| Confidential; Subject to Confidentiality Agreement Subject to FRE 408 CSE:AYR.A | OTC:AYRWF Bondholder Presentation | October 2023 The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed © 2023 AYR Wellness Inc. • CSE:AYR.A | OTC:AYRWF • Private and Confidential 2 Disclaimer This document is for informational purposes only and should not be considered a recommendation or offer to purchase, sell or hold a security. This document does not constitute an offering memorandum or an offer or solicitation in any country, state, province or territory or other jurisdiction. This document does not constitute either advice or a recommendation regarding any securities. An annual information form dated March 9, 2023 (the “AIF”), a management information circular dated May 26, 2022 (the “Circular”), an amended and restated short form base shelf prospectus dated February 24, 2021 (the “Shelf Prospectus”) and subsequent financial and material change reports have been filed containing important information relating to Ayr Wellness Inc. (“Ayr” or the “Company”) with the securities regulatory authorities in each of the provinces and territories of Canada and are available at www.sedar.com and on Ayr’s website at www.ayrwellness.com. In addition, information regarding the Company, including the Company’s annual report on Form 40-F (the “40-F”), may be found in the Company’s filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov. No securities regulatory authority has expressed an opinion about these securities and it is an offense to claim otherwise. This document does not provide full disclosure of all material facts relating to the securities described herein. Investors should read the AIF, the Circular, the Base Shelf Prospectus, the 40-F and any amendments, and subsequent financial and material change reports and other filings, for disclosure of those facts, especially risk factors relating to the securities. This presentation contains information, including estimated financial information of the Company, with respect to the quarter ended June 30, 2023. Neither the Company’s independent auditors, nor any other independent accountants, have audited, compiled, examined or performed any procedures with respect to such information, nor have they expressed any opinion or any other form of assurance on such information or its achievability. We are providing this information to provide you with information regarding the relative performance of the Company during the periods presented and such information represents the Company’s expectations as of the date of this document and may be subject to change. Forward-Looking Statements Certain information contained in this document are not historical facts but are forward-looking statements within the meaning of applicable securities laws including the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are often, but not always, identified by the use of words such as “target”, “expect”, “anticipate”, “believe”, “foresee”, “could”, “would”, “estimate”, “goal”, “outlook”, “intend”, “plan”, “seek”, “will”, “may”, “tracking”, “pacing”, "project", "forecast", "predict", "potential", "seem", "future" and “should” and similar expressions or words suggesting future outcomes. This document includes forward-looking information and statements pertaining to, among other things, Ayr’s future growth plans. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Numerous risks and uncertainties could cause the actual events and results to differ materially from the estimates, beliefs and assumptions expressed or implied in the forward-looking statements, including, but not limited to: anticipated strategic, operational and competitive benefits may not be realized; events or series of events may cause business interruptions; required regulatory approvals may not be obtained; inflationary pressures may increase input costs; supply chain issues may hamper production and distribution; laws or the interpretation, administration or enforcement thereof may change; differing regulatory requirements across states may prevent Ayr from achieving economies of scale; favorable locations may be restricted or difficult to obtain; acquisitions may not be able to be completed on satisfactory terms or at all, or if completed may not be successful; the enforcement of contracts may be restricted; scientific research regarding cannabis is still in its early stages and is subject to change as further research is completed; the inherent risks of an agricultural business; cyber-security, transportation, recall, product liability and litigation related risks; future capital expenditure assumptions may prove inaccurate; wholesale market expectations may prove inaccurate; debt restructuring plans may be unsuccessful; adverse results from litigation may occur; the illicit market may continue diverting revenues; and Ayr may not be able to raise additional debt or equity capital if required. Among other things, Ayr has assumed that its businesses will operate as anticipated, that it will be able to complete acquisitions and acquire desirable retail locations on reasonable terms, and that all required regulatory approvals will be obtained on satisfactory terms and within expected time frames. However, these assumptions may prove incorrect and there may be other factors that cause results not to be as anticipated, estimated or intended. The risks and uncertainties mentioned above are not exhaustive, and there may be additional risks that Ayr does not presently know or that Ayr currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these statements. In addition, forward-looking statements reflect Ayr's expectations, plans or forecasts of future events and views as of the date of this document. While Ayr may elect to update these forward-looking statements at some point in the future, Ayr specifically disclaims any obligation to do so. Cautionary Note Regarding Securities Laws This presentation does not constitute an offer to sell or the solicitation of an offer to buy the securities of Ayr in any jurisdiction, nor shall there be any sale of the securities of Ayr in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. Definition & Reconciliation of Non-GAAP Measures Ayr reports certain non-GAAP measures that are used to evaluate its performance and the performance of its business segments, as well as to manage its capital structure. As non-GAAP measures generally do not have a standardized meaning, they may not be comparable to similar measures presented by other issuers. Securities regulators require such measures to be clearly defined and reconciled with their most directly comparable GAAP measure. Please see Ayr’s Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of the operations of the Company for the quarter ended March 31, 2023 for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures. Adjusted EBITDA Adjusted EBITDA represents (loss) income from operations, as reported under GAAP, before interest and tax, adjusted to exclude non-core costs, other non-cash items, including depreciation and amortization and further adjusted to remove non-cash stock-based compensation, impairment expense, the accounting for the incremental costs to acquire cannabis inventory in a business combination, acquisition related costs, and start-up costs. Please see Ayr’s MD&A for the quarter ended March 31, 2023 for an illustration of Ayr’s calculation of Adjusted EBITDA and a reconciliation to GAAP figures. Assumptions & Risks Forward-looking information in this presentation is subject to the assumptions and risks as described in our Annual Information Form as of and for the year ended December 31, 2022 and in our MD&A for the three months ended June 30, 2023 and 2022, and our news releases dated March 9, 2023 and May 16, 2023. Legal Disclaimers |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 3 Executive Summary © 2023 AYR Wellness Inc. • Private and Confidential The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed ▪ Since 2019, Ayr strategically expanded its footprint from 2 to 8 U.S. states and invested over $200mm to construct a scaled platform that is positioned for sustained growth and profitability while consistently generating positive EBITDA ▪ The successful execution of its acquisition and infrastructure expansion strategy has led the Company to an inflection point at which key assets across various markets are online and are expected to ramp to their full potential heading into 2024 ▪ Even with strong operational positioning and embedded growth, a challenging debt capital markets environment and acute challenges within the cannabis industry creates refinancing uncertainty for the ~$336mm of debt coming due through 2024, including ~$243mm of Indenture Notes and ~$92mm of Seller Notes ▪ In an effort to better align the Company’s debt maturities with its business plan and given existing refinancing uncertainty, the Company preemptively approached Seller Noteholders seeking maturity extensions of two (2) years and pursued other capital structure alternatives - To date, agreements with Seller Noteholders have been reached to defer or extinguish 90% or ~$127mm of Seller Notes 1, 2, 3 , as well as $4.5mm of other assumed promissory notes, contingent on a two-year extension of the Indenture Notes (or an agreement in respect thereof) - Additionally, the Company has modified the terms of two earn-outs, resulting in the deferral of ~$25mm of cash payments 1 as well as refinanced and upsized an existing mortgage due May 2024, generating ~$13mm of incremental proceeds and extending the maturity to 10 years 4 ▪ As it stands today, without implementation of the extensions, the Company has ~$92mm of Seller Note maturity payments coming due before the December 2024 Indenture Note maturity ▪ The Company’s universal ask of a two-year extension from Seller Noteholders and Indenture Noteholders allows for the same prioritization of cash outflows and provides Ayr runway to execute its business plan by aligning maturities and the expected ramp of operational assets ▪ The proposed extension benefits all stakeholders by providing additional time for a recovery in the debt capital markets and avoiding potential value destruction associated with a restructuring to the extent the Company is unable to refinance its debt (restructurings are particularly challenging and costly for cannabis companies) 4 © 2023 AYR Wellness Inc. • Private and Confidential (Amounts expressed in United States dollars) As of October 31, 2023, Ayr Wellness Inc. (CSE:AYR.A, OTC:AYRWF) (“Ayr” or the “Company”) has entered into agreements that provide for two-year maturity extensions on its 12.5% Senior Secured Notes due 2024 (the “Indenture Notes”) and the vast majority of its vendor take-back promissory notes (the “Seller Notes”) Executive Summary Note: Outstanding principal as of 7/31/2023 1) Reflects amount extinguished, deferred past original maturity date and/or due after 2026 (the proposed revised maturity date of the Indenture Notes). 2) Figure includes AZ-Oasis Seller Note and NJ-GSD Earn-out Note amendments which are effective and not contingent on an extension of the Indenture Notes 3) Updated to reflect LivFree extension as of October 2023 4) Earn-out modifications and mortgage refinancing are not contingent on an extension of the Indenture Notes |

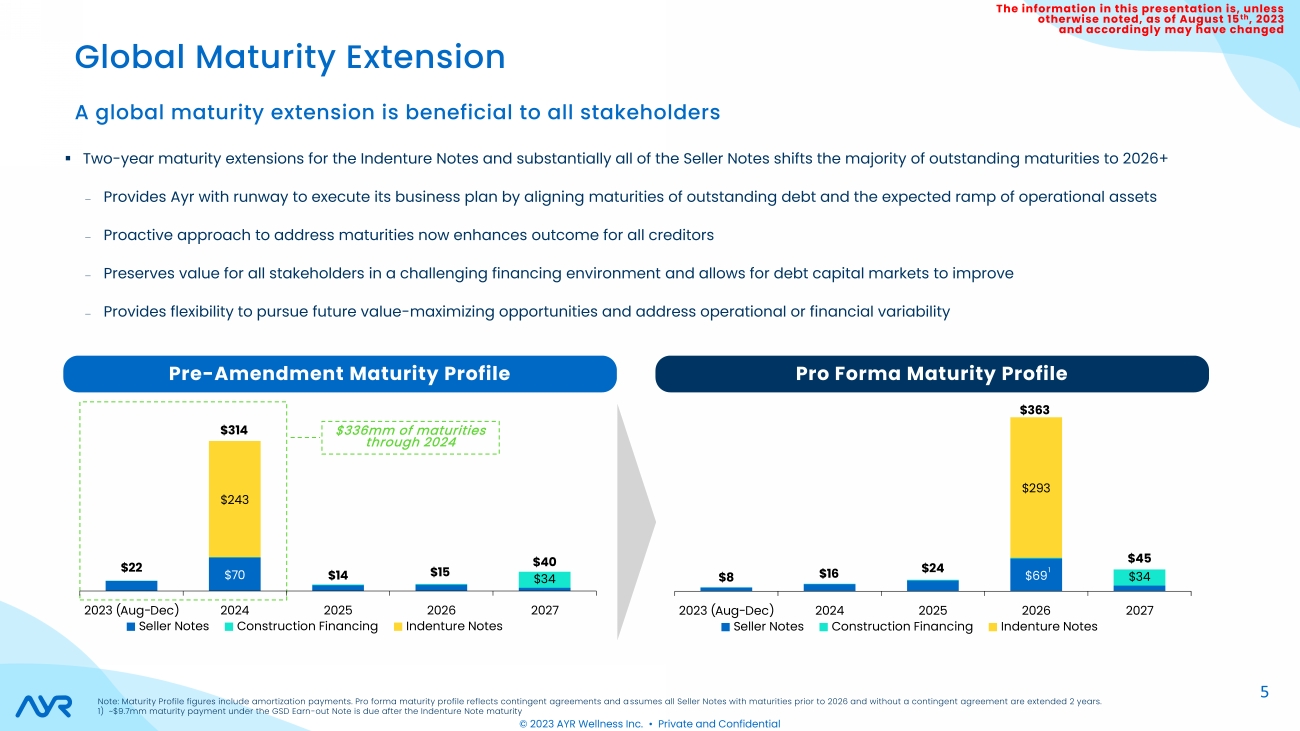

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed $69 $34 $293 $8 $16 $24 $363 $45 2023 (Aug-Dec) 2024 2025 2026 2027 Seller Notes Construction Financing Indenture Notes 5 ▪ Two-year maturity extensions for the Indenture Notes and substantially all of the Seller Notes shifts the majority of outstanding maturities to 2026+ ‒ Provides Ayr with runway to execute its business plan by aligning maturities of outstanding debt and the expected ramp of operational assets ‒ Proactive approach to address maturities now enhances outcome for all creditors ‒ Preserves value for all stakeholders in a challenging financing environment and allows for debt capital markets to improve ‒ Provides flexibility to pursue future value-maximizing opportunities and address operational or financial variability Pre-Amendment Maturity Profile Pro Forma Maturity Profile $336mm of maturities through 2024 © 2023 AYR Wellness Inc. • Private and Confidential A global maturity extension is beneficial to all stakeholders Global Maturity Extension $70 $34 $243 $22 $314 $14 $15 $40 2023 (Aug-Dec) 2024 2025 2026 2027 Seller Notes Construction Financing Indenture Notes Note: Maturity Profile figures include amortization payments. Pro forma maturity profile reflects contingent agreements and assumes all Seller Notes with maturities prior to 2026 and without a contingent agreement are extended 2 years. 1) ~$9.7mm maturity payment under the GSD Earn-out Note is due after the Indenture Note maturity 1 |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 6 Seller Noteholder Outreach Summary © 2023 AYR Wellness Inc. • Private and Confidential The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

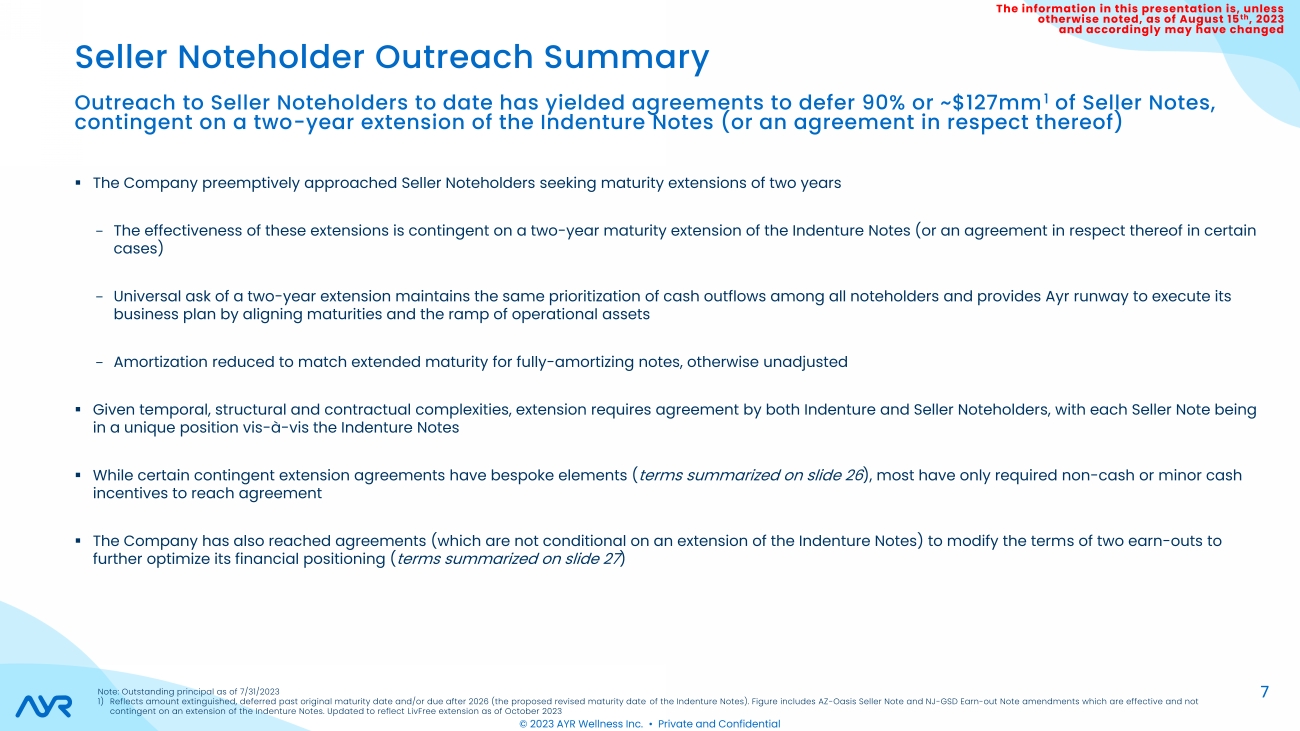

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Note: Outstanding principal as of 7/31/2023 1) Reflects amount extinguished, deferred past original maturity date and/or due after 2026 (the proposed revised maturity date of the Indenture Notes). Figure includes AZ-Oasis Seller Note and NJ-GSD Earn-out Note amendments which are effective and not contingent on an extension of the Indenture Notes. Updated to reflect LivFree extension as of October 2023 © 2023 AYR Wellness Inc. • Private and Confidential ▪ The Company preemptively approached Seller Noteholders seeking maturity extensions of two years – The effectiveness of these extensions is contingent on a two-year maturity extension of the Indenture Notes (or an agreement in respect thereof in certain cases) – Universal ask of a two-year extension maintains the same prioritization of cash outflows among all noteholders and provides Ayr runway to execute its business plan by aligning maturities and the ramp of operational assets – Amortization reduced to match extended maturity for fully-amortizing notes, otherwise unadjusted ▪ Given temporal, structural and contractual complexities, extension requires agreement by both Indenture and Seller Noteholders, with each Seller Note being in a unique position vis-à-vis the Indenture Notes ▪ While certain contingent extension agreements have bespoke elements (terms summarized on slide 26), most have only required non-cash or minor cash incentives to reach agreement ▪ The Company has also reached agreements (which are not conditional on an extension of the Indenture Notes) to modify the terms of two earn-outs to further optimize its financial positioning (terms summarized on slide 27) Outreach to Seller Noteholders to date has yielded agreements to defer 90% or ~$127mm1 of Seller Notes, contingent on a two-year extension of the Indenture Notes (or an agreement in respect thereof) Seller Noteholder Outreach Summary 7 |

