| BARBARA K. CEGA VSKE Secretary of Stale KIMBERLEY PERONDI Deputy Secretary for Commercial Recordings OFFICE OF THE SECRET ARY OF ST ATE Commercial Recordings Division 202 N. Carson Street Carson City. NV 89701 Telephone (775) 684-5708 Fax (775) 684-7138 North Las Vegas City Hall 2250 las Vegas Blvd North. Suite 400 North Las Vegas, NV 89030 Telephone (702) 486-2880 Fax (702) 486-2888 Business Entity - Filing Acknowledgement 11/18/2021 Work Order Item Number: Filing Number: Filing Type: Filing Date/Time: Filing Page(s): Indexed Entity Information: Entity ID: E 19013142021-7 Entity Status: Active Commercial Registered Agent W2021111800272-1723747 20211901313 Articles of Incorporation-For-Profit 11/18/2021 8:27:00 AM 31 Entity Name: CSAC Acquisition IL II Corp. Expiration Date: None CORPORA TE CREATIONS NETWORK INC. 8275 SOUTH EASTERN AVENUE #200, Las Vegas, NV 89123, USA The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future. Page 1 of l ~K.~ BARBARA K. CEGA VSKE Secretary of State Commercial Recording Division 202 N. Carson Street |

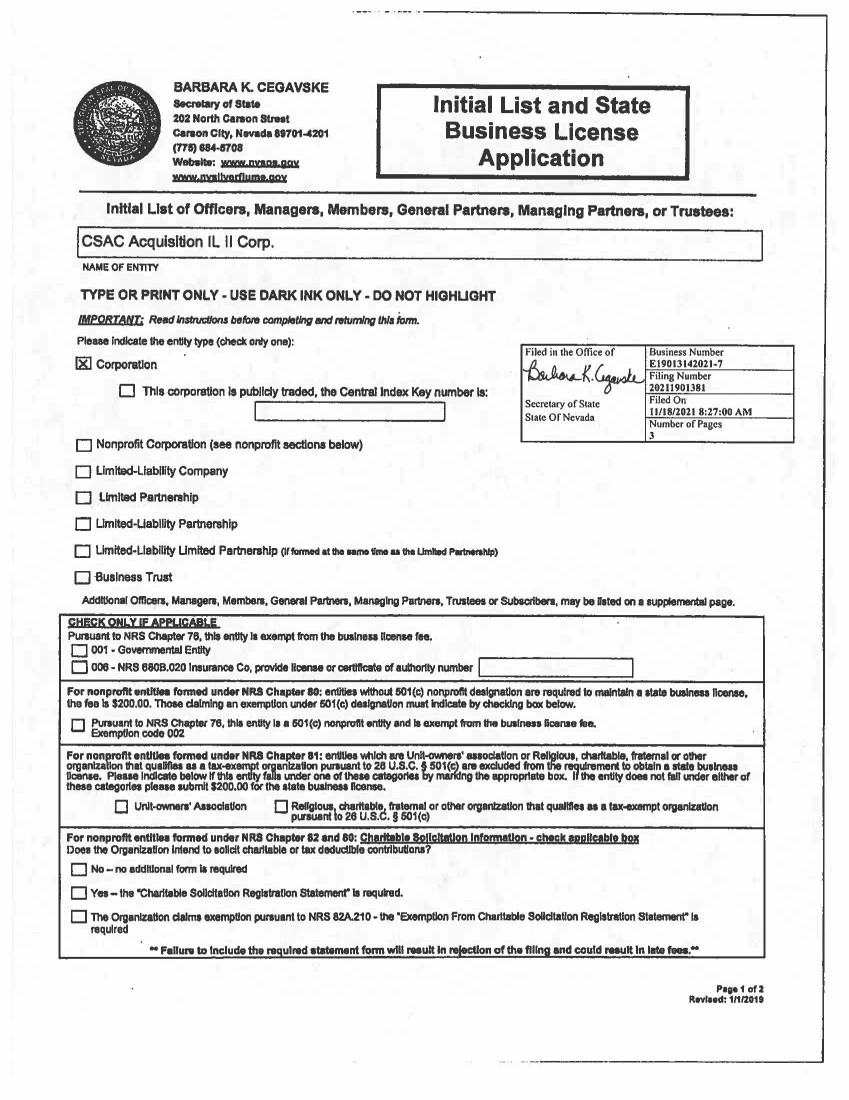

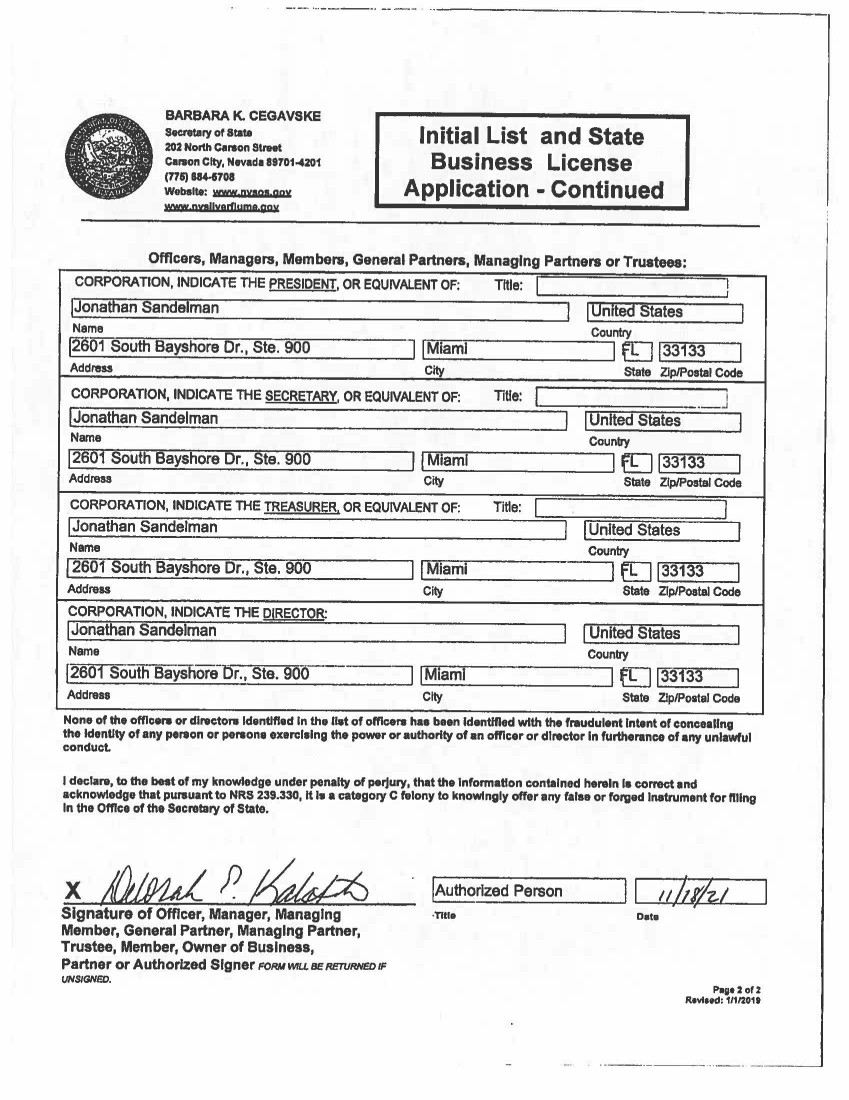

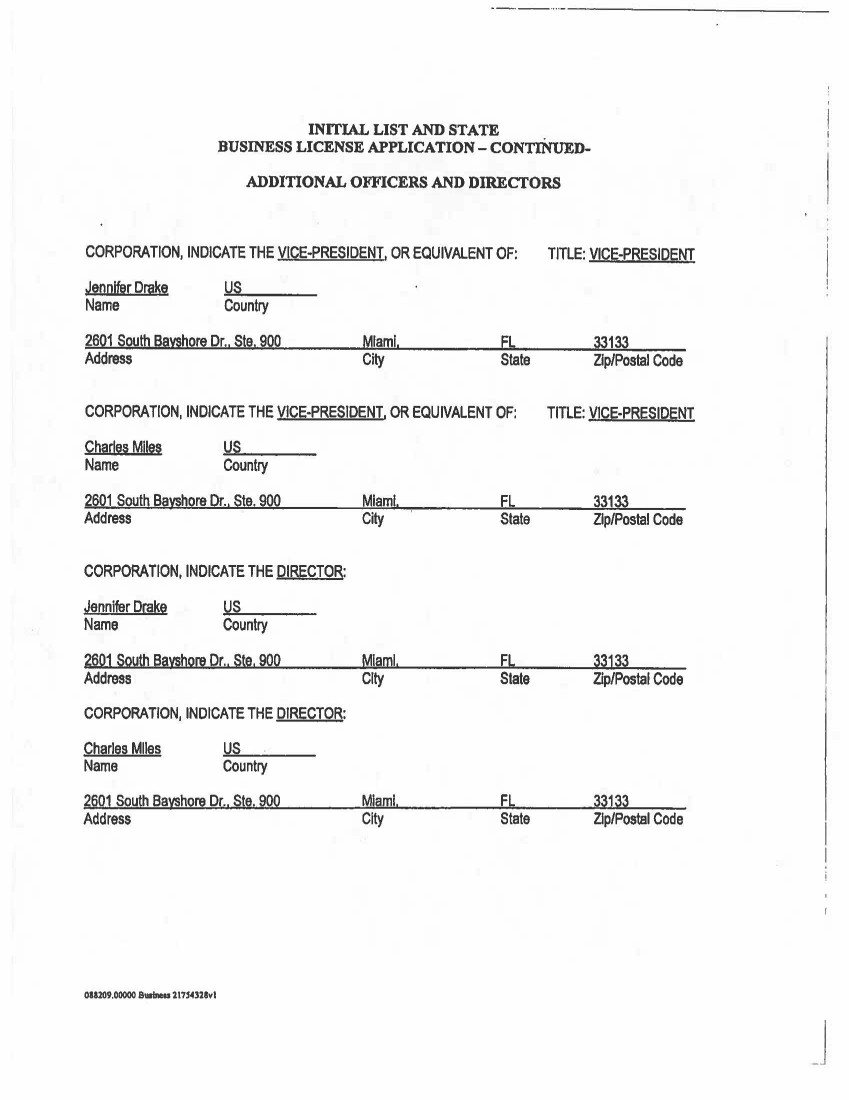

| BARBARA K. CEGA VSKE Secretary of State KIMBERLEY PERONDI Deputy Secretary for Commercial Recordings ~ J. 1-1. J. i!i V.I' l "li!i l' i-1.1.J'f-l. OFFICE OF THE SECRET ARY OF ST A TE Commercial Recordings Division 202 N. Carson Street Carso11 City, NV 8970/ Telephone (775) 684-5708 Fax (775) 684-7138 North las Vegas City Hall 2150 las Vegas Blvd North, Suite 400 North las Vegas, NV 89030 Telepho11e (702) 486-2880 Fax (702) 486-2888 Business Entity - Filing Acknowledgement 11/18/2021 Work Order Item Number: Filing Number: Filing Type: Filing Date/Time: Filing Page(s): Indexed Entity Information: Entity ID: E19013142021-7 Entity Status: Active Commercial Registered Agent W2021111800272-1723748 20211901381 Initial List 11/18/2021 8:27:00 AM 3 Entity Name: CSAC Acquisition IL II Corp. Expiration Date: None CORPORA TE CREATIONS NETWORK INC. 8275 SOUTH EASTERN AVENUE #200, Las Vegas, NV 89123, USA The attached document(s) were filed with the Nevada Secretary of State, Commercial Recording Division. The filing date and time have been affixed to each document, indicating the date and time of filing. A filing number is also affixed and can be used to reference this document in the future. Page 1 of 1 ~K.~ BARBARA K. CEGA VSKE Secretary of State Commercial Recording Division 202 N. Carson Street |

