless otherwise noted, all results are presented in U.S. dollars.

“2020 was a year of transformation for Ayr,” said Jon Sandelman, CEO of Ayr Wellness. “We are excited to report a strong finish to the year with fourth quarter revenues up 48% year-over-year and adjusted EBITDA up over 100% and we continue to maintain margins at the high end of the industry. And while we continued to deliver strong operating results throughout the year at our market leading operations in Massachusetts and Nevada, the Ayr story of 2020 was about building a foundation for a new Ayr Wellness, a bigger and better MSO. We spent the end of 2020 aggressively expanding our footprint and investing in our business to be positioned for exceptional growth in 2021 and 2022. We began 2020 as a 2-state MSO and we begin 2021 as a seven-state, top-5 MSO and we aren’t done yet.

“2020 was also a year of great change for the industry as new states moved forward with adult-use programs and the federal election shifted the tides in Washington. We enter 2021 with leading scale, talent and a recently bolstered balance sheet, that currently has more than $236 million of cash. The investments we made in the fourth quarter in additional infrastructure and people will prove critical as our new operations in Pennsylvania, Florida, New Jersey, Arizona and Ohio begin to ramp in 2021. We opened our second Ayr Wellness dispensary in Pennsylvania a couple weeks ago and the cultivations are on track for first harvest this spring. Our remaining four stores in Pennsylvania will open throughout 2021 and as the cultivation expands further, we expect Pennsylvania to be a meaningful contributor to our top and bottom line in the back half 2021.”

Mr. Sandelman continued, “We firmly believe that everything we do starts with the plant. We continue to demonstrate our commitment to this belief by investing additional resources in our cultivation facilities and team. These investments will prove to be impactful as we begin the integration efforts in Florida to bring that important asset up to the productivity level we know is achievable. The same will be true when we close on Arizona and Ohio later this month and New Jersey this summer. We expect to realize the benefit of these investments as we move through 2021. The full impact will be realized in 2022 when, as we’ve stated before, we expect to reach at least $725 million of revenue and $325 million of Adjusted EBITDA.”

Fourth Quarter Financial Highlights ($ in millions, excl. margin items)

| Q4 2019 | Q3 2020 | Q4 2020 | % Change Y/Y | % Change Q/Q | ||||||||||||||||

| Revenue | $ | 32.3 | $ | 45.5 | $ | 47.8 | 48 | % | 5 | % | ||||||||||

| Gross Profit before Fair Value Adj. | $ | 11.4 | $ | 27.4 | $ | 27.5 | 142 | % | 0 | % | ||||||||||

| Gross Profit | $ | 8.3 | $ | 40.8 | $ | 18.6 | 125 | % | -54 | % | ||||||||||

| Operating Income/(Loss) | $ | (16.9 | ) | $ | 22.0 | $ | (2.2 | ) | N/M | N/M | ||||||||||

| Adj. EBITDA | $ | 9.2 | $ | 19.3 | $ | 19.4 | 111 | % | 0 | % | ||||||||||

| AEBITDA Margin | 28.6 | % | 42.4 | % | 40.5 | % | 1190 bps | -190 bps | ||||||||||||

Full Year 2020 Financial Highlights ($ in millions, excl. margin items)

FY 2019 Actual | FY 2019 Annualized1 | FY 2020 | % Change Y/Y | |||||||||||||

| Revenue | $ | 75.2 | $ | 124.2 | $ | 155.1 | 25 | % | ||||||||

| Gross Profit before Fair Value Adj. | $ | 34.4 | $ | 63.0 | $ | 88.6 | 41 | % | ||||||||

| Gross Profit | $ | 26.3 | N/M | $ | 103.1 | 293 | % | |||||||||

| Operating Income/(Loss) | $ | (37.5 | ) | N/M | $ | 16.0 | N/M | |||||||||

| Adj. EBITDA | $ | 20.9 | $ | 34.5 | $ | 56.2 | 63 | % | ||||||||

| AEBITDA Margin | 27.8 | % | 27.8 | % | 36.2 | % | 840 bps | |||||||||

1Due to the qualifying transaction completed on May 24, 2019, the 2019 annual results have been normalized by taking the 221-day period and annualizing it to produce a full year of results.