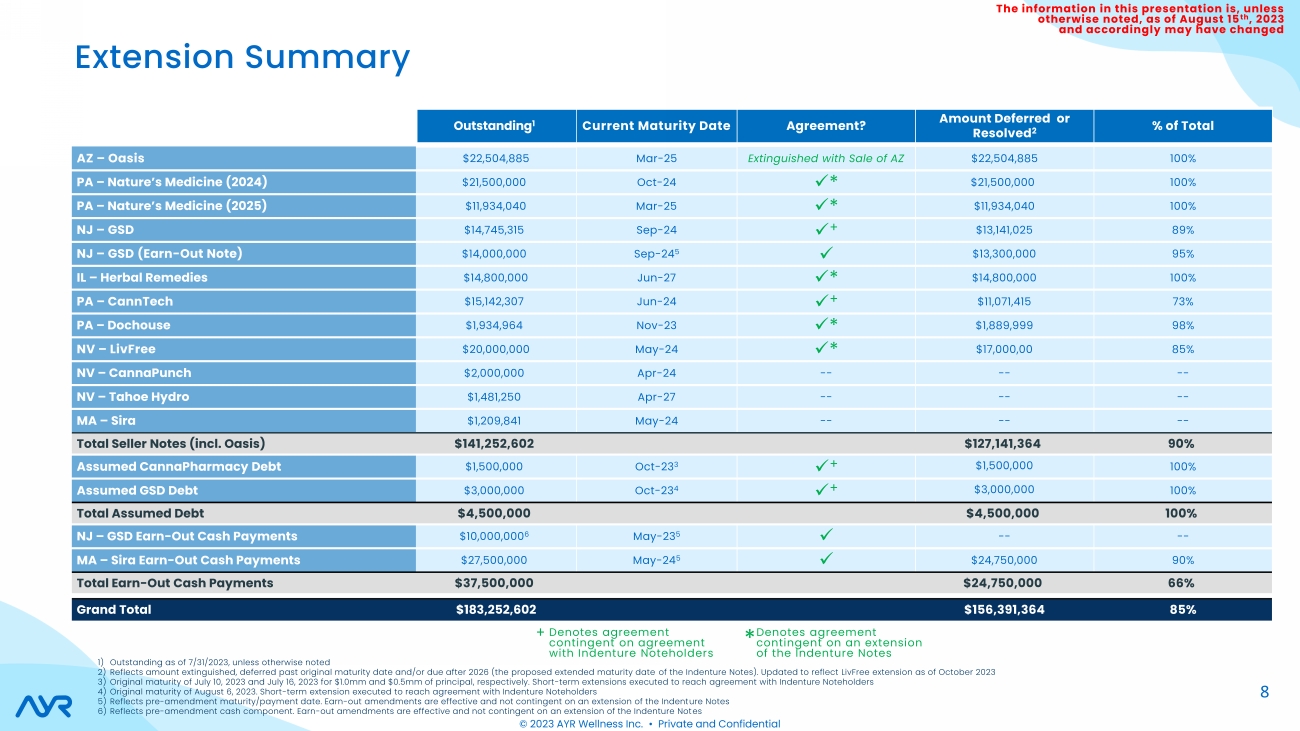

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 1) Outstanding as of 7/31/2023, unless otherwise noted 2) Reflects amount extinguished, deferred past original maturity date and/or due after 2026 (the proposed extended maturity date of the Indenture Notes). Updated to reflect LivFree extension as of October 2023 3) Original maturity of July 10, 2023 and July 16, 2023 for $1.0mm and $0.5mm of principal, respectively. Short-term extensions executed to reach agreement with Indenture Noteholders 4) Original maturity of August 6, 2023. Short-term extension executed to reach agreement with Indenture Noteholders 5) Reflects pre-amendment maturity/payment date. Earn-out amendments are effective and not contingent on an extension of the Indenture Notes 6) Reflects pre-amendment cash component. Earn-out amendments are effective and not contingent on an extension of the Indenture Notes © 2023 AYR Wellness Inc. • Private and Confidential Extension Summary 8 ` Outstanding1 Current Maturity Date Agreement? Amount Deferred or Resolved2 % of Total AZ – Oasis $22,504,885 Mar-25 Extinguished with Sale of AZ $22,504,885 100% PA – Nature’s Medicine (2024) $21,500,000 Oct-24 ✓* $21,500,000 100% PA – Nature’s Medicine (2025) $11,934,040 Mar-25 ✓* $11,934,040 100% NJ – GSD $14,745,315 Sep-24 ✓+ $13,141,025 89% NJ – GSD (Earn-Out Note) $14,000,000 Sep-245 ✓ $13,300,000 95% IL – Herbal Remedies $14,800,000 Jun-27 ✓* $14,800,000 100% PA – CannTech $15,142,307 Jun-24 ✓+ $11,071,415 73% PA – Dochouse $1,934,964 Nov-23 ✓* $1,889,999 98% NV – LivFree $20,000,000 May-24 ✓* $17,000,00 85% NV – CannaPunch $2,000,000 Apr-24 -- -- -- NV – Tahoe Hydro $1,481,250 Apr-27 -- -- -- MA – Sira $1,209,841 May-24 -- -- -- Total Seller Notes (incl. Oasis) $141,252,602 $127,141,364 90% Assumed CannaPharmacy Debt $1,500,000 Oct-233 ✓+ $1,500,000 100% Assumed GSD Debt $3,000,000 Oct-234 ✓+ $3,000,000 100% Total Assumed Debt $4,500,000 $4,500,000 100% NJ – GSD Earn-Out Cash Payments $10,000,0006 May-235 ✓ -- -- MA – Sira Earn-Out Cash Payments $27,500,000 May-245 ✓ $24,750,000 90% Total Earn-Out Cash Payments $37,500,000 $24,750,000 66% Grand Total $183,252,602 $156,391,364 85% * Denotes agreement contingent on an extension of the Indenture Notes + Denotes agreement contingent on agreement with Indenture Noteholders |

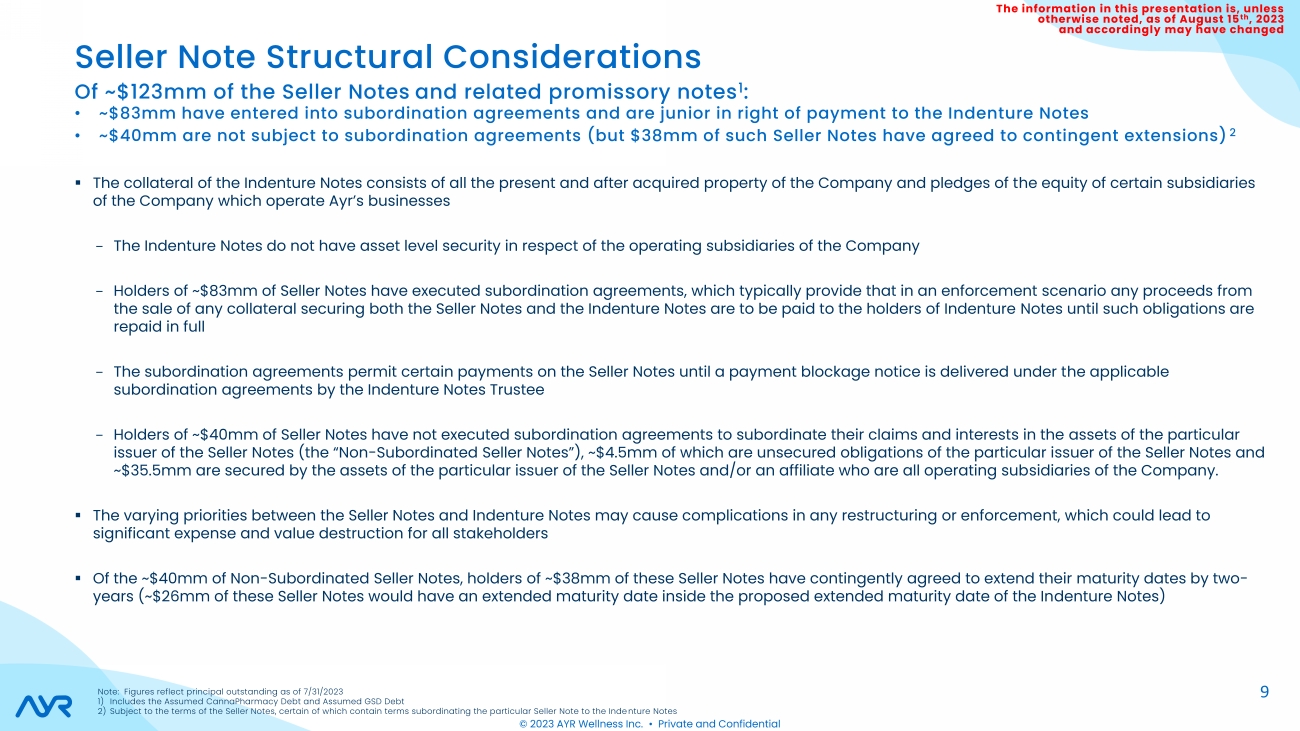

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed © 2023 AYR Wellness Inc. • Private and Confidential Seller Note Structural Considerations 9 Of ~$123mm of the Seller Notes and related promissory notes 1 : • ~$83mm have entered into subordination agreements and are junior in right of payment to the Indenture Notes • ~$40mm are not subject to subordination agreements (but $38mm of such Seller Notes have agreed to contingent extensions) 2 ▪ The collateral of the Indenture Notes consists of all the present and after acquired property of the Company and pledges of the equity of certain subsidiaries of the Company which operate Ayr’s businesses – The Indenture Notes do not have asset level security in respect of the operating subsidiaries of the Company – Holders of ~$83mm of Seller Notes have executed subordination agreements, which typically provide that in an enforcement scenario any proceeds from the sale of any collateral securing both the Seller Notes and the Indenture Notes are to be paid to the holders of Indenture Notes until such obligations are repaid in full – The subordination agreements permit certain payments on the Seller Notes until a payment blockage notice is delivered under the applicable subordination agreements by the Indenture Notes Trustee – Holders of ~$40mm of Seller Notes have not executed subordination agreements to subordinate their claims and interests in the assets of the particular issuer of the Seller Notes (the “Non-Subordinated Seller Notes”), ~$4.5mm of which are unsecured obligations of the particular issuer of the Seller Notes and ~$35.5mm are secured by the assets of the particular issuer of the Seller Notes and/or an affiliate who are all operating subsidiaries of the Company. ▪ The varying priorities between the Seller Notes and Indenture Notes may cause complications in any restructuring or enforcement, which could lead to significant expense and value destruction for all stakeholders ▪ Of the ~$40mm of Non-Subordinated Seller Notes, holders of ~$38mm of these Seller Notes have contingently agreed to extend their maturity dates by two-years (~$26mm of these Seller Notes would have an extended maturity date inside the proposed extended maturity date of the Indenture Notes) Note: Figures reflect principal outstanding as of 7/31/2023 1) Includes the Assumed CannaPharmacy Debt and Assumed GSD Debt 2) Subject to the terms of the Seller Notes, certain of which contain terms subordinating the particular Seller Note to the Indenture Notes |

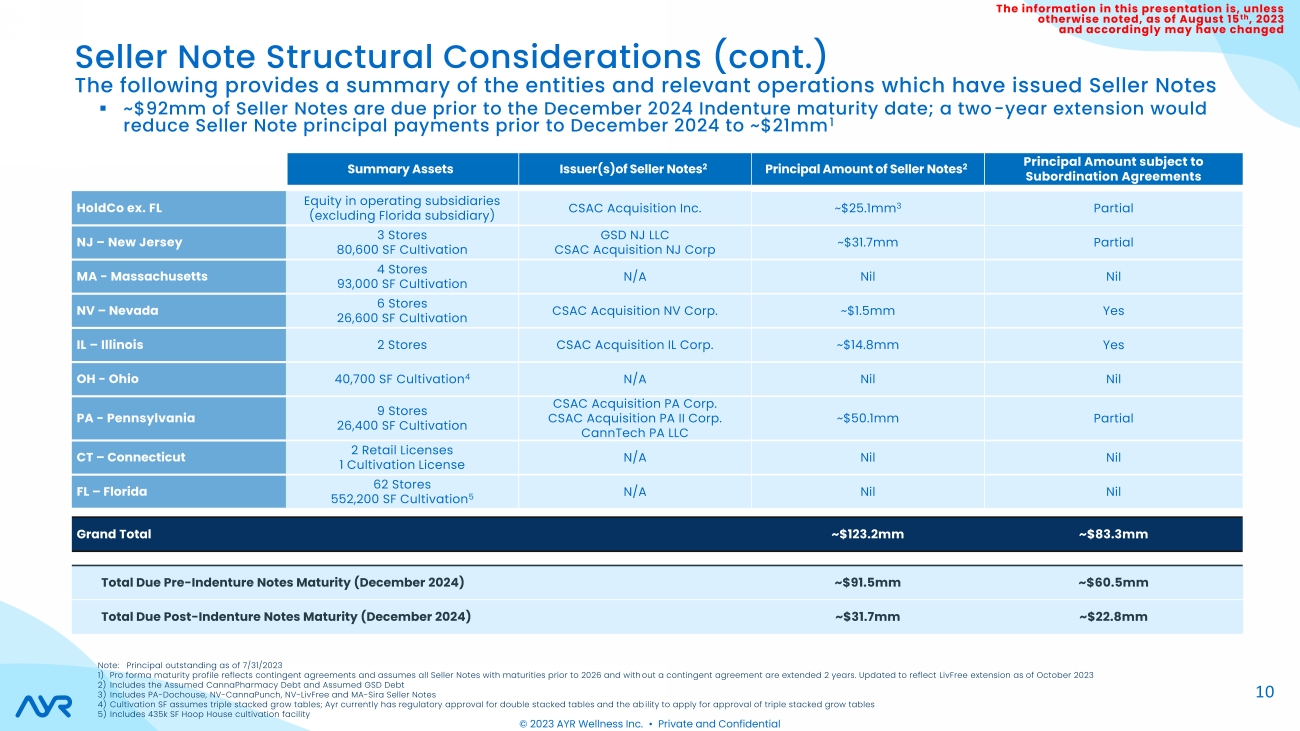

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed © 2023 AYR Wellness Inc. • Private and Confidential Seller Note Structural Considerations (cont.) 10 ` Summary Assets Issuer(s)of Seller Notes 2 Principal Amount of Seller Notes 2 Principal Amount subject to Subordination Agreements HoldCo ex. FL Equity in operating subsidiaries (excluding Florida subsidiary) CSAC Acquisition Inc. ~$25.1mm3 Partial NJ – New Jersey 3 Stores 80,600 SF Cultivation GSD NJ LLC CSAC Acquisition NJ Corp ~$31.7mm Partial MA - Massachusetts 4 Stores 93,000 SF Cultivation N/A Nil Nil NV – Nevada 6 Stores 26,600 SF Cultivation CSAC Acquisition NV Corp. ~$1.5mm Yes IL – Illinois 2 Stores CSAC Acquisition IL Corp. ~$14.8mm Yes OH - Ohio 40,700 SF Cultivation4 N/A Nil Nil PA - Pennsylvania 9 Stores 26,400 SF Cultivation CSAC Acquisition PA Corp. CSAC Acquisition PA II Corp. CannTech PA LLC ~$50.1mm Partial CT – Connecticut 2 Retail Licenses 1 Cultivation License N/A Nil Nil FL – Florida 62 Stores 552,200 SF Cultivation5 N/A Nil Nil Grand Total ~$123.2mm ~$83.3mm Total Due Pre-Indenture Notes Maturity (December 2024) ~$91.5mm ~$60.5mm Total Due Post-Indenture Notes Maturity (December 2024) ~$31.7mm ~$22.8mm The following provides a summary of the entities and relevant operations which have issued Seller Notes ▪ ~$92mm of Seller Notes are due prior to the December 2024 Indenture maturity date; a two-year extension would reduce Seller Note principal payments prior to December 2024 to ~$21mm1 Note: Principal outstanding as of 7/31/2023 1) Pro forma maturity profile reflects contingent agreements and assumes all Seller Notes with maturities prior to 2026 and without a contingent agreement are extended 2 years. Updated to reflect LivFree extension as of October 2023 2) Includes the Assumed CannaPharmacy Debt and Assumed GSD Debt 3) Includes PA-Dochouse, NV-CannaPunch, NV-LivFree and MA-Sira Seller Notes 4) Cultivation SF assumes triple stacked grow tables; Ayr currently has regulatory approval for double stacked tables and the ability to apply for approval of triple stacked grow tables 5) Includes 435k SF Hoop House cultivation facility |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 11 Business Overview © 2023 AYR Wellness Inc. • Private and Confidential The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