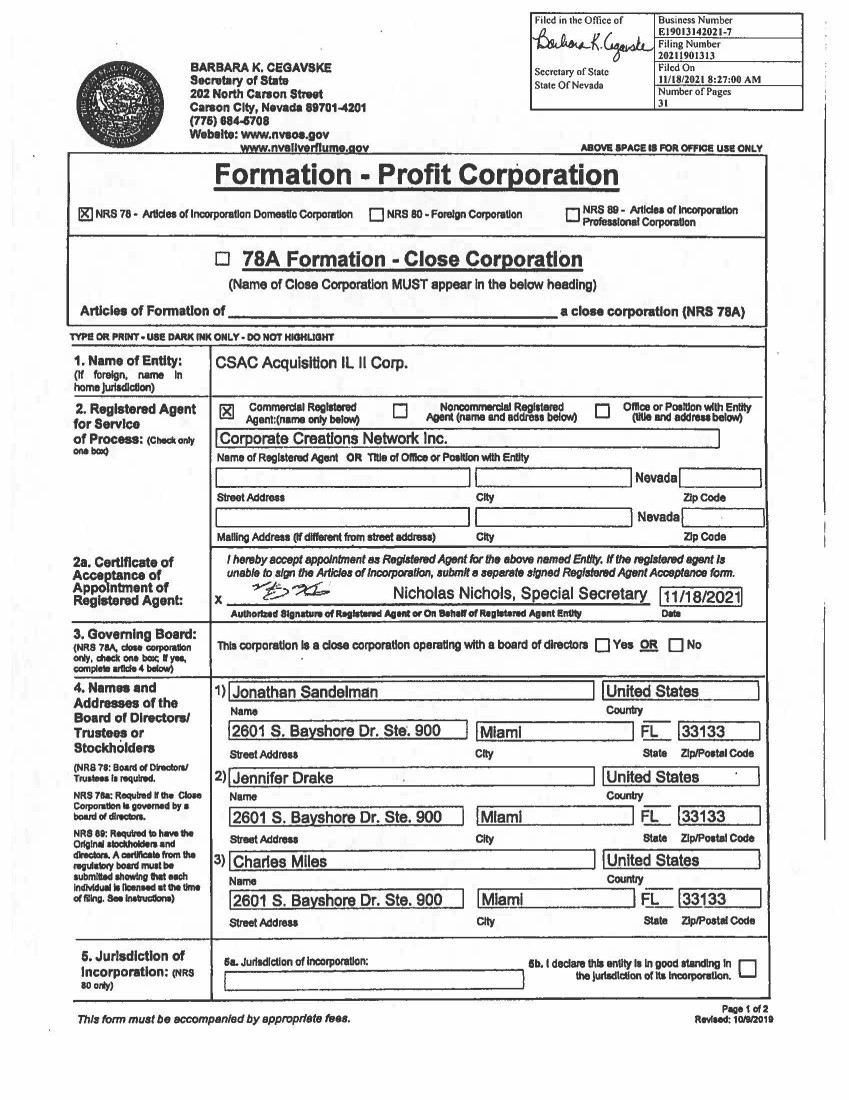

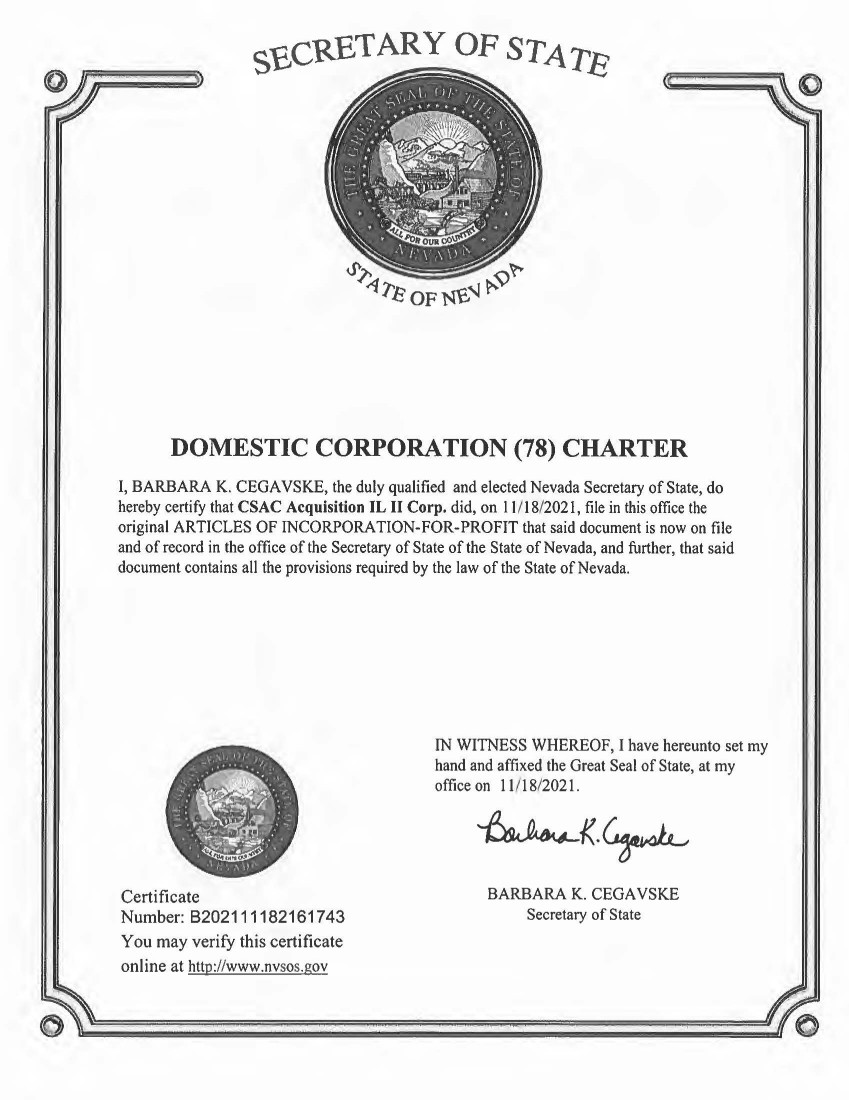

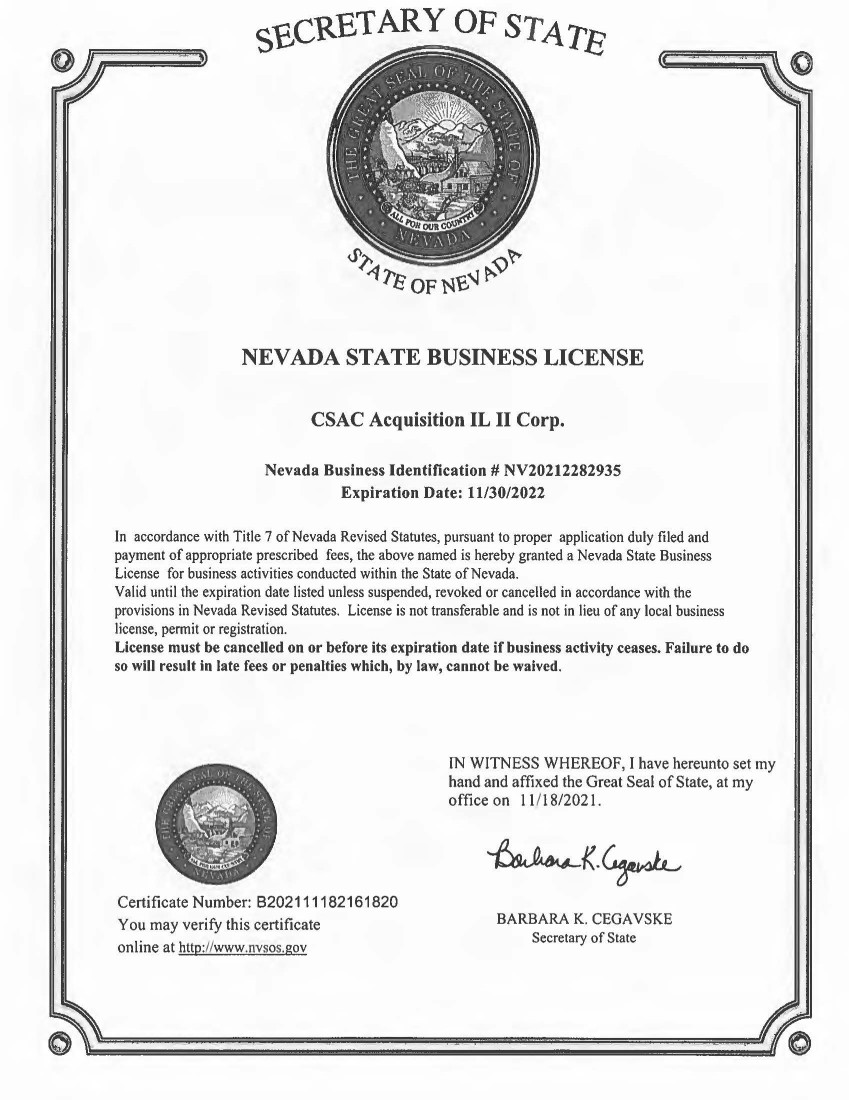

| Filed in the Office of Busmcss Number ~K/- ,. El9013142021-7 Filing Number 0 20211901313 BARBARA K. CEOAVSKE Filed On Secrvbuy of Stat& Secretary of State State Of Nevada 1111812021 8:27:00 AM 202 North Carson Street Carson City, Nevada 89701 201 (776) 884-4708 Webelte: www.nvso..gov Number of Pages 31 -- www.nvellverf1ume.1"'V ABOVE SPACE II FOR OFFICE UII! ONLY Formation • Profit Coreoration 18] NRS 78 • Artldes of lnc:orporatlon Domeatlc Corpoiatlon D NRS 80 - Foreign Corporation 0 NRS 89 - Altldn of Incorporation Profeaalonal Corporation □ 78A Formation - Close Coreoratlon (Name of Close Corporation MUST appear In the below heading) ArtlclH of Fonnatlon of a close corporation (NRS 78A) TYPI! OR PRINT• USE DARK INK ONLY• DO NOT HIGHUCIHT 1. Name of Entity: CSAC Acquisition IL II Corp. (If foreign, name In home jurildlcllon) 2. Registered Agent 181 commordal Registered □ Noncommercial ~ lstered D Offl01 or P01lllon wllh Entity for Service Agent:(nama only below) AQent (name and addrele below) (1IUe and addl'NI below) of Process: (Check only I Corporate Creations Network Inc. I onebGIC) Name of Regletanid Agent OR Title of Olllca or POlltlon with Entity I I I I Nevada[ I Street Addrvss City Zip Coda I 11 I Nevada! I Malling Addreu (If different from street addnm) City Zip Code 2a. Certlflcate of I hereby accept appointment aa Regl&tered Agent for th• above named Entity. If the registered agent la Acce~nceof unable to alr,n the ArlJckn of tncorporallon, aubmlt e ,eperatt atgned Regfatured Agent Acoeptanoe fonn. Appo ntment of ~::>~· Nicholas Nichols, Special Secretary I 11 /18/20211 Registered Agent: X Authorized 8lgnatur11 of btllnlrld Aalllt ,won 811111 of RtglNl'ICI Aa•nt 1!11111, Dall 3, Governing Board: (NRS 711A, c:loA co,poratlon Thia corporation Is a close corporation operating with a board of directors D Yes Q! D No Oft,, c:tieclt 0111 bole; IYIII, campln lltlde 4 bllow) 4.Namnand 1) I Jonathan Sandelmsn 11 United States I Addresses of the Board of Directors/ Name Country Trustees or 12601 S. Ba~shore Dr. Ste~ 900 I !Miami I FL 133133 I Stockholders streetAddntst City state Zlp/Poetal Code (NRS 78: Board ot Olredoral 2) I Jennifer Drake 11 United States I TrusleN 11 rwqund. NRS 711a: Required Ir the C1o1e Name Country Corpo,.llon II goyernad by a 12601 s. Ba:t!hOre Or. Ste. 900 I !Miami I FL 133133 I boud ot dll9Cb'I. NRS 88: Reqwecl 1111 h-11111 street Addrese City state Zlp/Poetal Code Ollglllll atodd!oldsrw and dlreetals. A cartJllcate rrorn Ille ragi.dl1Dly board muat be 3) I Charles MIies 11 United States I submllled lhowlng hit HCh Name Coul\1,y lndMdlllll II lleenHd at the time otfillng. s. lnaWl.llalw) 12601 S. Bavshore Dr. Ste. 900 I !Miami I f:..L 133133 I street Addreas City State Zip/Postal Code 6. Jurisdiction of 6L Jurlldlcllon of lncorp0'8tlon: Sb, I dadare thla anUty la In good atandlng In □ Incorporation: (NRS I I the JUfladlct1on of tta 1ncorporat1on. BOanly) This form must be sccompsn/ed by epproprlete fees. Page 1 af2 Re'IIMd: 10/9/20111 |

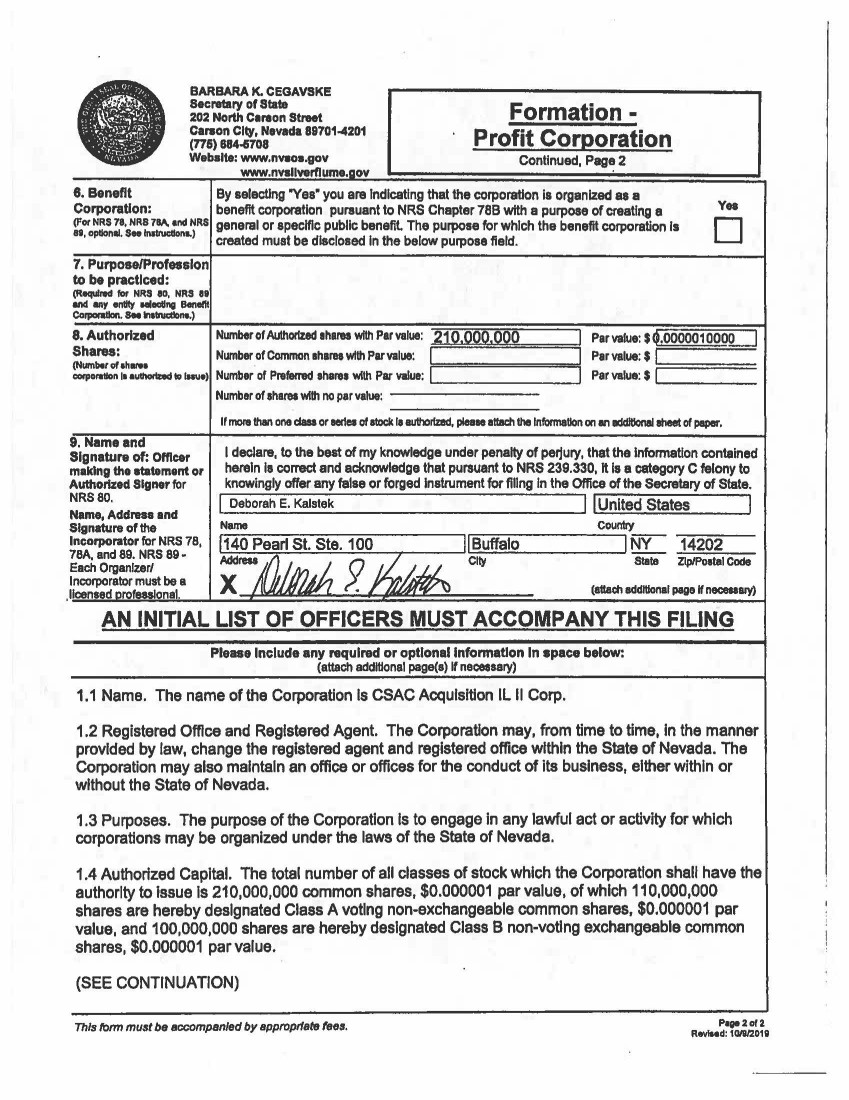

| BARBARA K. CEGAVSKE Secretary of State 202 North CINOn Street Carson City, Nevada 89701-4201 (775) 884.fi708 Website: www.nwo•.gov www.nvallverflume. ov Formation - Profit Corporation Continued, Page 2 8. Benefit By selectlng "Yes" you era Indicating that the corporation is organized as a Corporation: benefit corporation pursuant to NRS Chapter 78B with a purpose of creating a (For NRS 78, NRs 7BA. •nd NRS general or specific public benefit. The purpose for which the benefit corporation Is at, optlon.i. S• lnmldlons.) created must be disclosed in the below purpose field. 7. Purpose/Profession to be practiced: (ftaquhd for NRS ao, NRS 89 and any anllty Hlacllng Banaffl Co,pcnllan .... ffl1nlctlons.) Y• □ 8. Authorized Shares: Number of Aulhorfzed 1hares with Par value: 21 Q.000.Q00 Number of Convnon hares with Par value: (Number of ah.,..