Ayr Wellness Footprint (Pro-forma)

Fourth Quarter Operational Highlights

Nevada Results

| · | Average daily retail revenues were over $290,000 in the fourth quarter; daily transaction volumes of 4,685, with an average ticket of $62 per transaction |

| · | Sales increased 21% year-over-year, driven by a 15% increase in transaction volumes and 6% increase in average ticket |

| · | Recently opened sixth dispensary in Nevada, in Clark County |

| · | Increased market share despite increased competition in the locals’ market and difficult economic environment due to COVID-19 |

Massachusetts Results

| · | Average daily retail revenues (medical only) increased to over $64,000 in the fourth quarter; daily transaction volumes of ~410, with an average ticket of $157 per transaction |

| · | Retail sales increased 136% year-over-year, driven by a ~90% increase in transactions and ~45% increase in average ticket |

| · | Selling to 78 of the state’s 110 adult-use dispensaries, and Ayr remains one of the market share leaders in flower, vapes and concentrates according to BDS Analytics |

| · | Wholesale revenues ramped to over $13.4 million in the quarter, growth of 109% y/y reflecting the increase in capacity brought on in May 2020 |

Pennsylvania Update

| · | Ayr closed its two acquisitions in Pennsylvania during the fourth quarter |

| · | Completed first phase of cultivation construction; 15,000ft2 of canopy due for first harvest this spring |

| · | 21,000 ft2 of addition space approved for cultivation in February and first harvest expected in early summer |

| · | Two dispensaries recently opened under the Ayr Wellness banner, in New Castle and Plymouth Meeting |

Conference Call

Ayr CEO Jonathan Sandelman, COO Jennifer Drake and CFO Brad Asher will host the conference call, followed by a question and answer period.

Conference Call Date: Thursday, March 11, 2021

Time: 8:30 a.m. Eastern time

Toll-free dial-in number: (877) 282-0546

International dial-in number: (270) 215-9898

Conference ID: 2287507

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at (949) 574-3860.

The conference call will be broadcast live and available for replay here.

A telephonic replay of the conference call will also be available after 11:30 a.m. Eastern time on the same day through March 18, 2021.

Toll-free replay number: (855) 859-2056

International replay number: (404) 537-3406

Replay ID: 2287507

Financial Statements

Certain financial information reported in this news release is extracted from Ayr’s Consolidated Financial Statements for the year ended December 31, 2020 and 2019. Ayr files its annual financial statements on SEDAR. All such financial information contained in this news release is qualified in its entirety by reference to such financial statements.

Definition and Reconciliation of Non-IFRS Measures

The Company reports certain non-IFRS measures that are used to evaluate the performance of its businesses and the performance of their respective segments, as well as to manage their capital structures. As non-IFRS measures generally do not have a standardized meaning, they may not be comparable to similar measures presented by other issuers. Securities regulators require such measures to be clearly defined and reconciled with their most comparable IFRS measure.

The Company references non-IFRS measures and cannabis industry metrics in this document and elsewhere. Non-IFRS measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these are provided as additional information to complement those IFRS measures by providing further understanding of the results of the operations of the Company from management’s perspective. Accordingly, these measures should not be considered in isolation, nor as a substitute for analysis of the Company’s financial information reported under IFRS. Non-IFRS measures used to analyze the performance of the Company’s businesses include “adjusted EBITDA.”

The Company believes that these non-IFRS financial measures provide meaningful supplemental information regarding the Company’s performances and may be useful to investors because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making. These financial measures are intended to provide investors with supplemental measures of the Company’s operating performances and thus highlight trends in the Company’s core businesses that may not otherwise be apparent when solely relying on the IFRS measures.

Adjusted EBITDA

“Adjusted EBITDA” represents income (loss) from operations, as reported, before interest and tax, adjusted to exclude non-recurring items, other non-cash items, including stock-based compensation expense, depreciation and amortization, the adjustments for the accounting of the fair value of biological assets, and further adjusted to remove acquisition related costs.

A reconciliation of how Ayr calculates adjusted EBITDA is provided below. Additional reconciliations of adjusted EBITDA and other disclosures concerning non-IFRS measures will be provided in our MD&A for the three and twelve months ended December 31, 2020. As well, the Company reminds you that adjusted EBITDA is a non-IFRS measure.