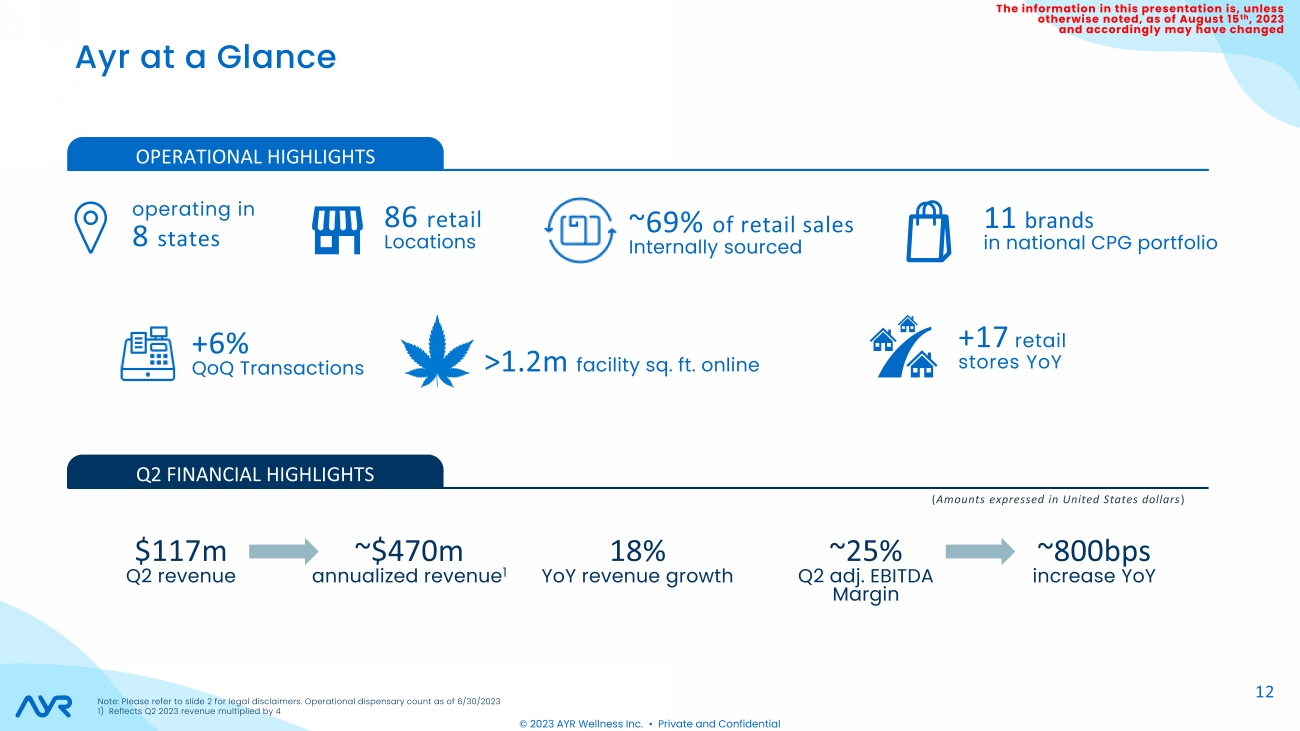

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 12 $117m Q2 revenue ~$470m annualized revenue1 18% YoY revenue growth ~25% Q2 adj. EBITDA Margin ~800bps increase YoY OPERATIONAL HIGHLIGHTS Q2 FINANCIAL HIGHLIGHTS operating in 8 states 86 retail Locations 11 brands in national CPG portfolio >1.2m facility sq. ft. online +17 retail stores YoY ~69% of retail sales Internally sourced © 2023 AYR Wellness Inc. • Private and Confidential +6% QoQ Transactions (Amounts expressed in United States dollars) Ayr at a Glance Note: Please refer to slide 2 for legal disclaimers. Operational dispensary count as of 6/30/2023 1) Reflects Q2 2023 revenue multiplied by 4 |

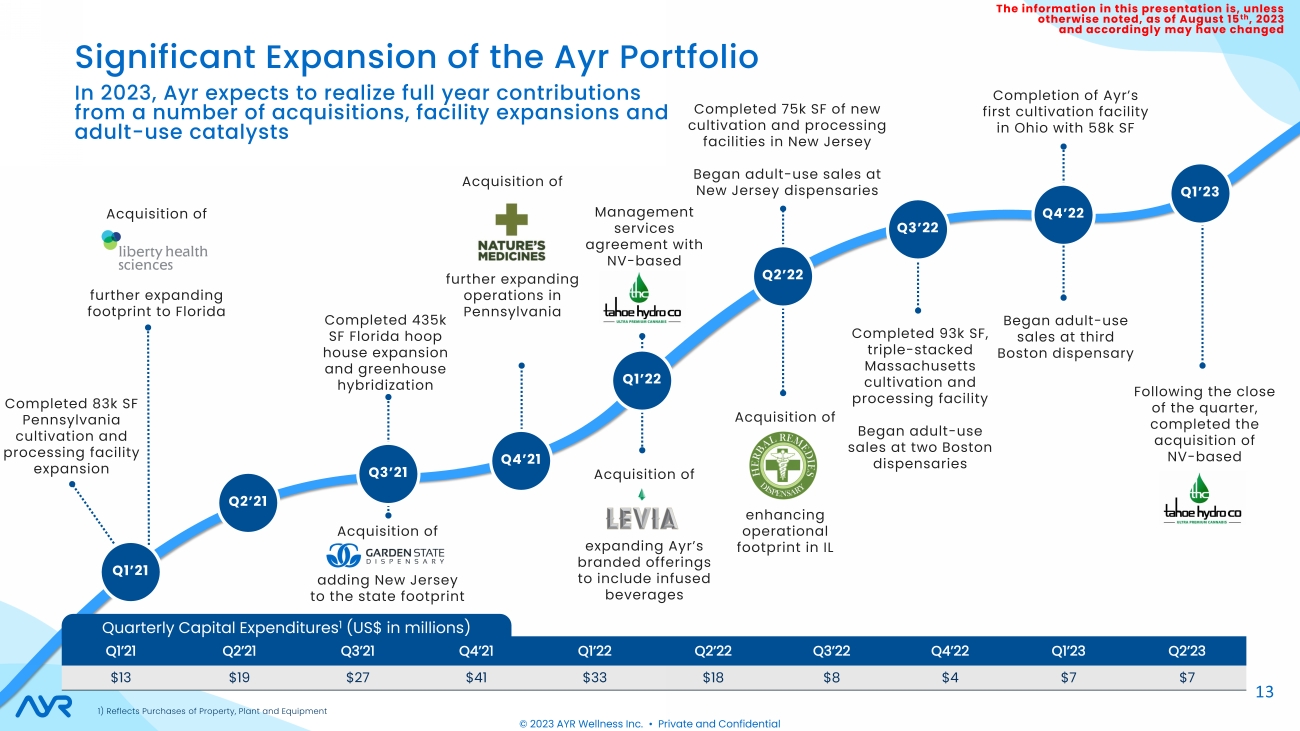

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Q4’22 Acquisition of expanding Ayr’s branded offerings to include infused beverages Completed 93k SF, triple-stacked Massachusetts cultivation and processing facility Began adult-use sales at two Boston dispensaries Management services agreement with NV-based Completion of Ayr’s first cultivation facility in Ohio with 58k SF Completed 83k SF Pennsylvania cultivation and processing facility expansion Acquisition of further expanding footprint to Florida Completed 75k SF of new cultivation and processing facilities in New Jersey Began adult-use sales at New Jersey dispensaries Acquisition of further expanding operations in Pennsylvania Acquisition of enhancing operational footprint in IL Q1’21 Q3’22 Q1’22 Q4’21 Q2’22 Began adult-use sales at third Boston dispensary Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 Q1’23 Q2’23 $13 $19 $27 $41 $33 $18 $8 $4 $7 $7 Quarterly Capital Expenditures1 (US$ in millions) Completed 435k SF Florida hoop house expansion and greenhouse hybridization Acquisition of adding New Jersey to the state footprint Q3’21 Q2’21 © 2023 AYR Wellness Inc. • Private and Confidential Q1’23 Following the close of the quarter, completed the acquisition of NV-based Significant Expansion of the Ayr Portfolio In 2023, Ayr expects to realize full year contributions from a number of acquisitions, facility expansions and adult-use catalysts 13 1) Reflects Purchases of Property, Plant and Equipment |

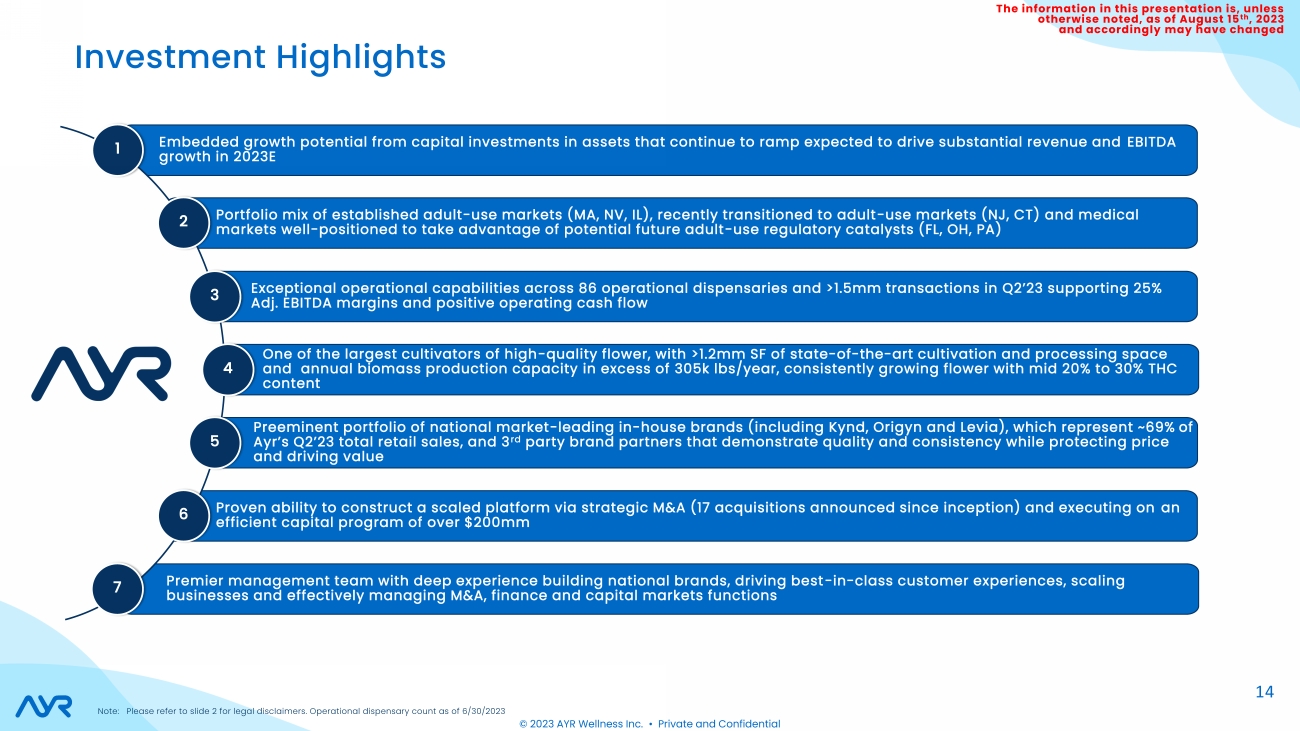

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Portfolio mix of established adult-use markets (MA, NV, IL), recently transitioned to adult-use markets (NJ, CT) and medical markets well-positioned to take advantage of potential future adult-use regulatory catalysts (FL, OH, PA) Premier management team with deep experience building national brands, driving best-in-class customer experiences, scaling businesses and effectively managing M&A, finance and capital markets functions Exceptional operational capabilities across 86 operational dispensaries and >1.5mm transactions in Q2’23 supporting 25% Adj. EBITDA margins and positive operating cash flow Proven ability to construct a scaled platform via strategic M&A (17 acquisitions announced since inception) and executing on an efficient capital program of over $200mm Preeminent portfolio of national market-leading in-house brands (including Kynd, Origyn and Levia), which represent ~69% of Ayr’s Q2’23 total retail sales, and 3rd party brand partners that demonstrate quality and consistency while protecting price and driving value Embedded growth potential from capital investments in assets that continue to ramp expected to drive substantial revenue and EBITDA growth in 2023E One of the largest cultivators of high-quality flower, with >1.2mm SF of state-of-the-art cultivation and processing space and annual biomass production capacity in excess of 305k lbs/year, consistently growing flower with mid 20% to 30% THC content 2 3 5 1 4 7 6 © 2023 AYR Wellness Inc. • Private and Confidential Investment Highlights 14 Note: Please refer to slide 2 for legal disclaimers. Operational dispensary count as of 6/30/2023 |

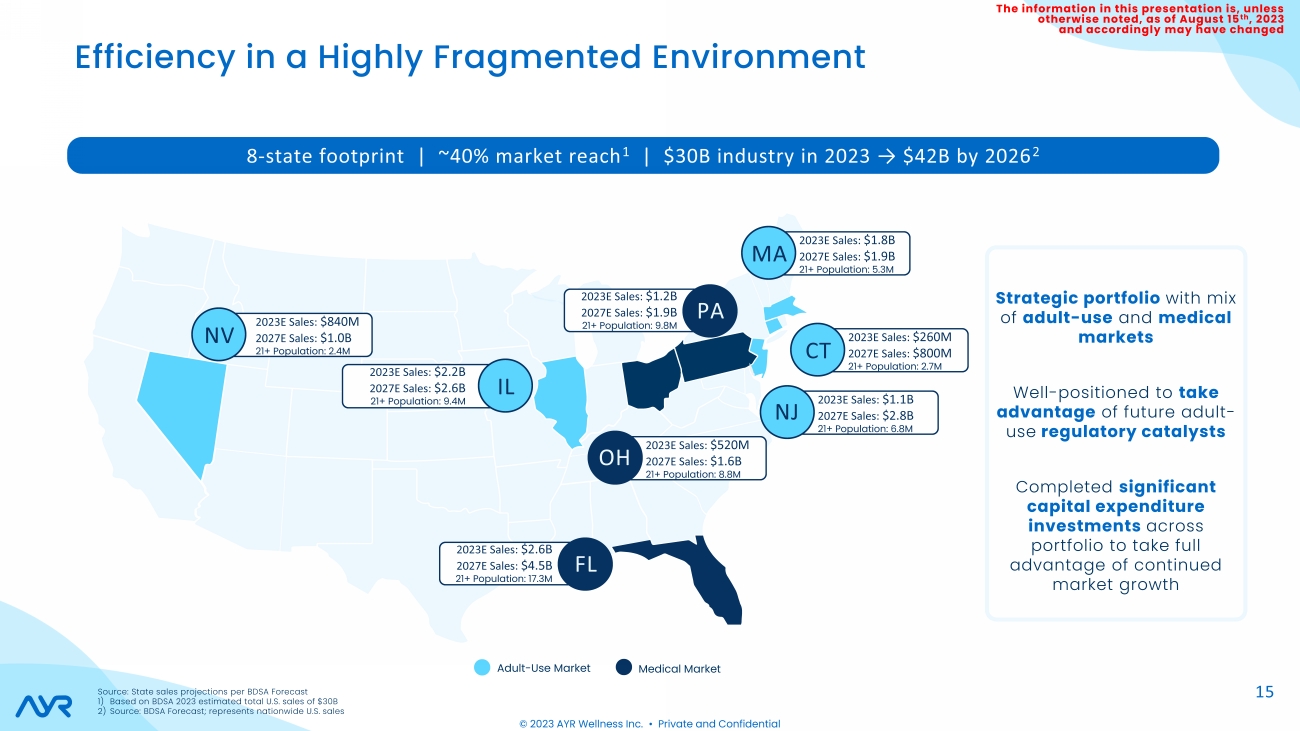

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Adult-Use Market Medical Market Strategic portfolio with mix of adult-use and medical markets Well-positioned to take advantage of future adult-use regulatory catalysts Completed significant capital expenditure investments across portfolio to take full advantage of continued market growth 8-state footprint | ~40% market reach1 | $30B industry in 2023 → $42B by 2026 2 2023E Sales: $840M 2027E Sales: $1.0B 21+ Population: 2.4M NV 2023E Sales: $2.2B 2027E Sales: $2.6B 21+ Population: 9.4M IL 2023E Sales: $2.6B 2027E Sales: $4.5B 21+ Population: 17.3M FL 2023E Sales: $520M 2027E Sales: $1.6B 21+ Population: 8.8M OH 2023E Sales: $1.8B 2027E Sales: $1.9B 21+ Population: 5.3M MA 2023E Sales: $1.1B 2027E Sales: $2.8B 21+ Population: 6.8M NJ 2023E Sales: $1.2B 2027E Sales: $1.9B 21+ Population: 9.8M PA © 2023 AYR Wellness Inc. • Private and Confidential 2023E Sales: $260M 2027E Sales: $800M 21+ Population: 2.7M CT Efficiency in a Highly Fragmented Environment Source: State sales projections per BDSA Forecast 15 1) Based on BDSA 2023 estimated total U.S. sales of $30B 2) Source: BDSA Forecast; represents nationwide U.S. sales |