• corporation 11 alllhorlliad 111 !Hue) Number of Prefefflld 1hare1 with Par value: '--------...J Par value: $ 0.000001 oooLJ Par value:$ :====== Par value:$ L------ 9. Name and Signature of: Officer making the atatement or Authorized Signer for NRS80. Name, Addreu and Signature of the lncorporator for NRS 78, 78A, and 89. NRS 89- Each Organizer/ lncorporator must be a ,licensed rofealonal. Number of shares wllh no par value: It 111019 then one dua or •• of ltoc:k 11 IIUthorfzed, pln e 11111ch the Information on an ICfdltlonal etieet of paper, I deelare, to the beat of my knowledge under penalty of perjury, that the Information contained herein la correct and acknowledge that pursuant to NRS 239.330, It la a category C felony to knowingly offer any false or forged Instrument for filing In the Office of the Secretary of State. I Deborah E. Kalstek I ! United States l Name countiy X (attaeh lddltlon11 page If nece11a,y) AN INITIAL LIST OF OFFICERS MUST ACCOMPANY THIS FILING Please Include any required or optlonal lnfonnatlon In space below: (attach additional page(s) If necessary) 1. 1 Name. The name of the Corporation Is CSAC Acquisition IL II Corp. 1.2 Registered Office and Registered Agent. The Corporation may, from time to time, In the manner provided by law, change the registered agent and registered office within the State of Nevada. The Corporation may also maintain an office or offices for the conduct of its business, either within or without the State of Nevada. 1.3 Purposes. The purpose of the Corporation Is to engage in any lawful act or activity for which corporations may be organized under the laws of the State of Nevada. 1.4 Authorized Capital. The total number of all classes of stock which the Corporation shall have the authority to Issue Is 210,000,000 common shares, $0.000001 par value, of which 110,000,000 shares are hereby designated Class A voting non-exchangeable common shares, $0.000001 par value, and 100,000.000 shares are hereby designated Class 8 non-voting exchangeable common shares, $0.000001 par value. (SEE CONTINUATION) This form must be accompanied by appropriate fees. Page2of:I. RevlHd: ICl/8/20111 |

| ARTICLES OF INCORPORATION OF CSAC ACQUISITION IL II CORP. --continued-1.5 Bylaws. The Board of Directors is expressly authorized to adopt, amend or repeal bylaws of the Corporation (the "Bylaws''). 1.6 Limitation of Directors' Liability; Indemnification. The personal liability of a director of the Corporation to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director shall be eliminated to the fullest extent pennitted by Jaw. The Corporation is authorized to indemnify (and advance expenses to) its directors and officers to the fullest extent pennitted by law. Neither the amendment, modification or repeal of these Articles of Incorporation nor the adoption of any provision in these Articles of Incorporation inconsistent with these Articles of Incorporation shall adversely affect any right or protection of a director or officer of the Corporation-with respect to any act or omission that occurred prior to the time of such amendment, modification, repeal or adoption. 1. 7 Elections of Directors. The Board of Directors shall be elected or appointed in such manner as shall be provided in the Bylaws, as amended from time to time, Except as otherwise fixed or provided for pursuant to the provisions of these Articles of lnco1p0ration. including any certificate of designation relating to any series of preferred stock, the number of directors· may be changed from time to time in the manner provided in the Bylaws. 1.8 Additional Terms. Part I (Class B Share Provisions), Part II (Class A Share Provisions) and Part III (General) and Exhibit A (Retraction Request), attached hereto, fonn a part of these Articles of Incorporation for all purposes. |