Forward-Looking Statements

Certain information contained in this news release may be forward-looking statements within the meaning of applicable securities laws. Forward-looking statements are often, but not always, identified by the use of words such as “target”, “expect”, “anticipate”, “believe”, “foresee”, “could”, “would”, “estimate”, “goal”, “outlook”, “intend”, “plan”, “seek”, “will”, “may”, “tracking”, “pacing” and “should” and similar expressions or words suggesting future outcomes. This news release includes forward-looking information and statements pertaining to, among other things, Ayr’s future growth plans. Numerous risks and uncertainties could cause the actual events and results to differ materially from the estimates, beliefs and assumptions expressed or implied in the forward-looking statements, including, but not limited to: anticipated strategic, operational and competitive benefits may not be realized; events or series of events, including in connection with COVID-19, may cause business interruptions; required regulatory approvals may not be obtained; acquisitions may not be able to be completed on satisfactory terms or at all; and Ayr may not be able to raise additional debt or equity capital. Among other things, Ayr has assumed that its businesses will operate as anticipated, that it will be able to complete acquisitions on reasonable terms, and that all required regulatory approvals will be obtained on satisfactory terms and within expected time frames. In particular, there can be no assurance that we will complete the pending acquisitions in or enter into agreements with respect to other acquisitions.

Forward-looking estimates and assumptions involve known and unknown risks and uncertainties that may cause actual results to differ materially. While Ayr believes there is a reasonable basis for these assumptions, such estimates may not be met. These estimates represent forward-looking information. Actual results may vary and differ materially from the estimates.

Assumptions

Forward-looking information in this subject to the assumptions and risks as described in our MD&A for December 31, 2020. For more information about the Company’s 2020 operations and outlook, please view Ayr’s corporate presentation posted in the Investors section of the Company’s website at www.ayrwellness.com. As well, we remind you that adjusted EBITDA is a non-IFRS measure. Additional reconciliations and other disclosures concerning non-IFRS measures will be provided in our MD&A for the three and twelve months ended December 31, 2020.

About Ayr Wellness Inc.

Ayr is an expanding vertically integrated, U.S. multi-state cannabis operator, focused on delivering the highest quality cannabis products and customer experience throughout its footprint. Based on the belief that everything starts with the quality of the plant, the Company is focused on superior cultivation to grow superior branded cannabis products. Ayr strives to enrich consumers’ experience every day through the wellness and wonder of cannabis.

Ayr’s leadership team brings proven expertise in growing successful businesses through disciplined operational and financial management, and is committed to driving positive impact for customers, employees and the communities they touch. For more information, please visit www.ayrwellness.com.

Company Contact:

Megan Kulick

Head of Investor Relations

T: (646) 977-7914

Email: IR@ayrwellness.com

Investor Relations Contact:

Sean Mansouri, CFA

Gateway Investor Relations

T: (949) 574-3860

Email: IR@ayrwellness.com

Ayr Wellness Inc. (formerly, Ayr Strategies Inc.)

Unaudited Condensed Interim Consolidated Statements of Financial Position

(Expressed in United States Dollars)

| As of | ||||||||

| December 31, 2020 | December 31, 2019 | |||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash and cash equivalents | $ | 127,238,165 | $ | 8,403,196 | ||||

| Accounts receivable | 3,464,401 | 2,621,239 | ||||||

| Due from related parties | 135,000 | 85,000 | ||||||

| Inventory | 28,257,942 | 13,718,840 | ||||||

| Biological assets | 12,069,851 | 2,935,144 | ||||||

| Prepaid expenses, deposits, and other current asset | 5,270,381 | 2,163,329 | ||||||