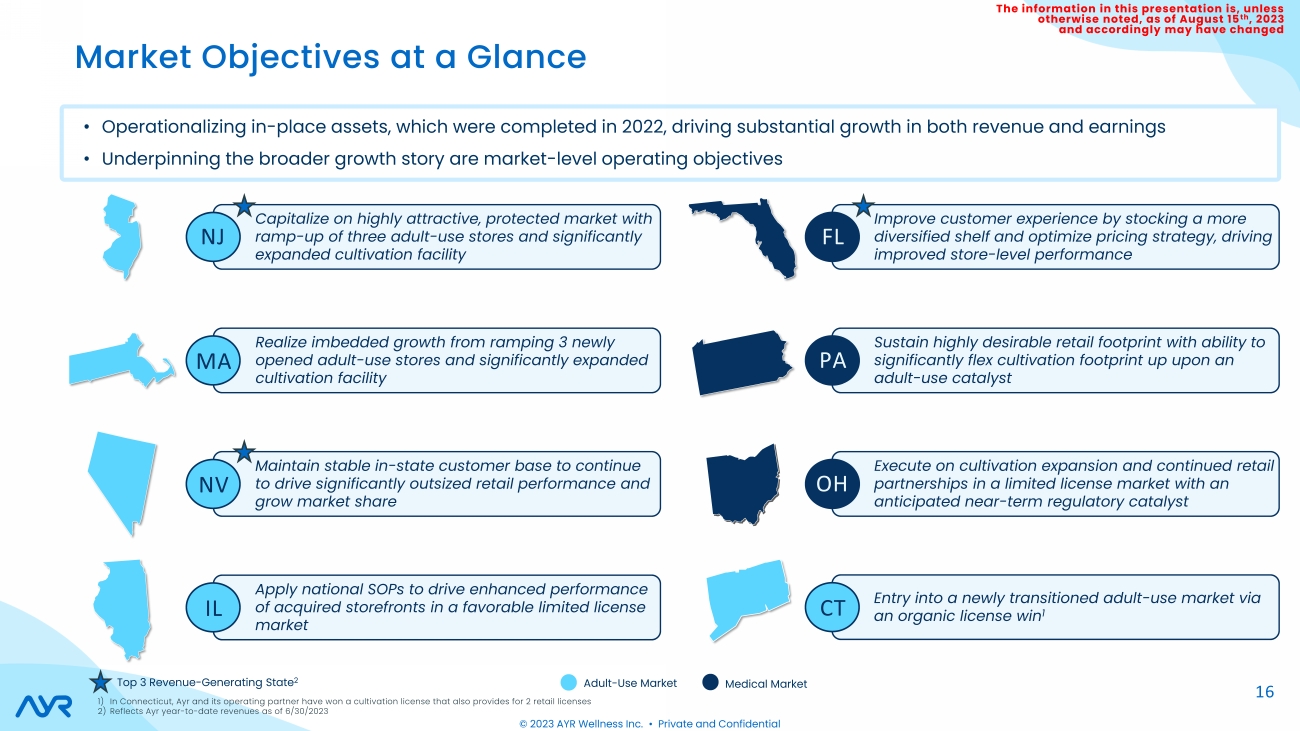

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Sustain highly desirable retail footprint with ability to significantly flex cultivation footprint up upon an adult-use catalyst Improve customer experience by stocking a more diversified shelf and optimize pricing strategy, driving improved store-level performance Execute on cultivation expansion and continued retail partnerships in a limited license market with an anticipated near-term regulatory catalyst Maintain stable in-state customer base to continue to drive significantly outsized retail performance and grow market share Realize imbedded growth from ramping 3 newly opened adult-use stores and significantly expanded cultivation facility Capitalize on highly attractive, protected market with ramp-up of three adult-use stores and significantly expanded cultivation facility Adult-Use Market Medical Market 16 • Operationalizing in-place assets, which were completed in 2022, driving substantial growth in both revenue and earnings • Underpinning the broader growth story are market-level operating objectives NV FL OH MA NJ PA Apply national SOPs to drive enhanced performance of acquired storefronts in a favorable limited license market IL © 2023 AYR Wellness Inc. • Private and Confidential Entry into a newly transitioned adult-use market via CT an organic license win1 Market Objectives at a Glance 1) In Connecticut, Ayr and its operating partner have won a cultivation license that also provides for 2 retail licenses 2) Reflects Ayr year-to-date revenues as of 6/30/2023 Top 3 Revenue-Generating State2 |

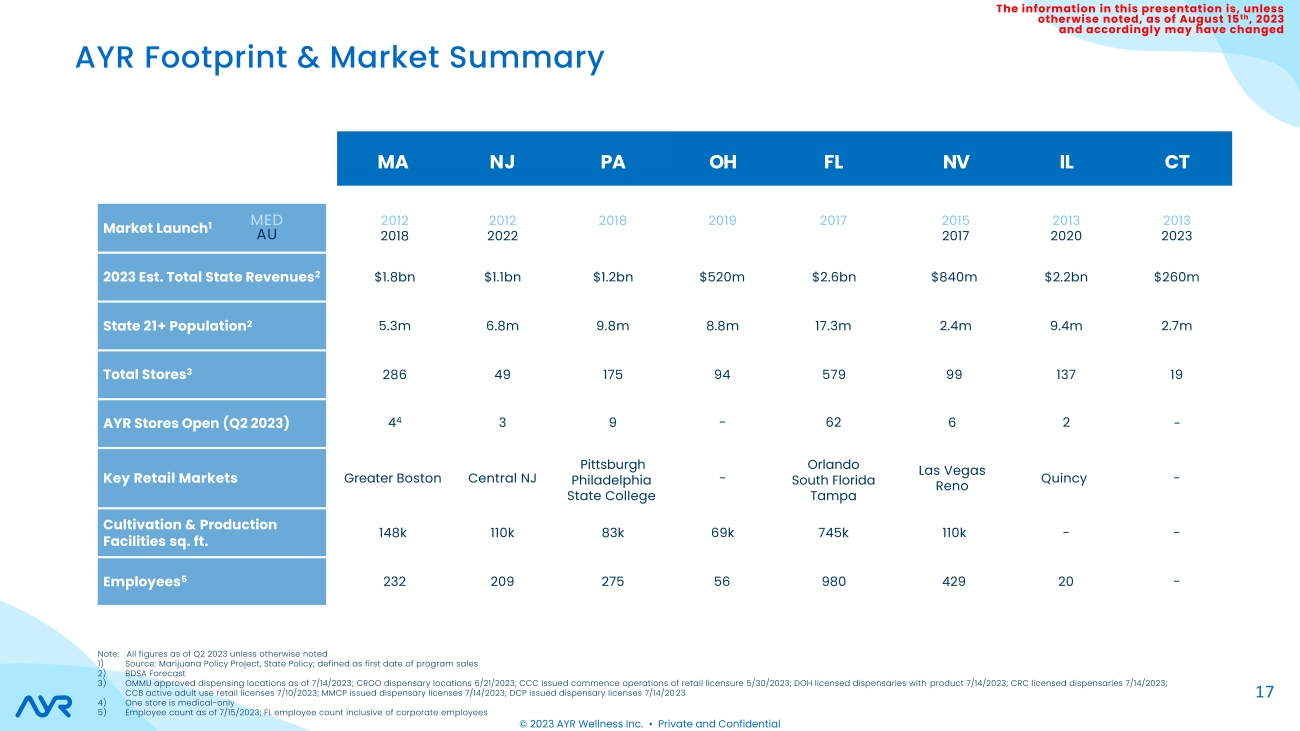

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Note: All figures as of Q2 2023 unless otherwise noted 1) Source: Marijuana Policy Project, State Policy; defined as first date of program sales 2) BDSA Forecast 3) OMMU approved dispensing locations as of 7/14/2023; CROO dispensary locations 6/21/2023; CCC issued commence operations of retail licensure 5/30/2023; DOH licensed dispensaries with product 7/14/2023; CRC licensed dispensaries 7/14/2023; CCB active adult use retail licenses 7/10/2023; MMCP issued dispensary licenses 7/14/2023; DCP issued dispensary licenses 7/14/20 23 4) One store is medical-only 5) Employee count as of 7/15/2023; FL employee count inclusive of corporate employees ` MA NJ PA OH FL NV IL CT Market Launch1 2012 2018 2012 2022 2018 2019 2017 2015 2017 2013 2020 2013 2023 2023 Est. Total State Revenues2 $1.8bn $1.1bn $1.2bn $520m $2.6bn $840m $2.2bn $260m State 21+ Population2 5.3m 6.8m 9.8m 8.8m 17.3m 2.4m 9.4m 2.7m Total Stores3 286 49 175 94 579 99 137 19 AYR Stores Open (Q2 2023) 44 3 9 - 62 6 2 - Key Retail Markets Greater Boston Central NJ Pittsburgh Philadelphia State College - Orlando South Florida Tampa Las Vegas Reno Quincy - Cultivation & Production Facilities sq. ft. 148k 110k 83k 69k 745k 110k - - Employees5 232 209 275 56 980 429 20 - © 2023 AYR Wellness Inc. • Private and Confidential MED AU AYR Footprint & Market Summary 17 |

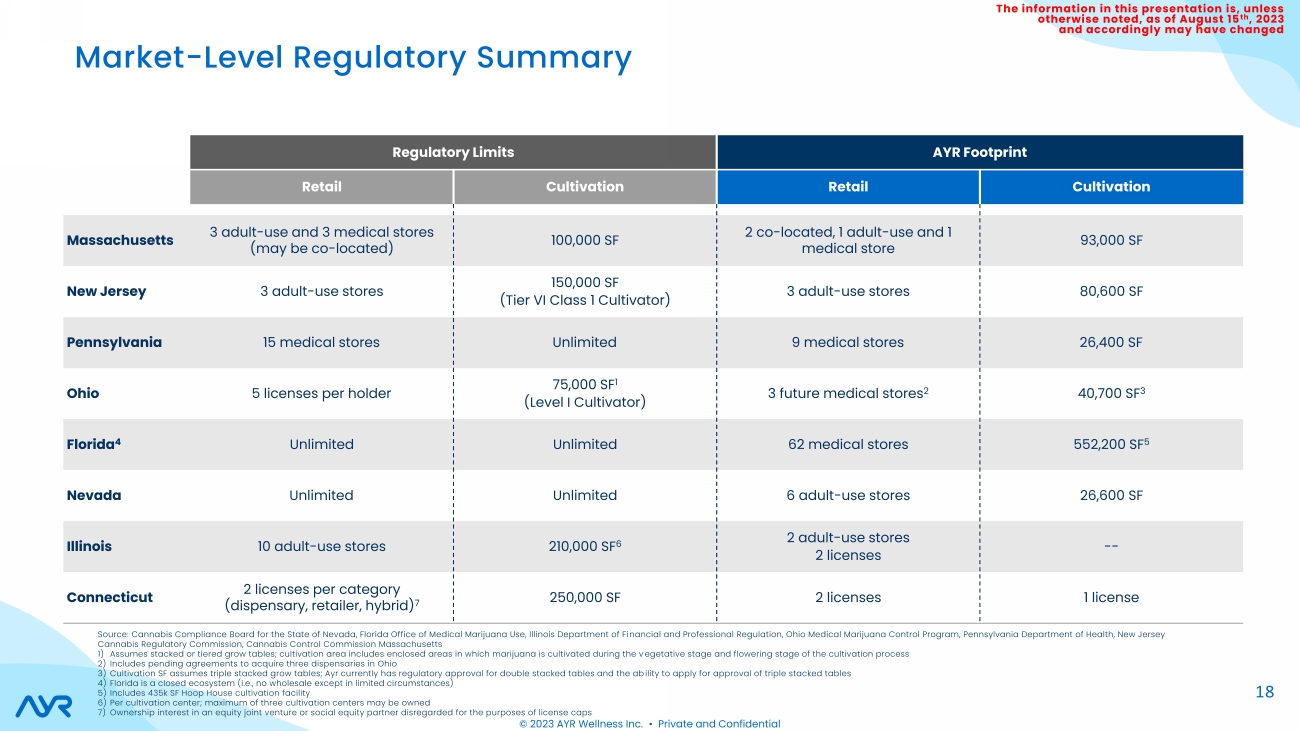

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 18 Regulatory Limits AYR Footprint Retail Cultivation Retail Cultivation Massachusetts 3 adult-use and 3 medical stores (may be co-located) 100,000 SF 2 co-located, 1 adult-use and 1 medical store 93,000 SF New Jersey 3 adult-use stores 150,000 SF (Tier VI Class 1 Cultivator) 3 adult-use stores 80,600 SF Pennsylvania 15 medical stores Unlimited 9 medical stores 26,400 SF Ohio 5 licenses per holder 75,000 SF1 (Level I Cultivator) 3 future medical stores 2 40,700 SF 3 Florida4 Unlimited Unlimited 62 medical stores 552,200 SF 5 Nevada Unlimited Unlimited 6 adult-use stores 26,600 SF Illinois 10 adult-use stores 210,000 SF6 2 adult-use stores 2 licenses -- Connecticut 2 licenses per category (dispensary, retailer, hybrid)7 250,000 SF 2 licenses 1 license © 2023 AYR Wellness Inc. • Private and Confidential Market-Level Regulatory Summary Source: Cannabis Compliance Board for the State of Nevada, Florida Office of Medical Marijuana Use, Illinois Department of Fi nancial and Professional Regulation, Ohio Medical Marijuana Control Program, Pennsylvania Department of Health, New Jersey Cannabis Regulatory Commission, Cannabis Control Commission Massachusetts 1) Assumes stacked or tiered grow tables; cultivation area includes enclosed areas in which marijuana is cultivated during the v egetative stage and flowering stage of the cultivation process 2) Includes pending agreements to acquire three dispensaries in Ohio 3) Cultivation SF assumes triple stacked grow tables; Ayr currently has regulatory approval for double stacked tables and the ability to apply for approval of triple stacked tables 4) Florida is a closed ecosystem (i.e., no wholesale except in limited circumstances) 5) Includes 435k SF Hoop House cultivation facility 6) Per cultivation center; maximum of three cultivation centers may be owned 7) Ownership interest in an equity joint venture or social equity partner disregarded for the purposes of license caps |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 19 Management Projections Overview © 2023 AYR Wellness Inc. • Private and Confidential The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