| ----···--------- PARTI CLASS B SHARE PROVISIONS The Class B Shares, as a class, shall have attached thereto the following rights, privileges, restrictions and conditions: ARTICLE I INTERPRETATION 1.1 Definitions. In these share provisions, the following tenns shall have the following meanings: "Additional Amount'' has the meaning ascribed thereto in the definition of Class B Share Consideration. "Affiliate" has the meaning ascribed thereto in the Business Corporations Act (British Columbia), as amended, but the holders of Class B Shares that are parties to the Exchange Rights Agreement shall not be deemed to be Affiliates of Parent or the Corporation. "Appraiser'' has the meaning ascribed thereto in Section 3.5. "Board of Directors" means the Board of Directors of the Corporation. "Business Day" means any day except Saturday, Sunday or any day on which banks are generally not open for business in the City of Toronto, Ontario or the City of New York. New York. "Canadian Dollar Equivalent" means in respect of an amount expressed in US Dollars at any date, the product obtained by multiplying: (a) the US Dollar amount by, (b) the average US Dollar/Canadian Dollar daily exchange rate as published by the Banlc of Canada for the period of five Business Days prior to the date of conversion. "Cash Dividend Amount" has the meaning ascribed thereto in the definition of Class B Share Consideration. "Class A Shares" means the Class A voting non-exchangeable common shares in the capital of the Corporation and any other securities into which such shares may be changed. "Class B Share Consideration" means, with respect to each Class B Share, for any acquisition, redemption or retraction of, or distribution of assets of the Corporation in respect of the Class B Share (any such event, "Exchange Event") the aggregate of the following: (a) one Parent Subordinate Voting Share; plus 2 |

| (b) the sum of (i) unless corresponding equivalent dividends or distributions have already been declared and have been or will be paid on the Class B Share under Section 3.l(a) of this Part I prior to or at the effective time of any Exchange Event, the excess, if any, of (A) the aggregate amount of all cash dividends or other cash distribu~ions declared and paid by Parent on a Parent Subordinate Voting Share prior to or at the effective time of such Exchange Event, over (B) the aggregate amount of all cash dividends or other cash distributions declared and paid by the Corporation on the Class B Share under Section 3.l(a) of this Part I prior to or at the effective time of such Exchange Event, plus (ii) the amount of any cash dividends or other cash distributions (other than Corresponding Dividends) on the Class B Share which have been declared (or required to have been declared) but not yet paid as of the effective time of such Exchange Event ( determined without duplication of amounts taken into account under clause (i), above), such sum payable in U.S. dollars or (only if payable to a holder of Class B Shares who is a Canadian resident) the Canadian Dollar Equivalent by means of a check payable at any branch of the bankers of the payor (such sum, the "Cash Dividend Amount''); plus (c) the sum of (i) unless corresponding equivalent dividends or distributions have already been declared and have been or will be paid on the Class B Share under Section 3.l(c) of this Part I prior to or at the effective time of any such Exchange Event, the excess, if any, of (A) the aggregate fair market value of all declared and paid non-cash dividends or other non-cash distributions by Parent on a Parent Subordinate Voting Share prior to or at the effective time of such Exchange Event, over (B) the aggregate fair market value of all nonweash dividends or other non-cash distributions declared and paid by the Corporation on the Class B Share under Section 3 .1 ( c) of this Part I prior to or at the effective time of such Exchange Event, ~ (ii) the aggregate fair market value of any non-cash dividends or other non-cash distributions (other than Corresponding Dividends) on the Class B Share which have been declared (or required to have been declared) but not yet paid as of the effective time of such Exchange Event (detennined without duplication of amounts taken into account under clause (i), above), such sum payable by means of a check payable at any branch of the bankers of the payor in U.S. dollars or (only if payable to a holder of Class B Shares who is a Canadian resident) the Canadian Dollar Equivalent or, at the option of the Board of Directors, payable by the delivery of non-cash items having a fair market value equal to the amount of such sum (such sum, the "Non-Cash Dividend Amount'' and together with the Cash Dividend Amount, the "Additional Amount''); provided that such consideration shall be paid less any amounts on account of tax properly withheld in accordance with Section 13.3. For greater certainty, in no event shall a holder of Class B Shares be entitled to receive or demand any consideration in connection with the acquisition, redemption, or retraction of, or distribution of the assets of the Corporation in respect of, any Class B Shares, other than the Class B Share Consideration payable in accordance with Article 5. 3 |

| "Class B Shareholders' Put Right'' means the right of the holders of Class B Shares to require Parent to purchase all or any part of the Class B Shares held by such holder of Class B Shares, as more particularly described in, and in accordance with, the Exchange Rights Agreement. "Class B Sharea" mean the Class B non-voting exchangeable common shares in the capital of the Corporation, having the rights, privileges, restrictions and conditions set forth herein. "CI05ing Date" has the meaning ascribed thereto in the Purchase Agreement. "Code,. means the Internal Revenue Code of 1986, as amended • ... Constating Documents" means the articles of incorporation and bylaws of the Corporation, as amended from time to time. "Control Transaction" means any of the following: (a) any person or group of persons acting jointly or in concert (within the meaning of National Instrument 62-104 - Take-Over Blda and Special Tran.sactions) ("NI 62--104'') acquires, directly or indirectly, control (as defined in NI 62-104) of Parent; (b) the shareholders of Parent shall have approved a merger, consolidation, recapitalization or reorganization of Parent, or, if shareholder approval is not sought or obtained, any such transaction shall have been consummated, in either case other than any such transaction which would result in at least 500/4 of the total voting power represented by the voting securities of the resulting entity outstanding immediately after such transaction being beneficially owned by ho]ders of outstanding voting securities of Parent immediately prior to the transaction, with the voting power of each such continuing holder relative to such· other continuing holders being not altered substantially in the transaction; or (c) the shareholders of Parent shall approve an agreement for the sale or disposition by Parent of all or substantially all of Parent's consolidated assets, except for the transfer of assets to a subsidiary of Parent; "Corporation" means CSAC Acquisition IL II Corp., a corporation organized under the laws of the State of Nevada and any successor corporation. "Corresponding Dividend" has the meaning ascribed thereto in Section 3.1. "Dispute Notice" has the meaning ascribed thereto in Section 3.5. ''Exchange Rights Agreemenf' means the exchange rights agreement among Parent, the Corporation and the holders of the Class B Shares setting out the terms and conditions relating to the exchange of the Class B Shares for Parent Subordinate Voting Shares, as it may be amended from time to time. 4 |

| "Governmental Entity" means (i) any multinational, federal, provincial, state, tenitorial, regional, municipal, local or other government. governmental or public department, central bank, court, tribunal, arbitral body, commission, board, bureau or agency, domestic or foreign, (ii) any subdivision, agent, commission, board, or authority of any of the foregoing, or (iii) any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing. "holder'' means, when used with reference to the Class B Shares, the holders of Class B Shares shown from time to time in the register maintained by or on behalf of the Corporation in respect of the Class B Shares. "Insolvency Evenf' means the institution by the Corporation of any proceeding to be adjudicated a bankrupt or insolvent or to be liquidated, dissolved or wound-up. or the consent of the Corporation to the institution of bankruptcy, insolvency, liquidation, dissolution or winding up proceedings against it. or the filing of a petition, answer or consent seeking liquidation, dissolution or winding up under any bankruptcy, insolvency or analogous laws in any jurisdiction, and the failure by the Corporation to contest in good faith any such proceedings instituted by any Person other than the Corporation commenced in respect of the Corporation within 30 days of becoming aware thereof, or the consent by the Corporation to the filing of any such petition or to the appointment of a receiver, or the making by the Corporation of a general assignment for the benefit of creditors, or the admission in writing by the Corporation of its inability to pay its debts generally as they become due, or the Corporation not being pennitted, pursuant to solvency requirements of applicable law, to purchase any Retracted Shares pursuant to these share provisions. "Liquidation Amount'' has the meaning ascribed thereto in Section 6.1. "Liquidation Call Right'' means the overriding right of Parent, in the event of and notwithstanding the proposed liquidation, dissolution or winding-up of the Corporation pursuant to Article 6, to purchase from all, but not less than all, of the holders of Class B Shares (other than any holder of Class B Shares which is an Affiliate of Parent) on the Liquidation Date all, but not less than all, of the Class B Shares held by each such holder, as more particularly described in the Exchange Rights Agreement. ''Liquidation Date,, has the meaning ascribed thereto in Section 6.1. ''Non-Cash Dividend Amount'' has the meaning ascribed thereto in the definition of Class B Share Consideration. "Parenf' means Ayr Wellness Inc., a corporation organized under the laws of the Province of British Columbia, and any successor corporation. ''Parent Distribution Declaration Date" means the date on which the Board of Directors of Parent declares any dividend or other distribution on the Parent Subordinate Voting Shares. "Parent Subordinate Voting Shares" means the subordinate voting shares of Parent and shall include the Restricted Voting Shares (as defined in the Parent's articles, as amended) s |