| 176,435,740 | 29,926,748 | |||||||

| Non-current | ||||||||

| Property, plant, and equipment | 69,104,080 | 37,152,861 | ||||||

| Intangible assets | 252,357,676 | 189,802,136 | ||||||

| Right-of-use assets | 22,604,065 | 12,315,417 | ||||||

| Goodwill | 92,321,934 | 84,837,304 | ||||||

| Equity investments | 503,509 | 427,399 | ||||||

| Deposits and other assets | 2,540,675 | 638,394 | ||||||

| Total assets | 615,867,679 | 355,100,259 | ||||||

| LIABILITIES | ||||||||

| Current | ||||||||

| Trade payables | 8,899,786 | 6,806,053 | ||||||

| Accrued liabilities | 8,706,813 | 5,123,865 | ||||||

| Lease obligations - current portion | 866,304 | 1,087,835 | ||||||

| Purchase consideration payable | 9,053,057 | 9,831,700 | ||||||

| Income tax payable | 21,585,523 | 5,202,943 | ||||||

| Debts payable - current portion | 8,644,633 | 6,628,843 | ||||||

| 57,756,116 | 34,681,239 | |||||||

| Non-current | ||||||||

| Deferred tax liabilities | 47,935,998 | 41,077,761 | ||||||

| Warrant liability | 151,949,611 | 36,874,124 | ||||||

| Lease obligations - non-current portion | 23,864,059 | 13,033,310 | ||||||

| Contingent consideration | 22,961,412 | 22,656,980 | ||||||

| Debts payable - non-current portion | 53,587,948 | 37,366,818 | ||||||

| Senior secured notes - non-current portion | 103,652,963 | - | ||||||

| Accrued interest payable | 3,301,155 | 815,662 | ||||||

| Total liabilities | 465,009,262 | 186,505,894 | ||||||

| SHAREHOLDERS' EQUITY (DEFICIENCY) | ||||||||

| Share capital | 518,992,215 | 382,210,006 | ||||||

| Treasury stock | (556,899 | ) | (245,469 | ) | ||||

| Contributed surplus | 60,035,984 | 28,879,225 | ||||||

| Accumulated other comprehensive (loss) income | (5,765,218 | ) | 3,265,610 | |||||

| Deficit | (421,847,665 | ) | (245,515,007 | ) | ||||

| Total shareholders' equity | 150,858,417 | 168,594,365 | ||||||

| Total liabilities and shareholders' equity | 615,867,679 | 355,100,259 | ||||||

Ayr Wellness Inc. (formerly, Ayr Strategies Inc.)

Unaudited Condensed Interim Consolidated Statements of Loss and Comprehensive Loss

(Expressed in United States Dollars)

| Three Months Ended | Year Ended | |||||||||||||||

| December 31, 2020 | December 31, 2019 | December 31, 2020 | December 31, 2019 | |||||||||||||

| Revenues, net of discounts | $ | 47,764,775 | $ | 32,282,616 | $ | 155,114,454 | $ | 75,195,556 | ||||||||

| Cost of goods sold before biological asset adjustments | 20,298,130 | 17,158,918 | 66,555,710 | 37,009,909 | ||||||||||||

| Incremental costs to acquire cannabis inventory in a business combination | - | 3,764,678 | - | 3,764,678 | ||||||||||||

| Cost of goods sold | 20,298,130 | 20,923,596 | 66,555,710 | 40,774,587 | ||||||||||||

| Gross profit before fair value adjustments | 27,466,645 | 11,359,020 | 88,558,744 | 34,420,969 | ||||||||||||

| Fair value adjustment on sale of inventory | (12,971,862 | ) | (4,838,814 | ) | (34,147,938 | ) | (18,272,212 | ) | ||||||||

| Unrealized gain on biological asset transformation | 4,115,927 | 1,765,527 | 48,690,657 | 10,108,105 | ||||||||||||

| Gross profit | 18,610,710 | 8,285,733 | 103,101,463 | 26,256,862 | ||||||||||||

| Expenses | ||||||||||||||||

| General and administrative | 9,258,098 | 7,248,271 | 36,342,955 | 19,036,452 | ||||||||||||

| Sales and marketing | 563,686 | 463,452 | 2,150,536 | 1,345,009 | ||||||||||||

| Depreciation | 714,933 | 1,017,198 | 2,364,224 | 1,392,994 | ||||||||||||

| Amortization | 3,028,714 | 2,434,288 | 12,024,715 | 7,222,595 | ||||||||||||

| Stock-based compensation | 5,207,204 | 13,296,643 | 31,156,759 | 28,879,225 | ||||||||||||

| Acquisition expense | 1,890,428 | 724,139 | 2,945,194 | 5,847,800 | ||||||||||||

| Total expenses | 20,663,063 | 25,183,991 | 86,984,383 | 63,724,075 | ||||||||||||