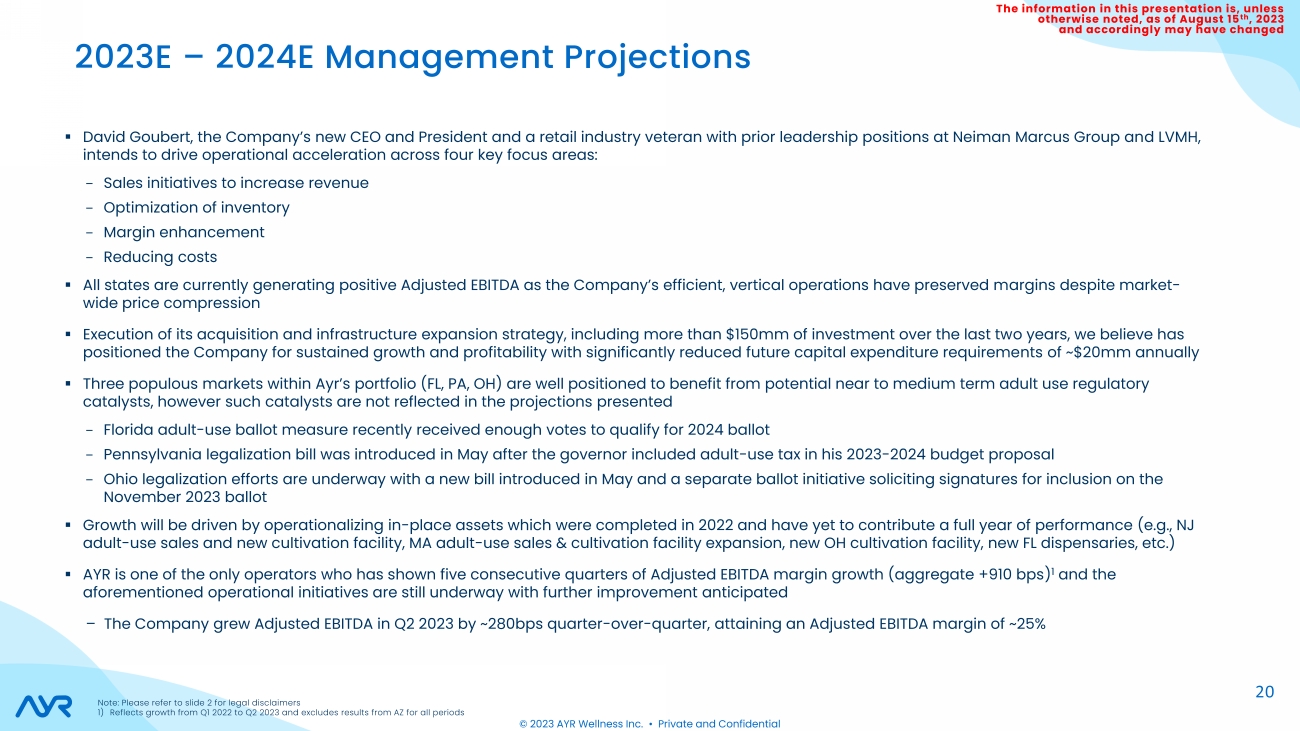

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed ▪ David Goubert, the Company’s new CEO and President and a retail industry veteran with prior leadership positions at Neiman Marcus Group and LVMH, intends to drive operational acceleration across four key focus areas: – Sales initiatives to increase revenue – Optimization of inventory – Margin enhancement – Reducing costs ▪ All states are currently generating positive Adjusted EBITDA as the Company’s efficient, vertical operations have preserved margins despite market-wide price compression ▪ Execution of its acquisition and infrastructure expansion strategy, including more than $150mm of investment over the last two years, we believe has positioned the Company for sustained growth and profitability with significantly reduced future capital expenditure requirements of ~$20mm annually ▪ Three populous markets within Ayr’s portfolio (FL, PA, OH) are well positioned to benefit from potential near to medium term adult use regulatory catalysts, however such catalysts are not reflected in the projections presented – Florida adult-use ballot measure recently received enough votes to qualify for 2024 ballot – Pennsylvania legalization bill was introduced in May after the governor included adult-use tax in his 2023-2024 budget proposal – Ohio legalization efforts are underway with a new bill introduced in May and a separate ballot initiative soliciting signatures for inclusion on the November 2023 ballot ▪ Growth will be driven by operationalizing in-place assets which were completed in 2022 and have yet to contribute a full year of performance (e.g., NJ adult-use sales and new cultivation facility, MA adult-use sales & cultivation facility expansion, new OH cultivation facility, new FL dispensaries, etc.) ▪ AYR is one of the only operators who has shown five consecutive quarters of Adjusted EBITDA margin growth (aggregate +910 bps) 1 and the aforementioned operational initiatives are still underway with further improvement anticipated – The Company grew Adjusted EBITDA in Q2 2023 by ~280bps quarter-over-quarter, attaining an Adjusted EBITDA margin of ~25% © 2023 AYR Wellness Inc. • Private and Confidential 2023E – 2024E Management Projections 20 Note: Please refer to slide 2 for legal disclaimers 1) Reflects growth from Q1 2022 to Q2 2023 and excludes results from AZ for all periods |

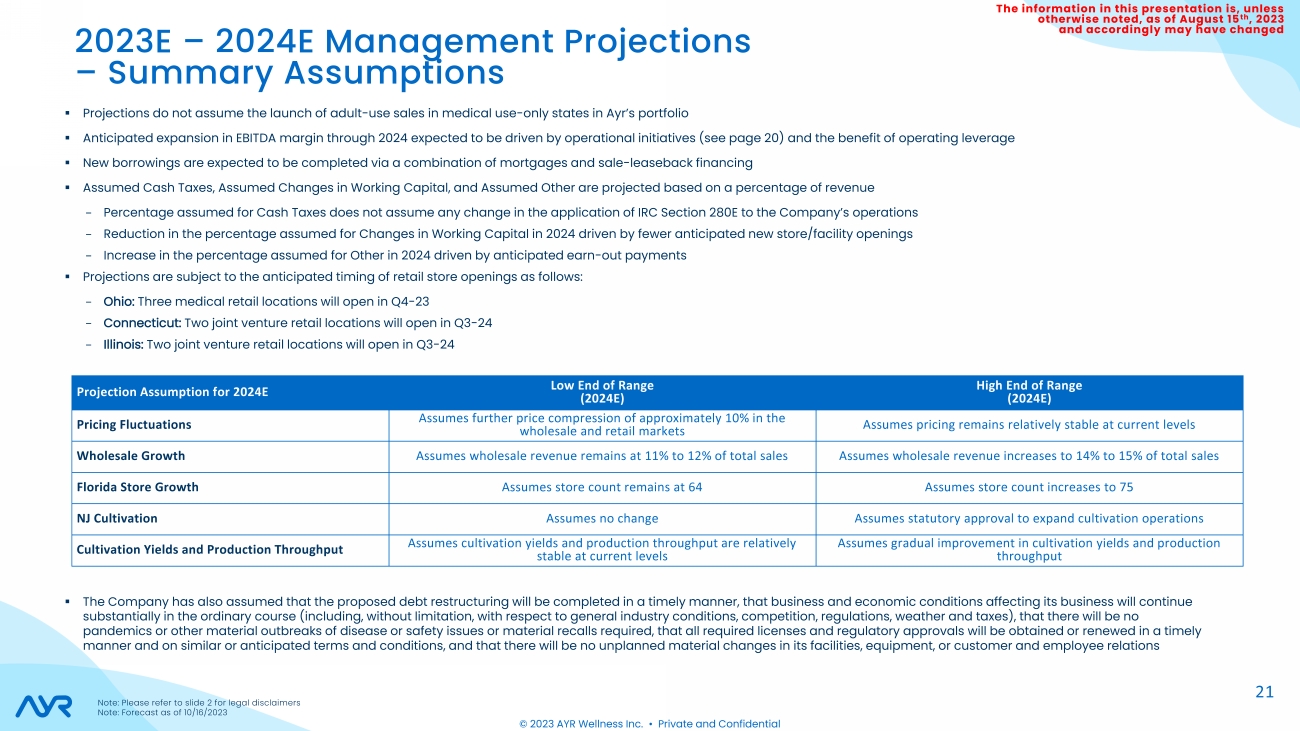

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed © 2023 AYR Wellness Inc. • Private and Confidential 2023E – 2024E Management Projections – Summary Assumptions 21 Note: Please refer to slide 2 for legal disclaimers Note: Forecast as of 10/16/2023 ▪ Projections do not assume the launch of adult-use sales in medical use-only states in Ayr’s portfolio ▪ Anticipated expansion in EBITDA margin through 2024 expected to be driven by operational initiatives (see page 20) and the benefit of operating leverage ▪ New borrowings are expected to be completed via a combination of mortgages and sale-leaseback financing ▪ Assumed Cash Taxes, Assumed Changes in Working Capital, and Assumed Other are projected based on a percentage of revenue – Percentage assumed for Cash Taxes does not assume any change in the application of IRC Section 280E to the Company’s operations – Reduction in the percentage assumed for Changes in Working Capital in 2024 driven by fewer anticipated new store/facility openings – Increase in the percentage assumed for Other in 2024 driven by anticipated earn-out payments ▪ Projections are subject to the anticipated timing of retail store openings as follows: – Ohio: Three medical retail locations will open in Q4-23 – Connecticut: Two joint venture retail locations will open in Q3-24 – Illinois: Two joint venture retail locations will open in Q3-24 ▪ The Company has also assumed that the proposed debt restructuring will be completed in a timely manner, that business and economic conditions affecting its business will continue substantially in the ordinary course (including, without limitation, with respect to general industry conditions, competition, regulations, weather and taxes), that there will be no pandemics or other material outbreaks of disease or safety issues or material recalls required, that all required licenses and regulatory approvals will be obtained or renewed in a timely manner and on similar or anticipated terms and conditions, and that there will be no unplanned material changes in its facilities, equipment, or customer and employee relations Projection Assumption for 2024E Low End of Range (2024E) High End of Range (2024E) Pricing Fluctuations Assumes further price compression of approximately 10% in the wholesale and retail markets Assumes pricing remains relatively stable at current levels Wholesale Growth Assumes wholesale revenue remains at 11% to 12% of total sales Assumes wholesale revenue increases to 14% to 15% of total sales Florida Store Growth Assumes store count remains at 64 Assumes store count increases to 75 NJ Cultivation Assumes no change Assumes statutory approval to expand cultivation operations Cultivation Yields and Production Throughput Assumes cultivation yields and production throughput are relatively stable at current levels Assumes gradual improvement in cultivation yields and production throughput |

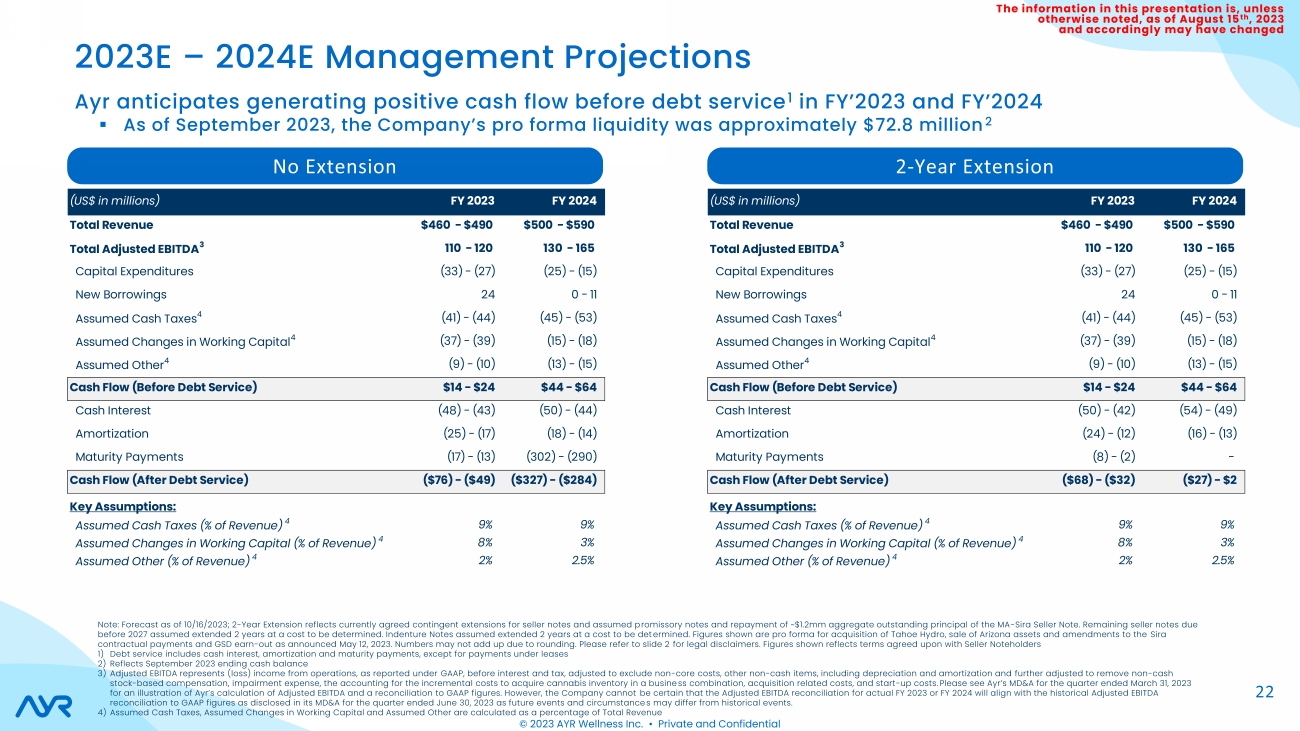

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed © 2023 AYR Wellness Inc. • Private and Confidential No Extension 2-Year Extension Ayr anticipates generating positive cash flow before debt service1 in FY’2023 and FY’2024 ▪ As of September 2023, the Company’s pro forma liquidity was approximately $72.8 million2 2023E – 2024E Management Projections 22 Note: Forecast as of 10/16/2023; 2-Year Extension reflects currently agreed contingent extensions for seller notes and assumed promissory notes and repayment of ~$1.2mm aggregate outstanding principal of the MA-Sira Seller Note. Remaining seller notes due before 2027 assumed extended 2 years at a cost to be determined. Indenture Notes assumed extended 2 years at a cost to be det ermined. Figures shown are pro forma for acquisition of Tahoe Hydro, sale of Arizona assets and amendments to the Sira contractual payments and GSD earn-out as announced May 12, 2023. Numbers may not add up due to rounding. Please refer to slide 2 for legal disclaimers. Figures shown reflects terms agreed upon with Seller Noteholders 1) Debt service includes cash interest, amortization and maturity payments, except for payments under leases 2) Reflects September 2023 ending cash balance 3) Adjusted EBITDA represents (loss) income from operations, as reported under GAAP, before interest and tax, adjusted to exclude non-core costs, other non-cash items, including depreciation and amortization and further adjusted to remove non-cash stock-based compensation, impairment expense, the accounting for the incremental costs to acquire cannabis inventory in a business combination, acquisition related costs, and start-up costs. Please see Ayr’s MD&A for the quarter ended March 31, 2023 for an illustration of Ayr’s calculation of Adjusted EBITDA and a reconciliation to GAAP figures. However, the Company cannot be certain that the Adjusted EBITDA reconciliation for actual FY 2023 or FY 2024 will align with the historical Adjusted EBITDA reconciliation to GAAP figures as disclosed in its MD&A for the quarter ended June 30, 2023 as future events and circumstance s may differ from historical events. 4) Assumed Cash Taxes, Assumed Changes in Working Capital and Assumed Other are calculated as a percentage of Total Revenue (US$ in millions) FY 2023 FY 2024 Total Revenue $460 - $490 $500 - $590 Total Adjusted EBITDA3 110 - 120 130 - 165 Capital Expenditures (33) - (27) (25) - (15) New Borrowings 24 0 - 11 Assumed Cash Taxes4 (41) - (44) (45) - (53) Assumed Changes in Working Capital4 (37) - (39) (15) - (18) Assumed Other4 (9) - (10) (13) - (15) Cash Flow (Before Debt Service) $14 - $24 $44 - $64 Cash Interest (48) - (43) (50) - (44) Amortization (25) - (17) (18) - (14) Maturity Payments (17) - (13) (302) - (290) Cash Flow (After Debt Service) ($76) - ($49) ($327) - ($284) Key Assumptions: Assumed Cash Taxes (% of Revenue) 4 9% 9% Assumed Changes in Working Capital (% of Revenue) 4 8% 3% Assumed Other (% of Revenue) 4 2% 2.5% (US$ in millions) FY 2023 FY 2024 Total Revenue $460 - $490 $500 - $590 Total Adjusted EBITDA3 110 - 120 130 - 165 Capital Expenditures (33) - (27) (25) - (15) New Borrowings 24 0 - 11 Assumed Cash Taxes4 (41) - (44) (45) - (53) Assumed Changes in Working Capital4 (37) - (39) (15) - (18) Assumed Other4 (9) - (10) (13) - (15) Cash Flow (Before Debt Service) $14 - $24 $44 - $64 Cash Interest (50) - (42) (54) - (49) Amortization (24) - (12) (16) - (13) Maturity Payments (8) - (2) - Cash Flow (After Debt Service) ($68) - ($32) ($27) - $2 Key Assumptions: Assumed Cash Taxes (% of Revenue) 4 9% 9% Assumed Changes in Working Capital (% of Revenue) 4 8% 3% Assumed Other (% of Revenue) 4 2% 2.5% |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 23 Appendix © 2023 AYR Wellness Inc. • Private and Confidential The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