| --------------- ---p------ " -- - .. , -··-----.. . _ ..-... and the Limited Voting Shares (as defined in the Parent's articles, as amended), and any such other securities into which such shares may be converted or for which such shares may be exchanged. 1 'Penon'' includes any individual, finn, partnership, joint venture, venture capital fund, association, trust, trustee, executor, administrator, legal personal representative, estate, group, body corporate, corporation, unincorporated association or organization, Governmental Entity, syndicate or other entity, whether or not having legal status. ''Purchase Agreement,, means the Equity and Exchange Agreement by and among, Inter a/la, Parent, the Corporation, Gentle Ventures, LLC, 5001 Partners, LLC, and the members of Gentle Ventures, LLC and 5001 Partners, LLC, as amended or amended and restated from time to time. "Redemption Call Right" means the overriding right of Parent, notwithstanding the proposed redemption of the Class B Shares by the Corporation pursuant to Article 8, to purchase from all but not less than all of the holders of Class B Shares (other than any holder of Class B Shares which is an Affiliate of Parent) on the Redemption Date all but not less than all of the Class B Shares held by each such holder, as more particularly described in the Exchange Rights Agreement. "Redemption Date" means the date, if any, established by the Board of Directors in connection with the occurrence of a Redemption Event, for the redemption by the Corporation of all but not less than all of the outstanding Class B Shares pursuant to Article 8 in accordance with the tenns hereof; provided, however, that the Redemption Date, if established, shall not be later than thirty (30) days after the occurrence of such Redemption Event ( except in the case of a Redemption Event set forth in clause ( d) of the definition thereof; in which case the Redemption Date shall occur not later than thirty (30) days after the Corporation's delivery of the Shareholder Redemption Notice, subject to Section 8.2). "Redemption Event'' means (a) the occurrence of a Control Transaction, (b) the occurrence of an Insolvency Event, ( c) the day upon which U.S. tax legislation is amended and becomes effective such that aU U.S. resident holders of Class B Shares may receive Parent Subordinate Voting Shares in exchange for their Class B Shares on a tax deferred basis for U.S. income tax purposes, or (d) it is the seventh anniversary of the Closing Date or any date thereafter. "Redemption Notice" has the meaning ascribed thereto in Section 8.2. "Redemption Price" has the meaning ascribed thereto in Section 8.1. ''Resident" means a Person who is a resident of the United States for purposes of the Code or, if a partnership, all of whose partners are Residents. "Retracted Shares" has the meaning ascribed thereto in Section 7. l(a). ''Retraction Call Right'' has the meaning ascribed thereto in Section 7.1 ( c ). 6 |

| "Retraction Date" has the meaning ascribed thereto in Section 7 .1 (b ). "Retraction Price" has the meaning ascribed thereto in Section 7.1. ''Retraction Request" has the meaning ascribed thereto in Section 7.1. "Sellers' Representative,, has the meaning ascribed thereto in the definition of Purchase Agreement "Shareholder Redemption Notice" has the meaning ascribed thereto in Section 8.2(b). 1.2 Headings; Article and Section References. The division of these share provisions into Articles, Sections and other portions and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of these share provisions. Unless otherwise indicated, all references to an "Article" or "Section" followed by a number and/or a letter refer to the specified Article or Section of these share provisions. Unless otherwise specified or required by conte~ the tenns ''these share provisions", "hereor, "herein" and "hereundert' and similar expressions refer to these Class B Share provisions and the Class A Share provisions and not to any particular Article, Section or other portion hereof and include any agreement or instrument supplementary or ancillary hereto. 1.3 Number and Gender. Words importing the singular number only shall include the plural and vice versa. Words importing any gender shall include all genders. 1.4 Business Days. If any date on which any action is required to be taken under these share provisions is not a Business Day, such action shall be required to be taken on the next succeeding Business Day. ARTICLE2 RANKING OF CLASS B SHARES 2.1 Ranking. Except for the exchange features and related rights of the Class B Shares and the fact that the Class B Shares are non-voting, the Class B Shares shall rank pari passu with the Class A Shares. ARTICLE3 DIVIDENDS 3.1 Dividends. A holder of a Class B Share shall be entitled to receive dividends it as and when declared by the Board of Directors out of the assets of the Corporation properly available for the payment of dividends of such amounts and payable in such manner as the Board of Directors may from time to time determine. A holder of a Class B Share shall be entitled to receive, and the Board of Directors shall, subject to applicable law, declare a dividend or other distribution on each Class B Share equivalent to each dividend or other distribution declared on each Class A Share. Without limiting the foregoing, a holder of a Class B Share shall be entitled to receive, and the Board of Directors shall, subject to applicable law, on each Parent Distribution Declaration Date declare, a dividend or other distribution on each Class B Shere e (each, a "Corresponding Dividend''): 7 |

| (a) in the case of a cash dividend or distribution declared on the Parent Subordinate Voting Shares, in an aggregate amount in cash for each Class B Share as is equal in U.S. dollars, or (only if payable to a holder of Class B Shares who is a Canadian resident) the Canadian Dollar Equivalent thereof on the Parent Distribution Declaration Date, in each case, to the per share cash dividend or distribution declared on the Parent Subordinate Voting Shares, as applicable and without duplication; (b) in the case of a stock dividend or distribution declared on the Parent Subordinate Voting Shares from and after the Closing Date to be paid in Parent Subordinate Voting Shares (or other equity securities of Parent, or securities convertible for or exchangeable into equity securities of Parent), by the issue or transfer by the Corporation of such number of Class B Shares for each Class B Share as is economically equal to the number of Parent Subordinate Voting Shares (or other equity securities of Parent, or securities convertible for or exchangeable into equity securities of Parent) to be paid on each Parent Subordinate Voting Share, as applicable and without duplication unless in lieu of such stock dividend or distribution the Corporation elects to effect a corresponding and contemporaneous and economically equivalent (as determined by the Board of Directors in accordance with Section 3.5) subdivision of the outstanding Class B Shares; or (c) in the case of a dividend or distribution declared on the Parent Subordinate Voting Shares to be paid in property other than (i) cash, (ii) Parent Subordinate Voting Shares, (iii) other equity securities of Parent or (iv) securities convertible for or exchangeable into equity securities of Parent. in such type and amount of property for each Class B Share as is the same as or economically equivalent (as determined by the Board of Directors in accordance with Section 3.5) to the type and aggregate amount of property declared as a dividend or distribution on the Parent Subordinate Voting Shares, as applicable and without duplication. Such dividends or distributions shall be paid out of money, assets or property of the Corporation properly applicable to the payment of dividends, or out of authorized but unissued shares of the Corporation, as applicable. Any dividend which should have been declared or paid on the Class B Shares pursuant to this Section 3.1 but was not so declared or paid due to the provisions of applicable law shall be declared and paid by the Corporation as soon as payment of such dividend is permitted by such law. Notwithstanding any other provision of these share provisions, no dividend shall be paid by the Corporation on the Class B Shares unless an equal per share dividend is paid by Parent on the Parent Subordinate Voting Shares and vice versa, and if a dividend is paid by the Corporation on the Class A Shares an equal per share dividend must also be paid by the Corporation on the Class B Shares and by the Parent on the Parent Subordinate Voting Shares with no entitlement of the Class B Shares to a Corresponding Dividend in respect of the latter. 3.2 Payment of Dividends. Checks of the Corporation payable at par at any branch of the bankers of the Corporation shall be issued in respect of any cash dividends or distributions contemplated by Section 3.l(a) and the sending of such a check to each holder of a Class B Share, 8 |

| and receipt by that holder of such check, shall satisfy the payment of the cash dividend or distribution represented thereby unless the check is not paid on presentation. Certificates registered in the name of the holder of Class B Shares shall be issued or transferred in respect of any stock dividends or distributions of Class B Shares contemplated by Section 3.l(b) and the sending of such a certificate to each holder of a Class B Share, and the receipt by that holder of such certificate, shall satisfy the stock dividend or distribution of Class B Shares represented thereby. Such other type and amount of property in respect of any dividends or distributions contemplated by Section 3.l(c) shall be paid, issued, distributed or transferred by the Corporation in such manner as it shall reasonably detennine and the payment, issuance, distribution or transfer thereof by the Corporation to each holder of a Class B Share shall satisfy the dividend or distribution represented thereby. No holder of a Class B Share shall be entitled to recover by action or other legal process against the-Corporation any dividend or distribution that is represented by a check that, if received by such holder, has not been duly presented to the Corporation•s bankers for payment or that otherwise remains unclaimed for a period of two years from the date on which such dividend or distribution was paid. 3.3 Record and Payment Dates. The record date for the detennination of the holders of Class B Shares entitled to receive payment of, and the payment date for, any dividend or distribution declared on the Class B Shares under Section 3.1 shall be the same dates as the record date and payment date, respectively, for the corresponding dividend or distribution declared on the Parent Subordinate Voting Shares, as applicable. 3.4 Inability to Pay Dividends. If on any payment date for any dividends or distributions declared on the Class B Shares under Section 3.1 due to solvency requirement of the provisions of applicable law, the dividends or distributions are not paid in full on all of the Class B Shares then outstanding, any such dividends or distributions that remain unpaid shall be paid on the · first subsequent date or dates dctennined by the Board of Directors on which the Corporation shall have sufficient moneys, assets or other property properly to make payment of such dividend or distribution n in satisfaction of such solvency requirements and in compliance with such applicable law. 3.5 Determination of Economic Equivalence. The Board of Directors shall detennine, in good faith and acting reasonably (with the assistance of such reputable and qualified independent financial advisors and/or other experts as the Board of Directors may require), economic equivalence for the purposes of Sections 3.1, 12.1 and 12.2, and shall provide the holders of Class B Shares with a copy of a written detennination of economic equivalence and the underlying calculations supporting such detennination and the final version of any written report provided by such fmancial advisors and/or other experts supporting such determination, if requested. For greater certainty, the Board of Directors shall not be under any obligation to procure any such assistance in support of their detennination of economic equivalence for the purposes of Sections 3.1, 12.1 and 12.2. Notwithstanding anything to the contrary in these share provisions, within (I 0) Business Days following the delivery of the written detennination of economic equivalence to the holders of Class B Shares, Sellers' Representative may dispute such · detennination by written notice to the Board of Directors (the "Dispute Notice"). lfthc Dispute Notice is so given, the Sellers• Representative, on the one hand, and the Board of Directors, on the other hand, shall jointly select an appraiser which shall be an independent, nationally recognized finn of chartered professional accountants (the "Appraiser") who shall dctennine the economic 9 |

| ---------------------· ---. equivalence; provided, however, that if the Sellers' Representative and the Board of Directors cannot agree upon a single appraiser, Ovist & Howard, CP As shall be the Appraiser for purposes of this Section 3.5. The Appraiser shall conduct such independent procedures and investigations as the Appraiser shall deem necessary in order to form an opinion as to the economic equivalence and shall give written notice within thirty (30) days of its appointment as Appraiser of its detennination to Sellers' Representative and the Board of Directors. Such detennination shall be final and binding upon the Class B Shareholders and the Corporation, absent manifest error. The fees of the Appraiser shall be borne by the holders of Class B Shares, on the one hand, and the Corporation, on the other hand, in such amount(s) as will be determined by the Appraiser based on the proportion that the aggregate dollar amount of disputed items submitted to the Appraiser that is unsuccessfully disputed by the Sellers' Representative, on the one hand, or the Corporation, on the other hand, as determined by the Appraiser, bears to the total amount of such disputed items so referred to the Appraiser for resolution. ARTICLE4 CERTAIN RESTRICTIONS 4.1 Certain Restrictions. So long as any of the Class B Shares are outstanding, the Corporation shall not at any time without, but may at any time with, the approval of the holders of Class B Shares given as specified in Section 11.2: (a) amend the Constating Documents; or (b) initiate the voluntary liquidatjon, dissolution or winding-up of the Corporation nor take any action or omit to take any action that is designed to result in the liquidation, dissolution or winding-up of the Corporation. ARTICLES PAYMENT OF THE CLASS B SHARE CONSIDERATION 5.1 Payment of the Class B Share Consideration. For all purposes of these rights, privileges, restrictions and conditions attaching to the Class B Shares, payment of the Class B Share Consideration (including payment of the Additional Amount, if any) in respect of each Class B Share shall be made by causing to be issued or transferred to each holder of such Class B Share a Parent Subordinate Voting Share (which share shall be fully paid and shall be free and clear of any lien, claims or encumbrance) plus delivering a check of the Corporation in respect of the Additional Amount, if any, and in all cases, less any amounts on account of tax properly withheld in accordance with Section 13.3. In connection with such issuance or transfer of such Parent Subordinate Voting Share, such holder will, in Parent's discretion as to physical or electronic fonn, (i) receive, at the address of such holder recorded in the register of shareholders of the Corporation for the Class B Shares or, if requested by the holder, by holding for pick-up by such holder at the principal executive office of the Corporation a physical share certificate representing such Parent Subordinate Voting Share, or (ii) have such Parent Subordinate Voting Share registered on an uncertificated basis in the direct registration system maintained by Parent's transfer agent in the name of such holder of the Class B Share. 10 |