| Income (Loss) from operations | (2,052,353 | ) | (16,898,258 | ) | 16,117,080 | (37,467,213 | ) | |||||||||

| Other (expense) income | ||||||||||||||||

| Share of loss on equity investments | (2,208 | ) | 241,115 | (33,591 | ) | (72,600 | ) | |||||||||

| Foreign exchange | 1,256 | (17,904 | ) | (7,782 | ) | (141,106 | ) | |||||||||

| Fair value loss on financial liabilities | (134,720,905 | ) | 2,771,673 | (164,042,264 | ) | (119,235,147 | ) | |||||||||

| Interest expense | (1,867,275 | ) | (1,176,278 | ) | (4,115,775 | ) | (3,035,492 | ) | ||||||||

| Interest income | 5,625 | 8,483 | 10,112 | 404,835 | ||||||||||||

| Other | 84,960 | 185,458 | 104,931 | 202,610 | ||||||||||||

| Total other (expense) income | (136,498,547 | ) | 2,012,547 | (168,084,369 | ) | (121,876,900 | ) | |||||||||

| Loss before income tax | (138,550,900 | ) | (14,885,711 | ) | (151,967,289 | ) | (159,344,113 | ) | ||||||||

| Current tax [Note 20] | (7,035,194 | ) | (3,795,071 | ) | (21,976,761 | ) | (8,728,061 | ) | ||||||||

| Deferred tax [Note 20] | 2,005,050 | 1,216,549 | (2,388,608 | ) | 3,892,570 | |||||||||||

| Net loss | (143,581,044 | ) | (17,464,233 | ) | (176,332,658 | ) | (164,179,604 | ) | ||||||||

| Foreign currency translation adjustment | (8,611,181 | ) | 468,229 | (9,030,828 | ) | (156,510 | ) | |||||||||

| Net loss and comprehensive loss | (152,192,225 | ) | (16,996,004 | ) | (185,363,486 | ) | (164,336,114 | ) | ||||||||

| Basic and diluted loss per share | (4.82 | ) | (0.65 | ) | (6.32 | ) | (9.43 | ) | ||||||||

| Weighted average number of shares outstanding (basic and diluted) | 29,814,594 | 26,672,864 | 27,892,441 | 17,404,742 | ||||||||||||

Ayr Wellness Inc. (formerly, Ayr Strategies Inc.)

Unaudited Condensed Interim Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

| Year Ended | ||||||||

| December 31, 2020 | December 31, 2019 | |||||||

| Operating activities | ||||||||

| Net loss | $ | (176,332,658 | ) | $ | (164,179,604 | ) | ||

| Adjustments for: | ||||||||

| Acquisition costs associated with financing activities | - | 129,235 | ||||||

| Net fair value loss on financial liabilities | 164,042,264 | 119,235,147 | ||||||

| Stock-based compensation | 31,156,759 | 28,879,225 | ||||||

| Depreciation | 4,720,198 | 2,172,373 | ||||||

| Amortization on intangible assets | 13,716,502 | 8,137,864 | ||||||

| Share of loss on equity investments | 33,591 | 72,600 | ||||||

| Incremental costs to acquire cannabis inventory in a business combination | - | 3,764,678 | ||||||

| Fair value adjustment on sale of inventory | 34,147,938 | 18,272,212 | ||||||

| Unrealized gain on biological asset transformation | (48,690,657 | ) | (10,108,105 | ) | ||||

| Deferred tax expense (benefit) | 2,388,608 | (3,892,570 | ) | |||||

| Amortization on financing costs | 90,858 | - | ||||||

| Interest accrued | 2,214,061 | 1,652,510 | ||||||

| Changes in non-cash operations, net of business acquisition: | ||||||||

| Accounts receivable | (843,162 | ) | (1,308,328 | ) | ||||

| Inventory and biological assets | (8,876,748 | ) | (5,809,848 | ) | ||||

| Prepaid expenses and other assets | (2,529,212 | ) | (1,459,072 | ) | ||||

| Trade payables | 1,616,253 | 2,992,073 | ||||||

| Accrued liabilities | 3,274,488 | (179,574 | ) | |||||

| Income tax payable | 16,382,580 | 5,202,943 | ||||||

| Cash provided by operating activities | 36,511,663 | 3,573,759 | ||||||

| Investing activities | ||||||||

| Transfer of restricted cash and short term investments held in escrow and interest income | - | 99,684,243 | ||||||