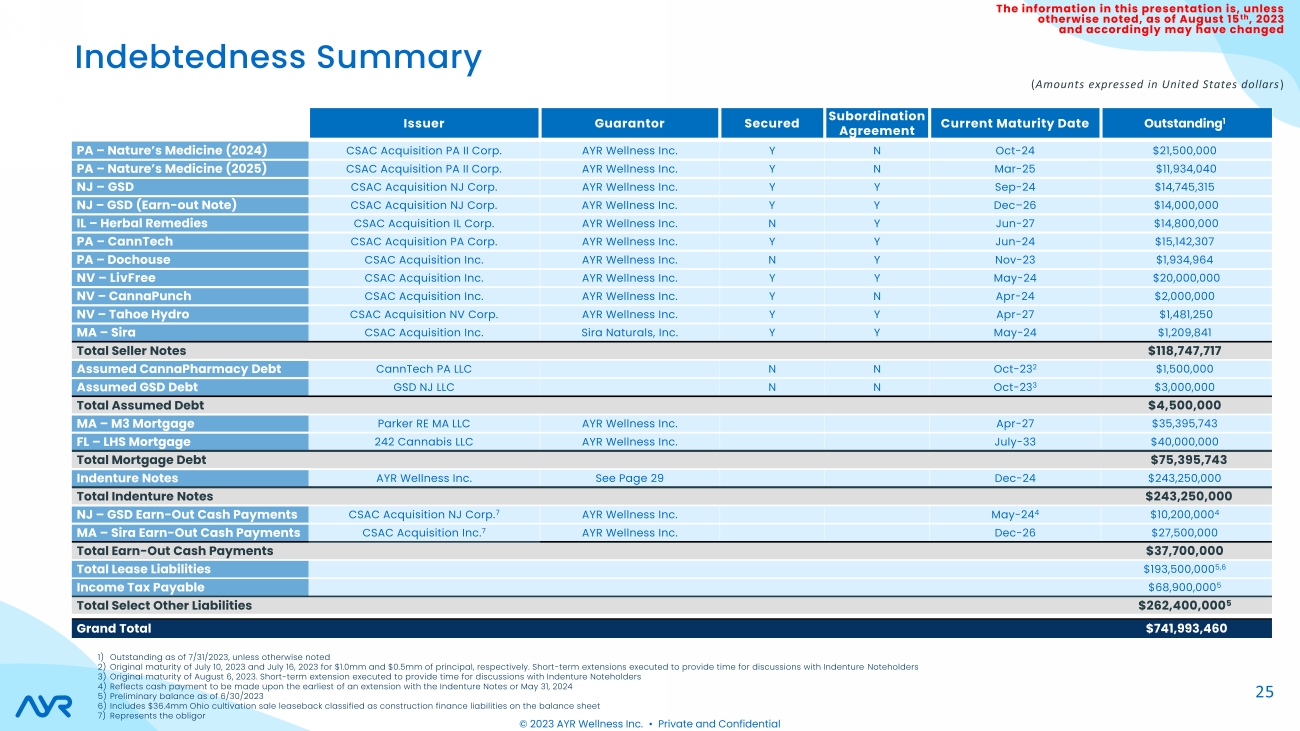

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 24 Indebtedness Summary The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 25 © 2023 AYR Wellness Inc. • Private and Confidential (Amounts expressed in United States dollars) Indebtedness Summary ` Issuer Guarantor Secured Subordination Agreement Current Maturity Date Outstanding1 PA – Nature’s Medicine (2024) CSAC Acquisition PA II Corp. AYR Wellness Inc. Y N Oct-24 $21,500,000 PA – Nature’s Medicine (2025) CSAC Acquisition PA II Corp. AYR Wellness Inc. Y N Mar-25 $11,934,040 NJ – GSD CSAC Acquisition NJ Corp. AYR Wellness Inc. Y Y Sep-24 $14,745,315 NJ – GSD (Earn-out Note) CSAC Acquisition NJ Corp. AYR Wellness Inc. Y Y Dec–26 $14,000,000 IL – Herbal Remedies CSAC Acquisition IL Corp. AYR Wellness Inc. N Y Jun-27 $14,800,000 PA – CannTech CSAC Acquisition PA Corp. AYR Wellness Inc. Y Y Jun-24 $15,142,307 PA – Dochouse CSAC Acquisition Inc. AYR Wellness Inc. N Y Nov-23 $1,934,964 NV – LivFree CSAC Acquisition Inc. AYR Wellness Inc. Y Y May-24 $20,000,000 NV – CannaPunch CSAC Acquisition Inc. AYR Wellness Inc. Y N Apr-24 $2,000,000 NV – Tahoe Hydro CSAC Acquisition NV Corp. AYR Wellness Inc. Y Y Apr-27 $1,481,250 MA – Sira CSAC Acquisition Inc. Sira Naturals, Inc. Y Y May-24 $1,209,841 Total Seller Notes $118,747,717 Assumed CannaPharmacy Debt CannTech PA LLC N N Oct-23 2 $1,500,000 Assumed GSD Debt GSD NJ LLC N N Oct-23 3 $3,000,000 Total Assumed Debt $4,500,000 MA – M3 Mortgage Parker RE MA LLC AYR Wellness Inc. Apr-27 $35,395,743 FL – LHS Mortgage 242 Cannabis LLC AYR Wellness Inc. July-33 $40,000,000 Total Mortgage Debt $75,395,743 Indenture Notes AYR Wellness Inc. See Page 29 Dec-24 $243,250,000 Total Indenture Notes $243,250,000 NJ – GSD Earn-Out Cash Payments CSAC Acquisition NJ Corp.7 AYR Wellness Inc. May-244 $10,200,0004 MA – Sira Earn-Out Cash Payments CSAC Acquisition Inc.7 AYR Wellness Inc. Dec-26 $27,500,000 Total Earn-Out Cash Payments $37,700,000 Total Lease Liabilities $193,500,0005,6 Income Tax Payable $68,900,0005 Total Select Other Liabilities $262,400,0005 Grand Total $741,993,460 1) Outstanding as of 7/31/2023, unless otherwise noted 2) Original maturity of July 10, 2023 and July 16, 2023 for $1.0mm and $0.5mm of principal, respectively. Short-term extensions executed to provide time for discussions with Indenture Noteholders 3) Original maturity of August 6, 2023. Short-term extension executed to provide time for discussions with Indenture Noteholders 4) Reflects cash payment to be made upon the earliest of an extension with the Indenture Notes or May 31, 2024 5) Preliminary balance as of 6/30/2023 6) Includes $36.4mm Ohio cultivation sale leaseback classified as construction finance liabilities on the balance sheet 7) Represents the obligor |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 26 Seller Note Extension Details The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

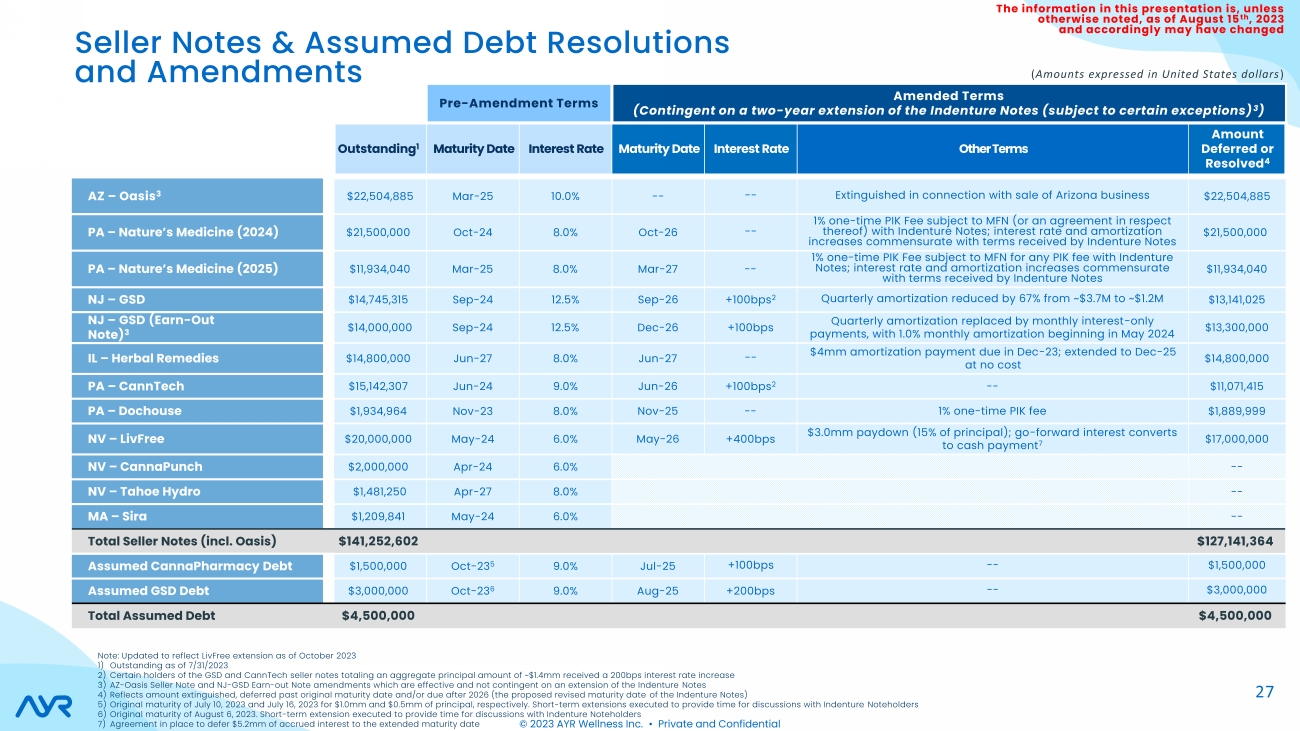

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Seller Notes & Assumed Debt Resolutions and Amendments Pre-Amendment Terms Amended Terms (Contingent on a two-year extension of the Indenture Notes (subject to certain exceptions) 3) ` Outstanding1 Maturity Date Interest Rate Maturity Date Interest Rate Other Terms Amount Deferred or Resolved4 AZ – Oasis3 $22,504,885 Mar-25 10.0% -- -- Extinguished in connection with sale of Arizona business $22,504,885 PA – Nature’s Medicine (2024) $21,500,000 Oct-24 8.0% Oct-26 -- 1% one-time PIK Fee subject to MFN (or an agreement in respect thereof) with Indenture Notes; interest rate and amortization increases commensurate with terms received by Indenture Notes $21,500,000 PA – Nature’s Medicine (2025) $11,934,040 Mar-25 8.0% Mar-27 -- 1% one-time PIK Fee subject to MFN for any PIK fee with Indenture Notes; interest rate and amortization increases commensurate with terms received by Indenture Notes $11,934,040 NJ – GSD $14,745,315 Sep-24 12.5% Sep-26 +100bps 2 Quarterly amortization reduced by 67% from ~$3.7M to ~$1.2M $13,141,025 NJ – GSD (Earn-Out Note)3 $14,000,000 Sep-24 12.5% Dec-26 +100bps Quarterly amortization replaced by monthly interest-only payments, with 1.0% monthly amortization beginning in May 2024 $13,300,000 IL – Herbal Remedies $14,800,000 Jun-27 8.0% Jun-27 -- $4mm amortization payment due in Dec-23; extended to Dec-25 at no cost $14,800,000 PA – CannTech $15,142,307 Jun-24 9.0% Jun-26 +100bps 2 -- $11,071,415 PA – Dochouse $1,934,964 Nov-23 8.0% Nov-25 -- 1% one-time PIK fee $1,889,999 NV – LivFree $20,000,000 May-24 6.0% May-26 +400bps $3.0mm paydown (15% of principal); go-forward interest converts to cash payment 7 $17,000,000 NV – CannaPunch $2,000,000 Apr-24 6.0% -- NV – Tahoe Hydro $1,481,250 Apr-27 8.0% -- MA – Sira $1,209,841 May-24 6.0% -- Total Seller Notes (incl. Oasis) $141,252,602 $127,141,364 Assumed CannaPharmacy Debt $1,500,000 Oct-235 9.0% Jul-25 +100bps -- $1,500,000 Assumed GSD Debt $3,000,000 Oct-236 9.0% Aug-25 +200bps -- $3,000,000 Total Assumed Debt $4,500,000 $4,500,000 © 2023 AYR Wellness Inc. • Private and Confidential Note: Updated to reflect LivFree extension as of October 2023 1) Outstanding as of 7/31/2023 2) Certain holders of the GSD and CannTech seller notes totaling an aggregate principal amount of ~$1.4mm received a 200bps interest rate increase 3) AZ-Oasis Seller Note and NJ-GSD Earn-out Note amendments which are effective and not contingent on an extension of the Indenture Notes 4) Reflects amount extinguished, deferred past original maturity date and/or due after 2026 (the proposed revised maturity date of the Indenture Notes) 5) Original maturity of July 10, 2023 and July 16, 2023 for $1.0mm and $0.5mm of principal, respectively. Short-term extensions executed to provide time for discussions with Indenture Noteholders 6) Original maturity of August 6, 2023. Short-term extension executed to provide time for discussions with Indenture Noteholders 7) Agreement in place to defer $5.2mm of accrued interest to the extended maturity date 27 (Amounts expressed in United States dollars) |

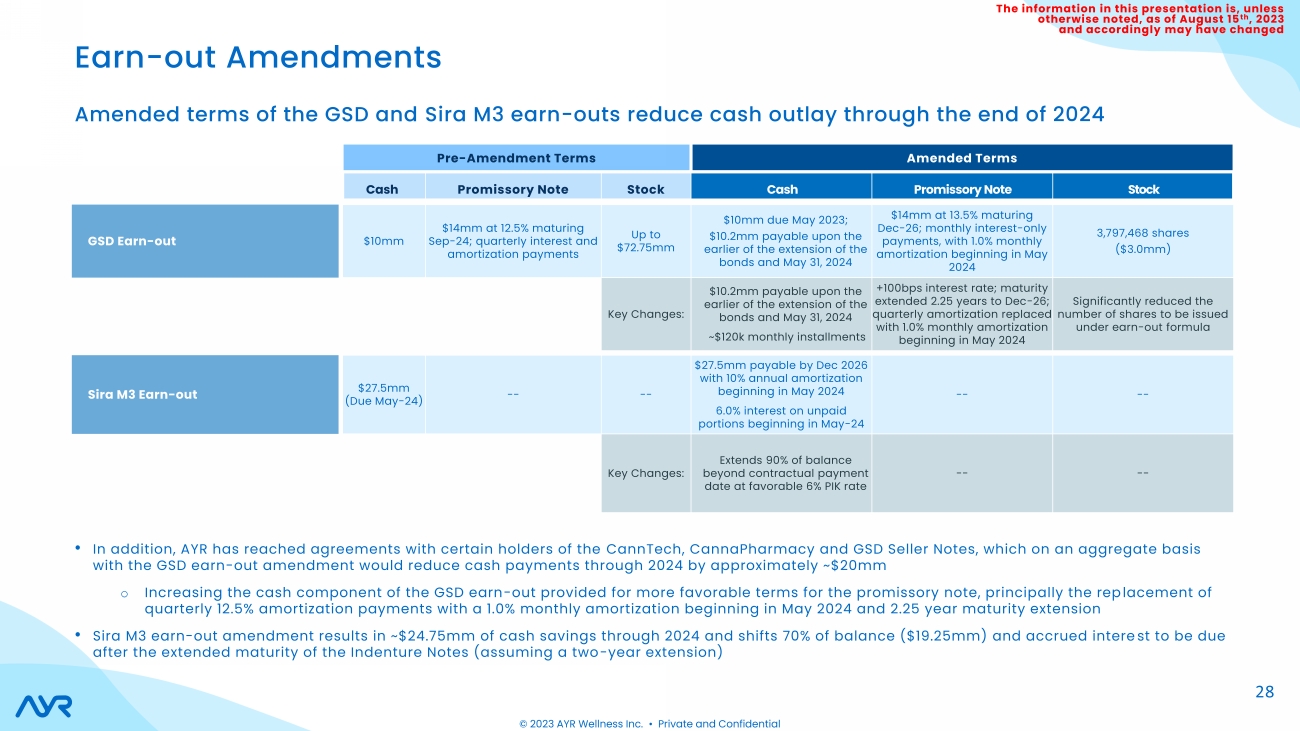

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed Earn-out Amendments © 2023 AYR Wellness Inc. • Private and Confidential Amended terms of the GSD and Sira M3 earn-outs reduce cash outlay through the end of 2024 Pre-Amendment Terms Amended Terms ` Cash Promissory Note Stock Cash Promissory Note Stock GSD Earn-out $10mm $14mm at 12.5% maturing Sep-24; quarterly interest and amortization payments Up to $72.75mm $10mm due May 2023; $10.2mm payable upon the earlier of the extension of the bonds and May 31, 2024 $14mm at 13.5% maturing Dec-26; monthly interest-only payments, with 1.0% monthly amortization beginning in May 2024 3,797,468 shares ($3.0mm) Key Changes: $10.2mm payable upon the earlier of the extension of the bonds and May 31, 2024 ~$120k monthly installments +100bps interest rate; maturity extended 2.25 years to Dec-26; quarterly amortization replaced with 1.0% monthly amortization beginning in May 2024 Significantly reduced the number of shares to be issued under earn-out formula Sira M3 Earn-out $27.5mm (Due May-24) -- -- $27.5mm payable by Dec 2026 with 10% annual amortization beginning in May 2024 6.0% interest on unpaid portions beginning in May-24 -- -- Key Changes: Extends 90% of balance beyond contractual payment date at favorable 6% PIK rate -- -- • In addition, AYR has reached agreements with certain holders of the CannTech, CannaPharmacy and GSD Seller Notes, which on an aggregate basis with the GSD earn-out amendment would reduce cash payments through 2024 by approximately ~$20mm o Increasing the cash component of the GSD earn-out provided for more favorable terms for the promissory note, principally the replacement of quarterly 12.5% amortization payments with a 1.0% monthly amortization beginning in May 2024 and 2.25 year maturity extension • Sira M3 earn-out amendment results in ~$24.75mm of cash savings through 2024 and shifts 70% of balance ($19.25mm) and accrued intere st to be due after the extended maturity of the Indenture Notes (assuming a two-year extension) 28 |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 29 Corporate Structure The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