| ARTICLE6 DISTRIBUTION ON LIQUIDATION 6.1 Liquidation Rights. Subject to applicable law and the due exercise by Parent of its Liquidation Call Right, in the event of a Liquidation Event (as defined in Part II, Section 4.1), a holder of Class B Shares shall be entitled to receive in respect of each Class B Share held by such holder on the effective date (the "Liquidation Date'') of such Liquidation Event, before any other distribution of any part of the assets of the Corporation, an amount per Class B Share equal to the Class B Share Consideration applicable on the last Business Day prior to the Liquidation Date (the "Liquidation Amount''), except that the Class A Shares will have equivalent rights with respect to any unpaid dividends and distributions as set forth in Article 4 of Part II of these share provisions. 6.2 Payment and Delivery of Liquidation Amount. On or promptly after the Liquidation Date, and subject to the exercise by Parent of the Liquidation Call Right, the Corporation shall cause to be delivered to the holders of the Class B Shares the Liquidation Amount for each such Class B Share upon presentation and su1TCnder of the certificates representing such Class B Shares (or a lost stock certificate affidavit in a fonn reasonably satisfactory to the Corporation), a document (in the case of a holder who is a Resident) containing a representation and warranty that the holder is a Resident, together with such other documents and instruments as may be reasonably required to effect a transfer of Class B Shares under applicable law and the Constating Documents, at the principal executive office of the Corporation. Payment of the total Liquidation Amount for such Class B Shares shall be made in accordance with the provisions of Article S. On and after the Liquidation Date, the holders of the Class B Shares shall cease to be holders of such Class B Shares and shall not be entitled to exercise any of the rights of holders in respect thereof, other than the right to receive their proportionate part of the total Liquidation Amount, unless payment of the total Liquidation Amount for such Class B Shares shall not be made upon presentation and surrender of share certificates (or a lost stock certificate affidavit in lieu thereof) in accordance with the foregoing provisions, in which case the rights of the holders all remain unaffected until the total Liquidation Amount has been paid in the manner hereinbefore provided. Upon delivery of Parent Subordinate Voting Shares, the holders of the Class B Shares shall thereafter be considered and deemed for all purposes to be holders of Parent Subordinate Voting Shares delivered to them or the custodian on their behalf. 6,3 Rights after Liquidation. After the Corporation has satisfied its obligations to pay the holders of the Class B Shares the total Liquidation Amount, such holders shall not be entitled, in respect of the Class B Shares, to share in any further distributions of the assets of the Corporation. ARTICLE7 RETRACTION OF CLASS B SHARES BY HOLDER 7.1 Retraction Rights. A holder of Class B Shares shall be entitled, at any time and from time to time, subject to applicable law and the exercise by Parent of the Retraction Call Right and otherwise upon compliance with the provisions of this Article 7, to require the Corporation to redeem all or any portion of the Class B Shares registered in the name of such holder for an amount per Class B Share equal to the Class B Share Consideration on the last Business Day prior to the Retraction Date (the "Retraction Price''). To effect such redemption, the holder shall present and 11 -----------------.J |

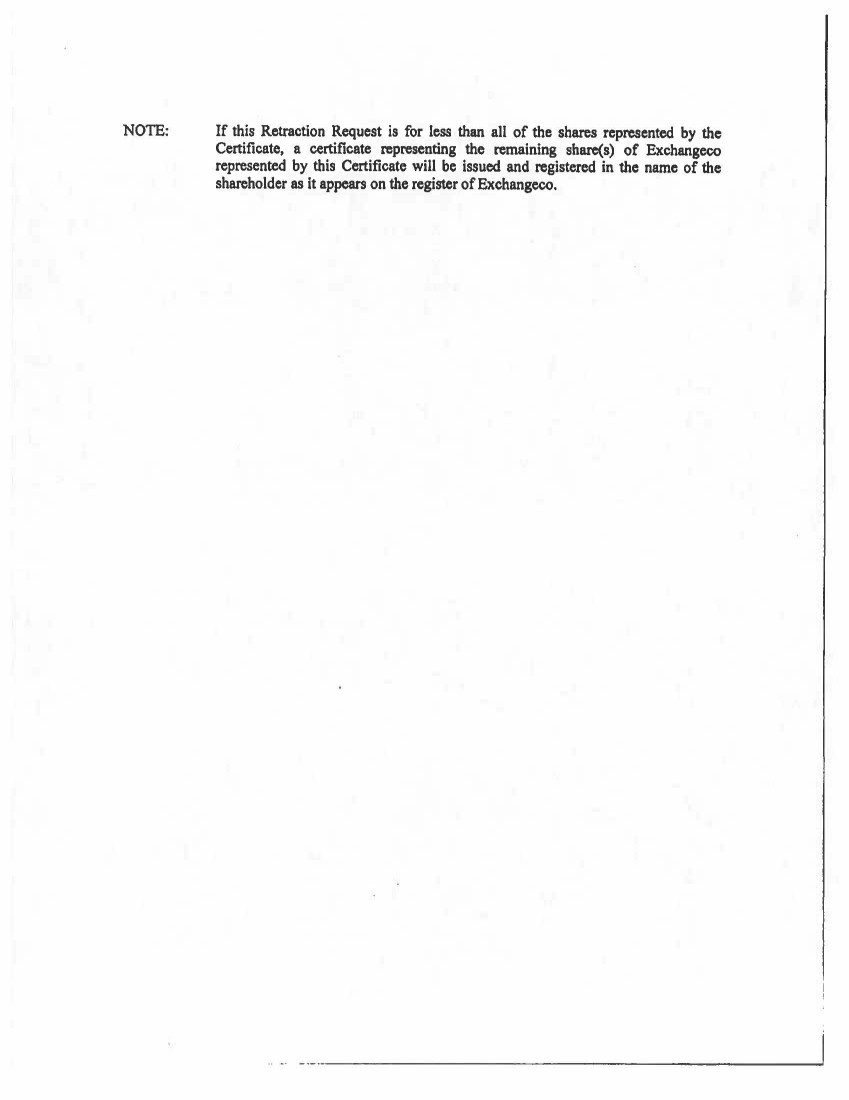

| ------ ------- ··-· -- surrender at the principal executive office of the Corporation the certificate or certificates representing the Class B Shares which the holder desires to have the Corporation redeem (or a lost stock certificate affidavit in a fonn reasonably satisfactory to the Corporation), together with such other documents and instruments as may be reasonably required to effect a transfer of Class B Shares under applicable Jaw and the Constating Documents and such additional documents and instruments as the Corporation may reasonably require, together with a duly executed statement (the "Retraction Request") in the fonn of Exhibit A or in such other fonn as may be acceptable to the Corporation: (a) specifying that the holder desires to have all or a specified portion of the Class B Shares represented by such certificate or certificates (the "Retracted Shares") redeemed by the Corporation; (b) stating the Business Day on which the holder desires to have the Corporation redeem the Retracted Shares (the "Retraction Date''), provided that the Retraction Date shall be not less than 1 O Business Days nor more than 20 Business Days after the date on which the Retraction Request is received by the Corporation and further provided that, in the event that no such Business Day is specified by the holder in the Retraction Request, the Retraction Date shall be deemed to be the 20th Business Day after the date on which the Retraction Request is received by the Corporation; (c) acknowledging the overriding right (the ''Retraction Call Right'') of Parent, pursuant to the Exchange Rights Agreement, to purchase all but not less than all of the Retracted Shares directly from the holder and that the Retraction Request shall be deemed to be a revocable offer by the holder to sell the Retracted Shares to Parent in accordance with the Retraction Call Right on the tenns and conditions set out in Article S of the Exchange Rights Agreement; and ( d) in the case of a holder who is a Resident, representing and warranting that the holder is a Resident. 7.2 Purchase by the Corporation. Subject to the exercise by Parent of the Retraction Call Right, upon receipt by the Corporation in the manner specified in Section 7 .1 of a certificate or certificates representing the number of Retracted Shares (or a lost stock certificate affidavit in lieu thereof), together with a Retraction Request, and provided that the Retraction Request is not revoked by the holder in the manner specified in Section 7.6, the Corporation shall redeem tho Retracted Shares effective at the close of business on the Retraction Date and shall cause to be delivered to such holder the Retraction Price. If only part of the Class B Shares represented by any certificate is redeemed (or purchased by Parent or any of its Affiliates pursuant to the Retraction Call Right), a new certificate for the balance of such Class B Shares to be retained by the holder of Class B Shares shall be issued to the holder by the Corporation. 7.3 Payment of Retraction Price. The Corporation shall deliver the Retraction Price in accordance with the provisions of Article S and such delivery by the Corporation shall be deemed to be payment of and shall satisfy and discharge all liability for the total Retraction Price. -- ·--· ------------------------- |