| Purchase of property, plant, and equipment | (14,367,690 | ) | (14,417,635 | ) | ||||

| Purchases of intangible assets | (400,000 | ) | - | |||||

| Deferred underwriters commission paid | - | (3,457,154 | ) | |||||

| Cash paid for business combinations and asset acquisitions, net of cash acquired | (35,174,880 | ) | (74,714,171 | ) | ||||

| Cash paid for business combinations and asset acquisitions, bridge financing | (8,040,804 | ) | - | |||||

| Cash paid for business combinations and asset acquisitions, working capital | (2,354,375 | ) | (547,042 | ) | ||||

| Payments for interests in equity accounted investments | (109,700 | ) | (500,000 | ) | ||||

| Advances to related corporation | (50,000 | ) | (809,191 | ) | ||||

| Deposits for business combinations | (1,750,000 | ) | - | |||||

| Cash (used in) provided by investing activities | (62,247,449 | ) | 5,239,050 | |||||

| Financing activities | ||||||||

| Proceeds from exercise of Warrants | 48,483,750 | 2,460,150 | ||||||

| Proceeds from senior secured notes, net of financing costs | 103,571,105 | - | ||||||

| Redemption of Class A shares | - | (7,519 | ) | |||||

| Repayments of debts payable | (5,615,225 | ) | (2,879,329 | ) | ||||

| Repayments of lease obligations (principal portion) | (1,557,445 | ) | (763,878 | ) | ||||

| Repurchase of Subordinate Voting Shares | (311,430 | ) | (311,674 | ) | ||||

| Cash provided by (used in) financing activities | 144,570,755 | (1,502,250 | ) | |||||

| Net increase in cash | 118,834,969 | 7,310,559 | ||||||

| Effect of foreign currency translation | - | 982,685 | ||||||

| Cash and cash equivalents, beginning of the year | 8,403,196 | 109,952 | ||||||

| Cash and cash equivalents, end of the year | 127,238,165 | 8,403,196 | ||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid during the year | 2,526,294 | 1,679,612 | ||||||

| Taxes paid during the year | 5,594,181 | 3,525,118 | ||||||

Ayr Wellness Inc. (formerly, Ayr Strategies Inc.)

Unaudited Condensed Interim Consolidated Adjusted EBITDA Reconciliation

(Expressed in United States Dollars)

| Three Months ended December 31, | Year ended December 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| (Loss) Income from operations | (2,052,353 | ) | (16,898,258 | ) | 16,117,080 | (37,467,213 | ) | |||||||||

| Non-cash items accounting for biological assets and inventory | ||||||||||||||||

| Incremental costs to acquire cannabis inventory in business combination | - | 3,764,678 | - | 3,764,678 | ||||||||||||

| Fair value adjustment on sale of inventory | 12,971,862 | 4,838,814 | 34,147,938 | 18,272,212 | ||||||||||||

| Unrealized gain on biological asset transformation | (4,115,927 | ) | (1,765,527 | ) | (48,690,657 | ) | (10,108,105 | ) | ||||||||

| 8,855,935 | 6,837,965 | (14,542,719 | ) | 11,928,785 | ||||||||||||

| Interest | 258,077 | 295,630 | 986,870 | 295,630 | ||||||||||||

| Depreciation and amortization (from statement of cash flows) | 5,017,319 | 4,511,734 | 18,436,700 | 10,310,237 | ||||||||||||

| Acquisition costs | 1,890,428 | 724,139 | 2,945,194 | 5,847,800 | ||||||||||||

| Stock-based compensation expense, non-cash | 5,207,204 | 13,296,643 | 31,156,759 | 28,879,225 | ||||||||||||

| Other non-operating1 | 182,343 | 472,326 | 1,089,912 | 1,105,694 | ||||||||||||

| 12,555,371 | 19,300,472 | 54,615,435 | 46,438,586 | |||||||||||||

| Adjusted EBITDA (non-IFRS) | 19,358,953 | 9,240,179 | 56,189,796 | 20,900,158 | ||||||||||||

1 Other non-operating adjustments made to exclude the impact of non-recurring items