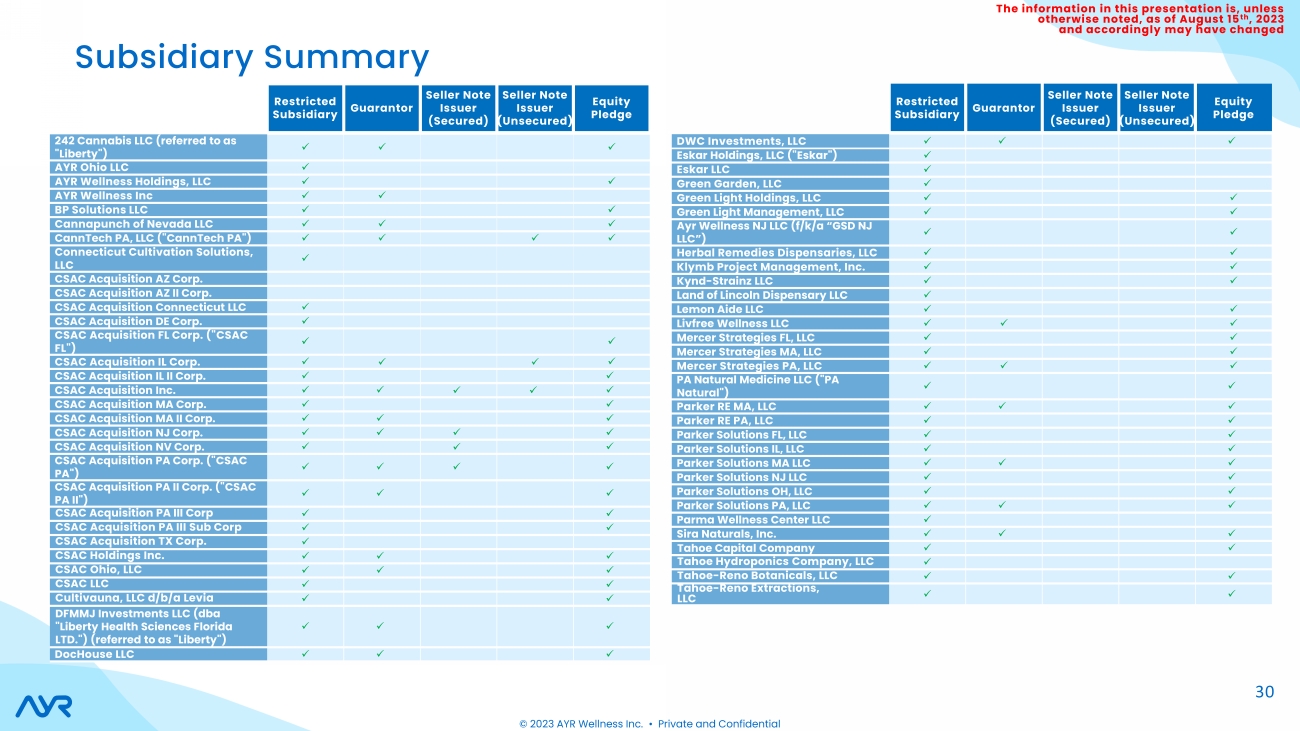

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 30 © 2023 AYR Wellness Inc. • Private and Confidential Subsidiary Summary ` Restricted Subsidiary Guarantor Seller Note Issuer (Secured) Seller Note Issuer (Unsecured) Equity Pledge 242 Cannabis LLC (referred to as "Liberty") ✓ ✓ ✓ AYR Ohio LLC ✓ AYR Wellness Holdings, LLC ✓ ✓ AYR Wellness Inc ✓ ✓ BP Solutions LLC ✓ ✓ Cannapunch of Nevada LLC ✓ ✓ ✓ CannTech PA, LLC ("CannTech PA") ✓ ✓ ✓ ✓ Connecticut Cultivation Solutions, LLC ✓ CSAC Acquisition AZ Corp. CSAC Acquisition AZ II Corp. CSAC Acquisition Connecticut LLC ✓ CSAC Acquisition DE Corp. ✓ CSAC Acquisition FL Corp. ("CSAC FL") ✓ ✓ CSAC Acquisition IL Corp. ✓ ✓ ✓ ✓ CSAC Acquisition IL II Corp. ✓ ✓ CSAC Acquisition Inc. ✓ ✓ ✓ ✓ ✓ CSAC Acquisition MA Corp. ✓ ✓ CSAC Acquisition MA II Corp. ✓ ✓ ✓ CSAC Acquisition NJ Corp. ✓ ✓ ✓ ✓ CSAC Acquisition NV Corp. ✓ ✓ ✓ CSAC Acquisition PA Corp. ("CSAC PA") ✓ ✓ ✓ ✓ CSAC Acquisition PA II Corp. ("CSAC PA II") ✓ ✓ ✓ CSAC Acquisition PA III Corp ✓ ✓ CSAC Acquisition PA III Sub Corp ✓ ✓ CSAC Acquisition TX Corp. ✓ CSAC Holdings Inc. ✓ ✓ ✓ CSAC Ohio, LLC ✓ ✓ ✓ CSAC LLC ✓ ✓ Cultivauna, LLC d/b/a Levia ✓ ✓ DFMMJ Investments LLC (dba "Liberty Health Sciences Florida LTD.") (referred to as "Liberty") ✓ ✓ ✓ DocHouse LLC ✓ ✓ ✓ ` Restricted Subsidiary Guarantor Seller Note Issuer (Secured) Seller Note Issuer (Unsecured) Equity Pledge DWC Investments, LLC ✓ ✓ ✓ Eskar Holdings, LLC ("Eskar") ✓ Eskar LLC ✓ Green Garden, LLC ✓ Green Light Holdings, LLC ✓ ✓ Green Light Management, LLC ✓ ✓ Ayr Wellness NJ LLC (f/k/a “GSD NJ LLC”) ✓ ✓ Herbal Remedies Dispensaries, LLC ✓ ✓ Klymb Project Management, Inc. ✓ ✓ Kynd-Strainz LLC ✓ ✓ Land of Lincoln Dispensary LLC ✓ Lemon Aide LLC ✓ ✓ Livfree Wellness LLC ✓ ✓ ✓ Mercer Strategies FL, LLC ✓ ✓ Mercer Strategies MA, LLC ✓ ✓ Mercer Strategies PA, LLC ✓ ✓ ✓ PA Natural Medicine LLC ("PA Natural") ✓ ✓ Parker RE MA, LLC ✓ ✓ ✓ Parker RE PA, LLC ✓ ✓ Parker Solutions FL, LLC ✓ ✓ Parker Solutions IL, LLC ✓ ✓ Parker Solutions MA LLC ✓ ✓ ✓ Parker Solutions NJ LLC ✓ ✓ Parker Solutions OH, LLC ✓ ✓ Parker Solutions PA, LLC ✓ ✓ ✓ Parma Wellness Center LLC ✓ Sira Naturals, Inc. ✓ ✓ ✓ Tahoe Capital Company ✓ ✓ Tahoe Hydroponics Company, LLC ✓ Tahoe-Reno Botanicals, LLC ✓ ✓ Tahoe-Reno Extractions, LLC ✓ ✓ |

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 31 Payment Schedules The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed |

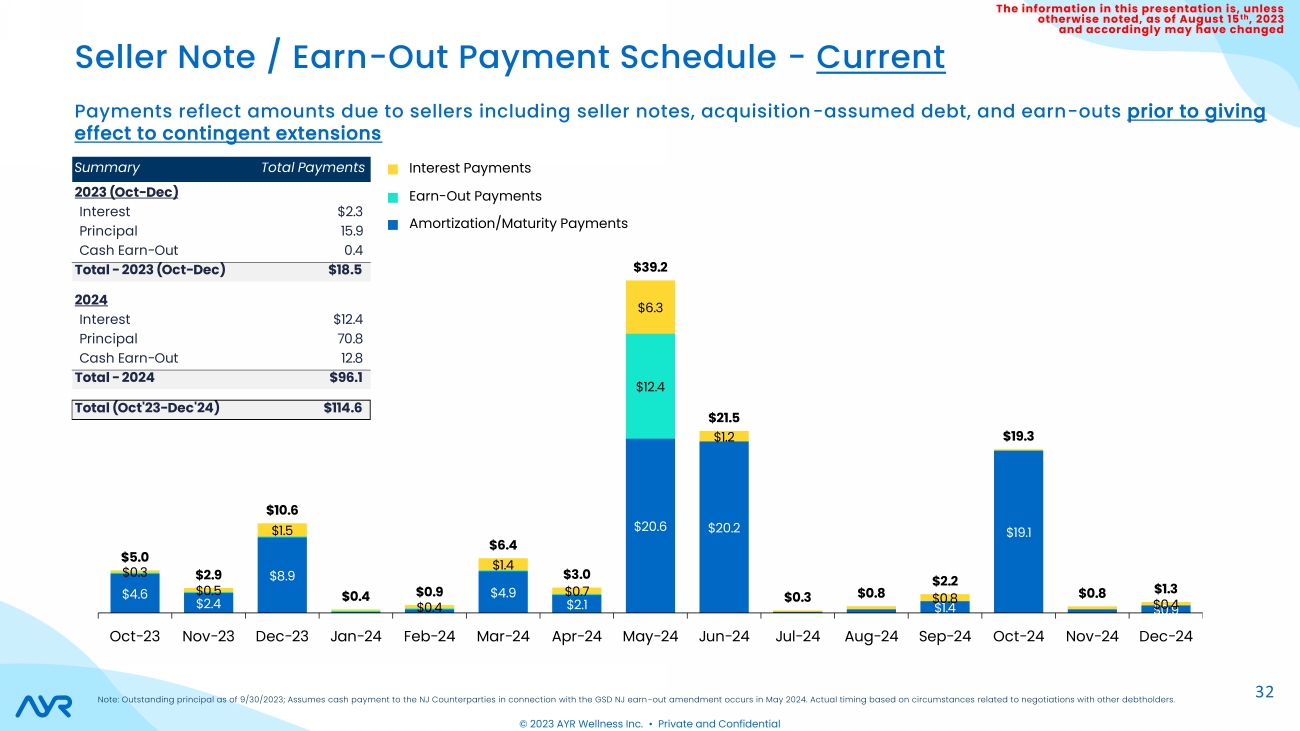

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed $4.6 $2.4 $8.9 $4.9 $2.1 $20.6 $20.2 $1.4 $19.1 $0.9 $12.4 $0.3 $0.5 $1.5 $0.4 $1.4 $0.7 $6.3 $1.2 $0.8 $0.4 $5.0 $2.9 $10.6 $0.4 $0.9 $6.4 $3.0 $39.2 $21.5 $0.3 $0.8 $2.2 $19.3 $0.8 $1.3 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 32 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs prior to giving effect to contingent extensions Seller Note / Earn-Out Payment Schedule - Current Summary Total Payments 2023 (Oct-Dec) Interest $2.3 Principal 15.9 Cash Earn-Out 0.4 Total - 2023 (Oct-Dec) $18.5 2024 Interest $12.4 Principal 70.8 Cash Earn-Out 12.8 Total - 2024 $96.1 Total (Oct'23-Dec'24) $114.6 Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn-out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders. Amortization/Maturity Payments Earn-Out Payments Interest Payments |

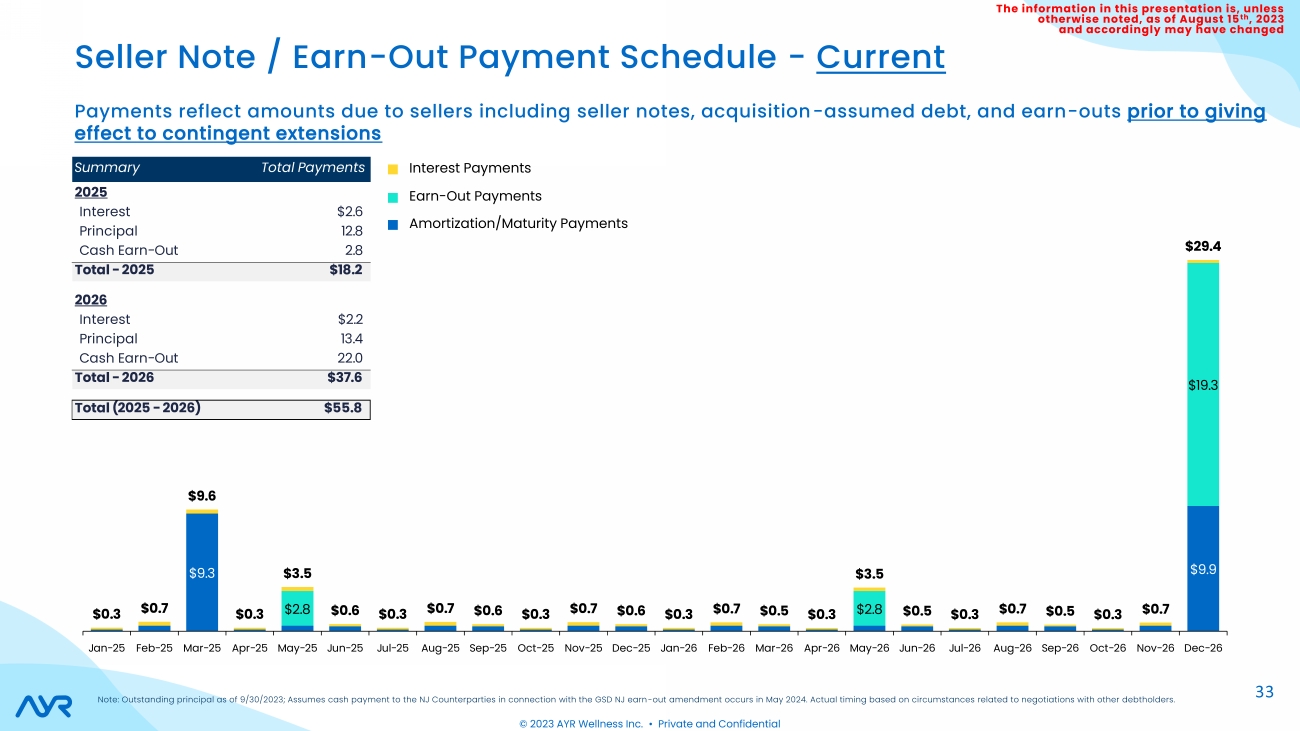

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed $9.3 $9.9 $2.8 $2.8 $19.3 $0.3 $0.7 $9.6 $0.3 $3.5 $0.6 $0.3 $0.7 $0.6 $0.3 $0.7 $0.6 $0.3 $0.7 $0.5 $0.3 $3.5 $0.5 $0.3 $0.7 $0.5 $0.3 $0.7 $29.4 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 Apr-26 May-26 Jun-26 Jul-26 Aug-26 Sep-26 Oct-26 Nov-26 Dec-26 33 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs prior to giving effect to contingent extensions Seller Note / Earn-Out Payment Schedule - Current Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn-out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders. Amortization/Maturity Payments Earn-Out Payments Summary Total Payments Interest Payments 2025 Interest $2.6 Principal 12.8 Cash Earn-Out 2.8 Total - 2025 $18.2 2026 Interest $2.2 Principal 13.4 Cash Earn-Out 22.0 Total - 2026 $37.6 Total (2025 - 2026) $55.8 |

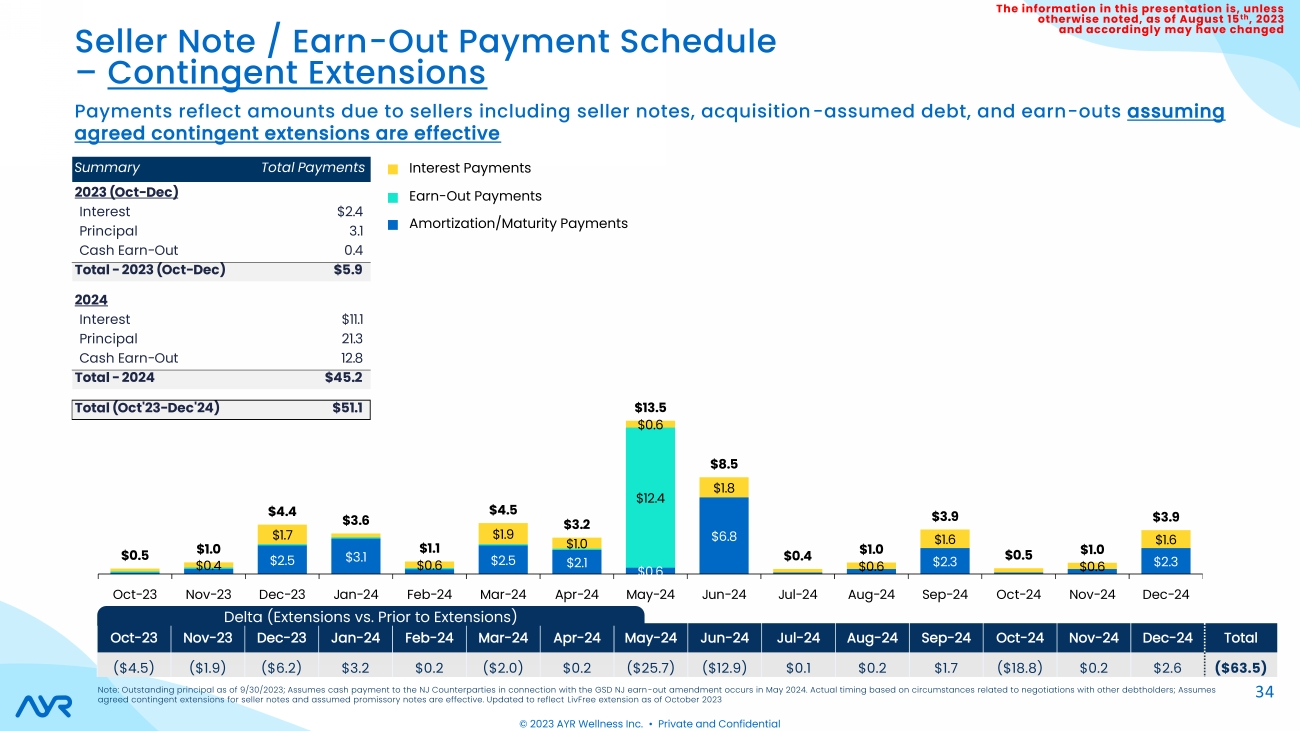

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 34 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs assuming agreed contingent extensions are effective Seller Note / Earn-Out Payment Schedule – Contingent Extensions $2.5 $3.1 $2.5 $2.1 $0.6 $6.8 $2.3 $2.3 $12.4 $0.4 $1.7 $0.6 $1.9 $1.0 $0.6 $1.8 $0.6 $1.6 $0.6 $1.6 $0.5 $1.0 $4.4 $3.6 $1.1 $4.5 $3.2 $13.5 $8.5 $0.4 $1.0 $3.9 $0.5 $1.0 $3.9 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Summary Total Payments 2023 (Oct-Dec) Interest $2.4 Principal 3.1 Cash Earn-Out 0.4 Total - 2023 (Oct-Dec) $5.9 2024 Interest $11.1 Principal 21.3 Cash Earn-Out 12.8 Total - 2024 $45.2 Total (Oct'23-Dec'24) $51.1 Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn-out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders; Assumes agreed contingent extensions for seller notes and assumed promissory notes are effective. Updated to reflect LivFree extension as of October 2023 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Total ($4.5) ($1.9) ($6.2) $3.2 $0.2 ($2.0) $0.2 ($25.7) ($12.9) $0.1 $0.2 $1.7 ($18.8) $0.2 $2.6 ($63.5) Delta (Extensions vs. Prior to Extensions) Amortization/Maturity Payments Earn-Out Payments Interest Payments |