| --· ··---.. ········-·- "- . ·--· - 7.4 Rights after Retraction. On and after the close of business on the Retraction Date, the holder of the Retracted Shares shall cease to be a holder of such Retracted Shares and shall not be entitled to exercise any of the rights of a holder in respect thereof, other than the right to receive the Retraction Price per Class B Share, less any amounts on account of tax properly withheld accordance with applicable law and Section 13.3, unless upon presentation and surrender of certificates ( or a lost stock certificate affidavit in lieu thereof) in accordance with the foregoing provisions, payment of the total Retraction Price payable to such holder shall not be made as provided in Section 7 .3, in which case the rights of such holder shall remain unaffected until the total Retraction Price has been paid in the manner· hereinbefore provided. On and after the close of business on the Retraction Date, provided that presentation and surrender of certificates ( or a lost stock certificate affidavit in lieu thereof) and payment of the total Retraction Price has been made in accordance with the foregoing provisions, the holder of the Retracted Shares so redeemed by the Corporation shall thereafter be considered and deemed for all purposes to be a holder of the Parent Subordinate Voting Shares delivered to such holder. 7.5 Limitation on Retraction Rights. Notwithstanding any other provision of this Article 7, the Corporation shall not be obligated to redeem Retracted Shares specified by a holder in a Retraction Request to the extent that such redemption of Retracted Shares would be contrary to solvency requirements or other provisions of applicable law. If the Board of Directors determines that on any Retraction Date the Corporation would not be permitted by any of such provisions to redeem the Retracted Shares tendered for redemption on such date, the Corporation shall only be obligated to redeem Retracted Shares specified by a holder in a Retraction Request to the extent of the maximum number that may be so redeemed (rounded down to the next whole number of shares) as would not be contrary to such provisions and shall notify the holder at least two Business Days prior to the Retraction Date as to the number of Retracted Shares which will not be redeemed by the Corporation. In any case in which the redemption by the Corporation of Retracted Shares would be contrary to solvency requirements or other provisions of applicable law, and more than one holder has duly delivered a Retraction Request, the Corporation shall redeem Retracted Shares in accordance with Section 7.2 on a pro rata basis and shall issue to each holder of Retracted Shares a new certificate, at the expense of the Corporation, representing the Retracted Shares not redeemed by the Corporation pursuant to Section 7 .2. Provided that the Retraction Request is not revoked by the holder in the manner specified in Section 7 .6, the holder of any such Retracted Shares not redeemed by the Corporation pursuant to Section 7.2 as a result of solvency requirements or other provisions of applicable law shall be redeemed by giving the Retraction Request to require Parent to purchase such Retracted Shares from such holder on the Retraction Date or as soon as practicable thereafter on payment by Parent to such holder of the Retraction Price for each such Retracted Share pursuant to the Exchange Rights Agreement. 7.6 Withdrawal of Retraction Request. A holder of Retracted Shares may, by notice in writing given by the holder to the Corporation before the close of business on the Business Day immediately preceding the Retraction Date, withdraw such holder's Retraction Request, in which event such Retraction Request shall be null and void and, for greater certainty, the revocable offer constituted by the Retraction Request to sell the Retracted Shares to Parent shall be deemed to have been revoked. 13 |

| - ------------------· .. --· ARTICLES REDEMPTION OF CLASS B SHARES BY THE CORPORATION 8.1 Redemption Rights. Subject to applicable law, and provided Parent has not exercised the Redemption Call Right and the applicable holders of Class B Shares have not exercised the Class B Shareholders' Put Right, upon the occurrence of a Redemption Event the Corporation shall have the right to redeem all but not Jess than ail of the then outstanding Class B Shares for an amount per Class B Share equal to the Class B Share Consideration on the last Business Day prior to the Redemption Date (the "Redemption Price"). 8.2 Exercise of Redemption Rights. In the case of a proposed redemption by the Corporation of Class B Shares under this Article 8, the Corporation shall, (a) at least 15 days before the Redemption Date (other than a Redemption Date established in connection with a Control Transaction), notify Parent in writing (the "Redemption Notice") of the intention of the Corporation to redeem the Class B Shares; and (b) at least 10 days before the Redemption Date (other than a Redemption Date established in connection with a Control Transaction), send or cause to be sent to Parent and each holder of Class B Shares a notice in writing (the "Shareholder Redemption Notice") of the redemption by the Corporation of the Class B Shares held by such holder. In the case of a Redemption Date established in coMection with a Control Transaction, the Redemption Notice and the Shareholder Redemption Notice will be sent on or before the Redemption Date, on as many days prior written notice as may be detennined by the Board of Directors to be reasonably practicable in the circumstances (provided that at least ten Business Days' notice is given). In any such case, such notice shall set out the Redemption Date. 8.3 Payment and Delivery of Redemption Price. On the Redemption Date and subject to the exercise by Parent of the Redemption Call Right or the exercise of the Class B Shareholders' Put Right, the Corporation shall cause to be delivered to the holders of the Class B Shares to be redeemed the Class B Share Consideration representing the full Redemption Price for each such Class B Share, upon presentation and surrender at the principal executive office of the Corporation of the certificates representing such Class B Shares ( or a lost stock certificate affidavit in a fonn reasonably satisfactory to the Corporation), together with such other documents and instruments as may be reasonably required to effect a transfer of Class B Shares under the applicable law and the Constating Documents and (in the case of a holder who is a Resident) a representation and warranty by such holder of Class B Shares to be redeemed that such holder is a Resident Payment of the total Redemption Price for such Class B Shares shall be made in accordance with the provisions of Article 5. On and after the Redemption Date, the holders of the Class B Shares called for redemption shall cease to be holders of such Class B Shares and shall not be entitled to exercise any of the rights of holders in respect thereof, other than the right to receive their proportionate part of the total Redemption Price, less any amounts on account of tax properly withheld in accordance with applicable law and Section 13.3, unless payment of the total Redemption Price delivered to a holder for such Class B Shares shall not be made upon presentation and surrender 14 |

| of share certificates ( or lost stock certificate affidavit in lieu thereof) in accordance with the foregoing provisions, in which case the rights of the holders shall remain unaffected until the total Redemption Price has been paid in the manner hercinbefore provided. Upon such payment of the total Redemption Price, the holders of the Class B Shares shall thereafter be considered and deemed for all purposes to be holders of the Parent Subordinate Voting Shares delivered to them. ARTICLE!> PURCHASE FOR CANCELLATION 9.1 Purchase for Cancellation. Subject to applicable law and at the option of the holder of Class B Shares, the Corporation may at any time and from time to time purchase for cancellation all or any part of the Class B Shares by private contract with any holder of Class B Shares at any price agreed to between the Corporation and such holder of Class B Shares. ARTICLElO VOTING RIGHTS 10.1 Voting Rights. Except as required by applicable law and by Article 11 and 12, the holders of the Class B Shares shall not be entitled to receive notice of or to attend any meeting of the shareholders of the Corporation or to vote at any such meeting. ARTICLEll AMENDMENT AND APPROVAL 11.1 Holder Approval. The rights, privileges, restrictions and conditions attaching to the Class B Shares and the Class A Shares may be added to, changed or removed but only with approval of the holders of the Class B Shares given as hereinafter specified. 11.2 Approval Process. Any approval given by the holders of the Class B Shares to add to, change or remove any right, privilege, restriction or condition attaching to the Class B Shares or the Class A Shares or otherwise satisfy the requirements of Section 4.1 shall be deemed to have been sufficiently given if it shall have been given in accordance with applicable law subject to a minimum requirement that such approval be evidenced by resolution passed by not less than two-- thirds of the votes cast on such resolution at a meeting of holders of Class B Shares duly called and held at which the holders of at least 50% of the outstanding Class B Shares at that time are present or represented by proxy. If at any such meeting the holders of at least 50% of the outstanding Class B Shares at that time arc not present or represented by proxy within one-half hour after the time appointed for such meeting, then the meeting shall be adjourned to such date not less than five days thereafter and to such time and place as may be designated by the Chairman of such meeting. At such adjourned meeting the holders of Class B Shares present or represented by proxy thereat shall form a quorum and may transact the business for which the meeting was originally called and a resolution passed thereat by the affirmative vote of not less than two-thirds of the votes cast on such resolution at such meeting shall constitute the approval or consent of the holders of the Class B Shares. Notwithstanding anything to the contrary herein, any such approval or consent may be given without a meeting if, before the action, a written consent thereto is signed by holders of Class B Shares holding not less than two•thirds of the voting power of the Class B Shares then outstanding. 15 |

| ARTICLE 12 RECIPROCAL CHANGES, ETC. IN RESPECT OF PARENT SUBORDINATE VOTING SHARES 12.1 Except for the issuance of employee incentive stock-based compensation in accordance with the terms of any employee stock option plan of the Corporation or Parent then in effect, in the event that Parent, without the prior approval of the Corporation and the prior approval of the holders of the Class B Shares given in accordance with Section 11.2, (a) issues or distributes Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares) to the holders of the then outstanding Parent Subordinate Voting Shares, as applicable and without duplication, by way of stock dividend or other distribution, other than: (i) an issue of Parent Subordinate Voting Shares pursuant to a distribution to which Section 3.l(b) applies, or (ii) an issue of Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares) to holders of Parent Subordinate Voting Shares who exercise an option to receive dividends of Parent Subordinate Voting Shares ( or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares) in lieu of receiving cash dividends, provided that the holders of Class B Shares shall receive the same option to either receive such cash dividends or distributions pursuant to Section 3. l(a) or receive dividends or distributions of Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares) or have their Class B Shares adjusted pursuant to Section 3.l(b); (b) issues or distributes rights, options or wmants to the holders of the then outstanding Parent Subordinate Voting Shares entitling them to subscribe for or to purchase Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares, all as applicable and without duplication); or (c) issues or distributes to the holders of the then outstanding Parent Subordinate Voting Shares ( other than an issuance or distribution pursuant to which Section 3.l(c) applies): (i) shares or securities of Parent of any class other than Parent Subordinate Voting Shares; (ii) rights, options or warrants other than those referred to in Section 12.l(b); or (iii) evidences of indebtedness of Parent, 16 |

| the Corporation will provide at least five Business Days prior notice to the holders of Class B Shares and will ensure that the economic equivalent (as determined by the Board of Directors in accordance with Section 3.5) on a per share basis of such Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares), rights, options, warrants, securities, shares, evidences of indebtedness or other assets is issued or distributed simultaneously to holders of the Class B Shares, all as applicable and without duplication. For the avoidance of doubt, no stock, securities or other assets shall be issued or distributed to the holders of Class B Shares under this Section 12.1 unless an equivalent amount on a per share basis is issued or distributed to the holders of Class A Shares under Section 5.1 of Part Il. 12,2 In the event that Parent, without the prior approval of the Corporation and the prior approval of the holders of the Class B Shares given in accordance with Section 11.2, (a) subdivides, redivides or changes the then outstanding Parent Subordinate Voting Shares into a greater number of Parent Subordinate Voting Shares; (b) reduces, combines, consolidates or changes the then outstanding Parent Subordinate Voting Shares into a lesser number of Parent Subordinate Voting Shares;or · (c) reclassifies or otherwise changes the Parent Subordinate Voting Shares or effects an amalgamation, merger, reorganization or other similar transaction affecting the Parent Subordinate Voting Shares, the Corporation will ensure that the same or an economically equivalent (as detennined by the Board of Directors in accordance with Section 3.5) change as effected in respect of the Parent Subordinate Voting Shares shall simultaneously be made to, or in, the rights of the holders of the Class B Shares. Notwithstanding any other provision in these share provisions, this Article 12 shall not be changed without the approval of the holders of the Class B Shares given in accordance with Section 11.2. ARTICLE13 LEGEND, WITHHOLDING RIGHTS; SPECIFIED AMOUNT 13.1 Legend. The certificates evidencing the Class B Shares shall contain or have affixed thereto a legend in fonn and on tenns approved by the Board of Directors with respect to the provisions of the Exchange Rights Agreement. 13.2 Acknowledgement. Each holder of a Class B Share, whether of record or beneficial, by virtue of becoming and being such a holder, shall be deemed to acknowledge each of the Liquidation Call Right, the Retraction Call Right and the Redemption Call Right, in each case, in favor of Parent, and the overriding nature thereof in coMection with the liquidation, dissolution or winding-up of the Corporation, or the retraction or redemption of Class B Shares, as the case may be, and to be bound thereby in favor of Parent as therein provided. 13.3 Withholding Rights. Each of the Corporation, Parent and their Affiliates shall be entitled to deduct and withhold from any dividend or other amount otherwise payable to any holder of 17 |