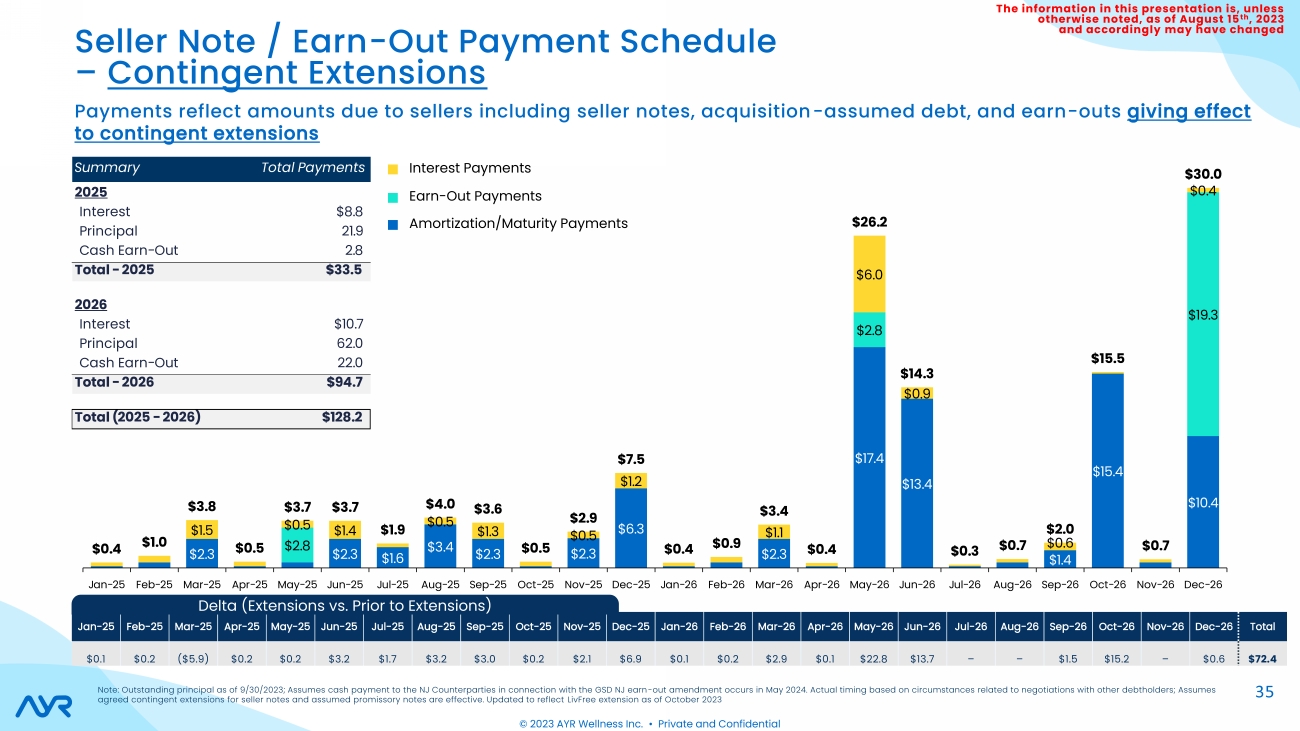

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed $2.3 $2.3 $1.6 $3.4 $2.3 $2.3 $6.3 $2.3 $17.4 $13.4 $1.4 $15.4 $10.4 $2.8 $2.8 $19.3 $1.5 $0.5 $1.4 $0.5 $1.3 $0.5 $1.2 $1.1 $6.0 $0.9 $0.6 $0.4 $0.4 $1.0 $3.8 $0.5 $3.7 $3.7 $1.9 $4.0 $3.6 $0.5 $2.9 $7.5 $0.4 $0.9 $3.4 $0.4 $26.2 $14.3 $0.3 $0.7 $2.0 $15.5 $0.7 $30.0 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 Apr-26 May-26 Jun-26 Jul-26 Aug-26 Sep-26 Oct-26 Nov-26 Dec-26 35 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs giving effect to contingent extensions Seller Note / Earn-Out Payment Schedule – Contingent Extensions Amortization/Maturity Payments Earn-Out Payments Interest Payments Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 Apr-26 May-26 Jun-26 Jul-26 Aug-26 Sep-26 Oct-26 Nov-26 Dec-26 Total $0.1 $0.2 ($5.9) $0.2 $0.2 $3.2 $1.7 $3.2 $3.0 $0.2 $2.1 $6.9 $0.1 $0.2 $2.9 $0.1 $22.8 $13.7 – – $1.5 $15.2 – $0.6 $72.4 Delta (Extensions vs. Prior to Extensions) Summary Total Payments 2025 Interest $8.8 Principal 21.9 Cash Earn-Out 2.8 Total - 2025 $33.5 2026 Interest $10.7 Principal 62.0 Cash Earn-Out 22.0 Total - 2026 $94.7 Total (2025 - 2026) $128.2 Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn-out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders; Assumes agreed contingent extensions for seller notes and assumed promissory notes are effective. Updated to reflect LivFree extension as of October 2023 |

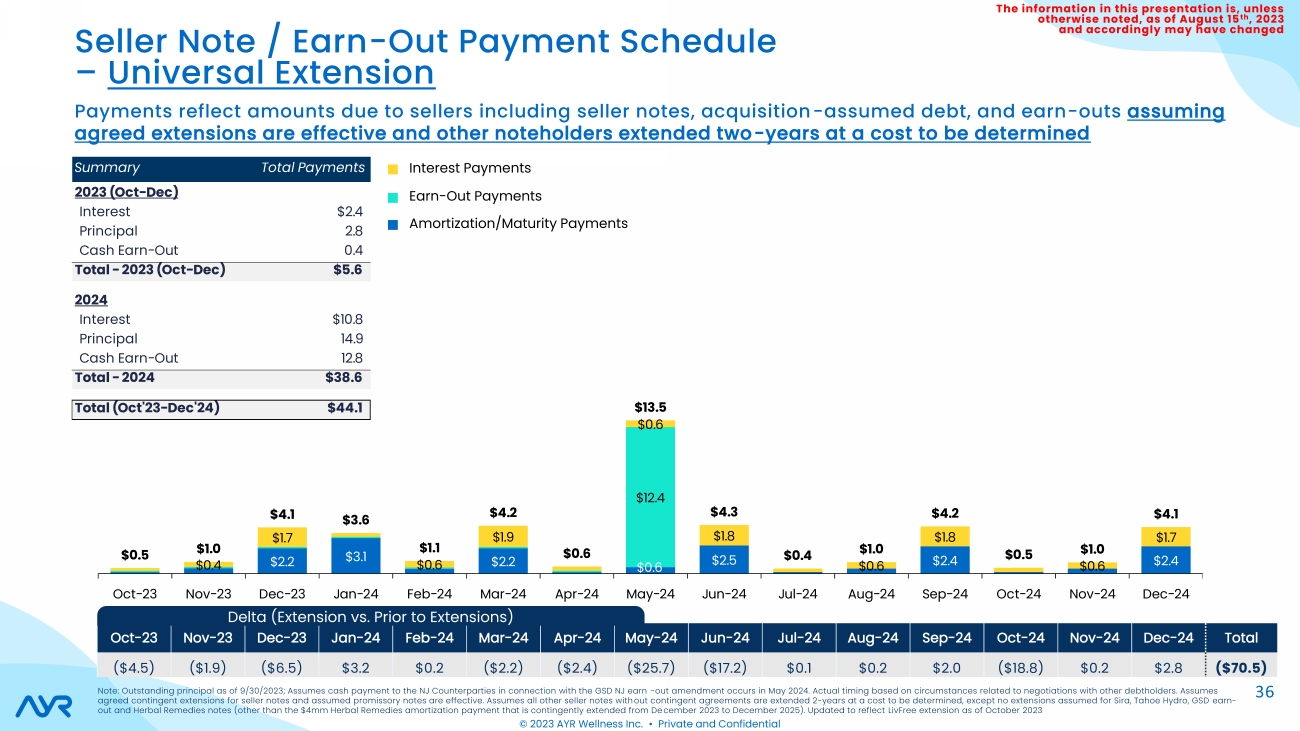

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed 36 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs assuming agreed extensions are effective and other noteholders extended two-years at a cost to be determined Seller Note / Earn-Out Payment Schedule – Universal Extension $2.2 $3.1 $2.2 $0.6 $2.5 $2.4 $2.4 $12.4 $0.4 $1.7 $0.6 $1.9 $0.6 $1.8 $0.6 $1.8 $0.6 $1.7 $0.5 $1.0 $4.1 $3.6 $1.1 $4.2 $0.6 $13.5 $4.3 $0.4 $1.0 $4.2 $0.5 $1.0 $4.1 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Summary Total Payments 2023 (Oct-Dec) Interest $2.4 Principal 2.8 Cash Earn-Out 0.4 Total - 2023 (Oct-Dec) $5.6 2024 Interest $10.8 Principal 14.9 Cash Earn-Out 12.8 Total - 2024 $38.6 Total (Oct'23-Dec'24) $44.1 Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn -out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders. Assumes agreed contingent extensions for seller notes and assumed promissory notes are effective. Assumes all other seller notes without contingent agreements are extended 2-years at a cost to be determined, except no extensions assumed for Sira, Tahoe Hydro, GSD earn-out and Herbal Remedies notes (other than the $4mm Herbal Remedies amortization payment that is contingently extended from De cember 2023 to December 2025). Updated to reflect LivFree extension as of October 2023 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 Total ($4.5) ($1.9) ($6.5) $3.2 $0.2 ($2.2) ($2.4) ($25.7) ($17.2) $0.1 $0.2 $2.0 ($18.8) $0.2 $2.8 ($70.5) Delta (Extension vs. Prior to Extensions) Amortization/Maturity Payments Earn-Out Payments Interest Payments |

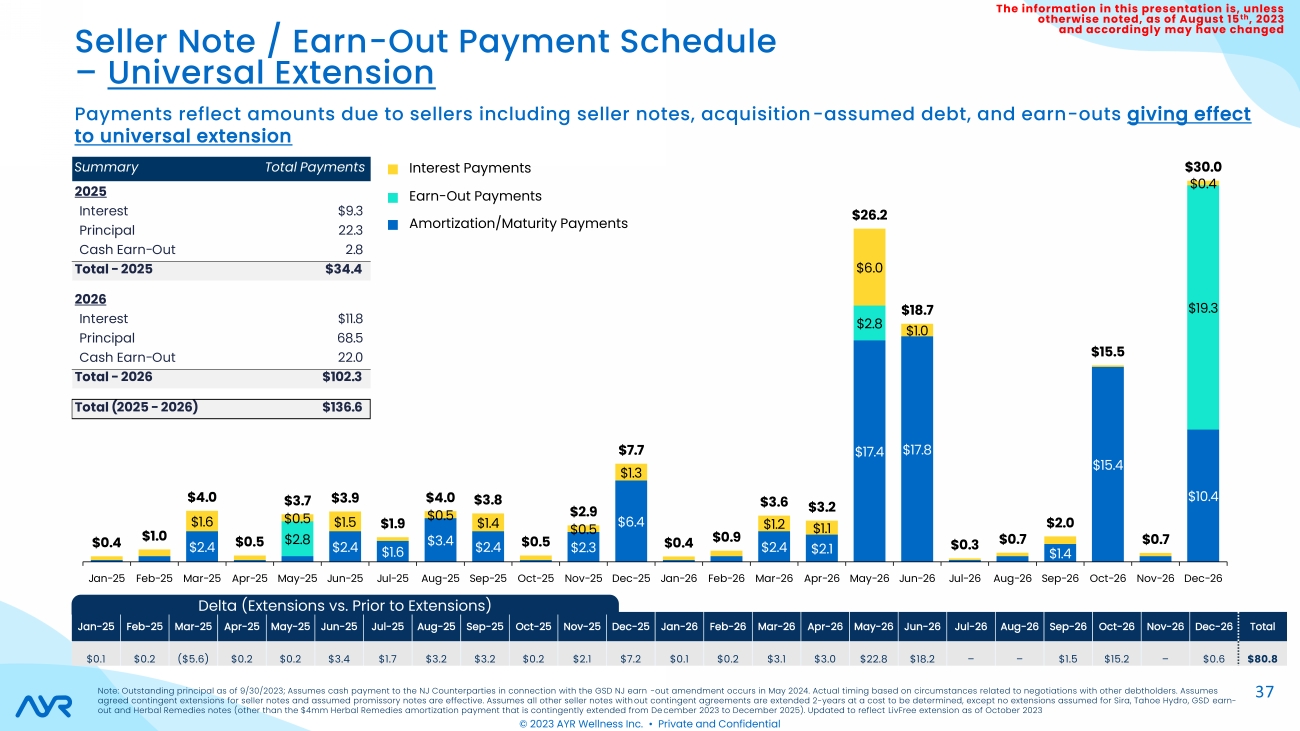

| The information in this presentation is, unless otherwise noted, as of August 15th, 2023 and accordingly may have changed $2.4 $2.4 $1.6 $3.4 $2.4 $2.3 $6.4 $2.4 $2.1 $17.4 $17.8 $1.4 $15.4 $10.4 $2.8 $2.8 $19.3 $1.6 $0.5 $1.5 $0.5 $1.4 $0.5 $1.3 $1.2 $1.1 $6.0 $1.0 $0.4 $0.4 $1.0 $4.0 $0.5 $3.7 $3.9 $1.9 $4.0 $3.8 $0.5 $2.9 $7.7 $0.4 $0.9 $3.6 $3.2 $26.2 $18.7 $0.3 $0.7 $2.0 $15.5 $0.7 $30.0 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 Apr-26 May-26 Jun-26 Jul-26 Aug-26 Sep-26 Oct-26 Nov-26 Dec-26 37 © 2023 AYR Wellness Inc. • Private and Confidential Payments reflect amounts due to sellers including seller notes, acquisition-assumed debt, and earn-outs giving effect to universal extension Seller Note / Earn-Out Payment Schedule – Universal Extension Amortization/Maturity Payments Earn-Out Payments Interest Payments Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Aug-25 Sep-25 Oct-25 Nov-25 Dec-25 Jan-26 Feb-26 Mar-26 Apr-26 May-26 Jun-26 Jul-26 Aug-26 Sep-26 Oct-26 Nov-26 Dec-26 Total $0.1 $0.2 ($5.6) $0.2 $0.2 $3.4 $1.7 $3.2 $3.2 $0.2 $2.1 $7.2 $0.1 $0.2 $3.1 $3.0 $22.8 $18.2 – – $1.5 $15.2 – $0.6 $80.8 Delta (Extensions vs. Prior to Extensions) Summary Total Payments 2025 Interest $9.3 Principal 22.3 Cash Earn-Out 2.8 Total - 2025 $34.4 2026 Interest $11.8 Principal 68.5 Cash Earn-Out 22.0 Total - 2026 $102.3 Total (2025 - 2026) $136.6 Note: Outstanding principal as of 9/30/2023; Assumes cash payment to the NJ Counterparties in connection with the GSD NJ earn -out amendment occurs in May 2024. Actual timing based on circumstances related to negotiations with other debtholders. Assumes agreed contingent extensions for seller notes and assumed promissory notes are effective. Assumes all other seller notes without contingent agreements are extended 2-years at a cost to be determined, except no extensions assumed for Sira, Tahoe Hydro, GSD earn-out and Herbal Remedies notes (other than the $4mm Herbal Remedies amortization payment that is contingently extended from De cember 2023 to December 2025). Updated to reflect LivFree extension as of October 2023 |