| Class B Shares such amounts as the Corporation, Parent or such Affiliate is required or permitted (to the extent that absent such permitted withholding, the payor would be liable for, or for amounts on account of, taxes, interest and/or penalties in connection with the payment) to deduct or withhold with respect to such payment under the Income Tax Act (Canada) (including without limitation Section 116 and Part XIII thereof), the Code or any provision of provincial, state, local or foreign tax law, in each case, as amended. To the extent that amounts arc so withheld, such withheld amounts shall be treated for all purposes hereof as having been paid to the holder of the Class B Shares in respect of which such deduction and withholding was made, provided that such withheld amounts are actually remitted when due to the appropriate taxing authority and reasonable documentation respecting such payment is provided to the holder of the Class B Shares. To the extent that the amount so required or permitted to be deducted or withheld from any payment to a holder exceeds the cash portion of the consideration otherwise payable to the holder, subject to right of the holder of Class B Shares as provided for below to provide such additional cash as is necessary to satisfy the tax obligations set out above, the Corporation, Parent and their Affiliates are hereby authorized to sell or otherwise dispose of such portion of the non-cash consideration as is necessary to provide sufficient funds to the Corporation, Parent or such of their Affiliates, as the case may be, to enable it to comply with such deduction withholding requirement and the Corporation, Parent or such of their Affiliates shall notify the holder thereof and remit to the holder any portion of the net proceeds of such sale not required or permitted to be deducted or withheld. All payments to be made hereunder shall be made without interest. Notwithstanding anything to the contrary herein and if commercially reasonable, prior to selling any non-cash consideration to satisfy tax obligations as provided for above, the Corporation, Parent or its Affiliates, as applicable, shall notify the holder of Class B Shares that it shall be making the deductions or withholdings noted above and the holder of Class B Shares shall have the option to provide cash to the Corporation, Parent or its Affiliates, as applicable, in amount equal to the amounts to be withheld or deducted within three Business Days of delivery of the notice, in which case the Corporation, Parent or its Affiliates, as applicable, shall not sell any non-cash consideration until such three (3) Business Day period had passed. ARTICLE 14 NOTICES 14.1 Any notice, request or other communication to be given to the Corporation by a holder of . Class B Shares shall be in writing and shall be valid and effective if given by mail (postage prepaid) or by facsimile or by delivery to the principal executive office of the Corporation and addressed to the attention of the President of the Corporation. Any such notice, request or other communication, if given by mail, facsimile or delivery, shall only be deemed to have been given and received (i) on the date of personal delivery, (ii) on the date of confirmed facsimile transmission, (iii) on the Business Day after it is deposited for delivery with a nationally recognized commercial overnight delivery service, or (iv) on the third (3rd) Business Day after deposit in the national certified or prepaid mail. 14.2 Any presentation and surrender by a holder of Class B Shares to the Corporation of certificates representing Class B Shares in connection with the liquidation, dissolution or winding-up of the Corporation or the retraction or redemption of Class B Shares shall be made by registered mail (postage prepaid) or by delivery to the principal executive office of the Corporation addressed to the attention of the President of the Corporation. Any such presentation and surrender of 18 |

| -·------·------- certificates shall only be deemed to have been made and to be effective upon actual receipt thereof by the Corporation. Any such presentation and surrender of certificates made by registered mail shall be at the sole risk of the holder mailing the same. 14.3 Any notice, request or other communication to be given to a holder of Class B Shares by or on behalf of the Corporation shall be in writing and shall be valid and effective if given by delivery to the address of the holder recorded in the register of shareholders of the Corporation or in the event of the address of any such holder not being so recorded, then at the last known address of such holder. Any such notice, request or other communication, shall be deemed to have been given and received on (i) the date of personal delivery, (ii) on the date of confirmed facsimile transmission, (iii) on the Business Day after it is deposited for delivery with a nationally recognized commercial overnight delivery service, or (iv) on the third (3nl) Business Day after deposit in the national certified or prepaid mail. Accidental failure or omission to give any notice, request or other communication to one or more holders of Class B Shares shall not invalidate or otherwise alter or affect any action or proceeding to be taken by the Corporation pursuant thereto except where such failure or omission has a material prejudicial effect in respect of the rights of that holder of the Class B Shares. 19 |

| PART II CLASS A SHARE PROVISIONS The Class A Shares, as a class, shall have attached thereto the following rights, privileges, restrictions and conditions: ARTICLE 1 INTERPRETATION 1.1 The defmed tenns and other provisions in Article 1 of Part I of these share provisions shall also apply to this Part II. References to Sections made in this Part II are to Sections in this Part II, unless otherwise indicated. Unless otherwise specified or required by context, the terms ''these share provisions", "hereof', "herein" and "hereunder" and similar expressions refer to these Class A Share provisions and the Class B Share provisions and not to any particular Article, Section or other portion hereof and include any agreement or instrument supplementary or ancillary hereto. ARTICLE2 DIVIDENDS 2.1 A holder of a Class A Share shall be entitled to receive dividends if, as and when declared by the Board of Directors out of the assets of the Corporation properly available for the payment of dividends of such amounts and payable in such manner as the Board of Directors may from time to time detennine. A holder of a Class A Share shall be entitled to receive, and the Board of Directors shall, subject to applicable law, declare a dividend or other distribution on each Class A Share equivalent to each dividend or other distribution declared on each Class B Share. Without limiting the foregoing, a holder of a Class A Share shall be entitled to receive, and the Board of Directors shall, subject to applicable law, on each Parent Distribution Declaration Date declare, a dividend or other distribution on each Class A Share: (a} in the case of a cash dividend or distribution declared on the Parent Subordinate Voting Shares, in an aggregate amount in cash for each Class A Share as is equal in U.S. dollars, or the Canadian Dollar Equivalent thereof on the Parent Distribution Declaration Date, in each case, to the per share cash dividend or distribution declared on the Parent Subordinate Voting Shares, as applicable and without duplication; (b) in the case of a stock dividend or distribution declared on the Parent Subordinate Voting Shares from and after the Closing Date to be paid in Parent Subordinate Voting Shares ( or other equity securities of Parent, or securities convertible for or exchangeable into equity securities of Parent}, by the payment by the Corporation of cash in an amount that is economically equivalent (as determined by the Board of Directors) to the number of Parent Subordinate Voting Shares (or other equity securities of Parent, or securities convertible for or exchangeable into equity securities of Parent) to be paid on each Parent Subordinate Voting Share, as applicable and without duplication; or 20 |

| (c) in the case of a dividend or distribution declared on the Parent Subordinate Voting Shares to be paid in property other than (i) cash, (ii) Parent Subordinate Voting Shares, (iii) other equity securities of Parent or (iv) securities convertible for or exchangeable into equity securities of Parent, in such type and amount of property for each Class A Share as is the same as or economically equivalent (as detennined by the Board of Directors in accordance with Section 2.5) to the type and aggregate amount of property declared as a dividend or distribution on the Parent Subordinate Voting Shares, as applicable and without duplication. Such dividends or distributions shall be paid out of money, assets or property of the Corporation properly applicable to the payment of dividends, or out of authorized but unissued shares of the Corporation, as applicable. Any dividend which should have been declared or paid on the Class A Shares pursuant to this Section 2.1 but was not so declared or paid due to the provisions of applicable law shall be declared and paid by the Corporation as soon as payment of such dividend is pennitted by such law. 2.2 Payment of Dividends. Checks of the Corporation payable at par at any branch of the bankers of the Corporation shall be issued in respect of any cash dividends or distributions contemplated by Section 2.1 (a) and the sending of such a check to each holder of a Class A Share, and receipt by that holder of such check, shall satisfy the payment of the cash dividend or distribution represented thereby . unless the check is not paid on presentation. Certificates registered in the name of the holder of Class A Shares shall be issued or transferred in respect of any stock dividends or distributions of Class A Shares contemplated by Section 2. l(b) and the sending of such a certificate to each holder of a Class A Share, and the receipt by that holder of such certificate, shall satisfy the stock dividend or distribution of Class A Shares represented thereby. Such other type and amount of property in respect of any dividends or distributions contemplated by Section 2.1 (a) shall be paid, issued, distributed or transferred by the Corporation in such manner as it shall reasonably determine and the payment, issuance, distribution or transfer thereof by the Corporation to each holder of a Class A Share · shall satisfy the dividend or distribution represented thereby. No holder of a Class A Share shall be entitled to recover by action or other legal process against the Corporation any dividend or distribution that is represented by a check that, if received by such holder, has not been duly presented to the Corporation's bankers for payment or that otherwise remains unclaimed for a period of two years from the date on which such dividend or distribution was paid. 2.3 Record and Payment Dates. The record date for the detennination of the holders of Class A Shares entitled to receive payment of, and the payment date for, any dividend or distribution declared on the Class A Shares under Section 2.1 shall be the same dates as the record and payment date, respectively, for the corresponding dividend or distribution declared on the Class B Shares, as applicable. l.4 Inability to Pay Dividends. If on any payment date for any dividends or distributions declared on the Class A Shares under Section 2.1, the dividends or distributions are not paid in full on all of the Class A Shares then outstanding due to solvency requirements or the provisions of applicable law, any such dividends ~r distributions that remain unpaid shall be paid on the first subsequent date or dates detennined by the Board of Directors on which the Corporation shall have 21 |

| sufficient moneys, assets or other property to make payment of such dividend or distribution n in satisfaction of such solvency requirements and in compliance with such applicable law. 2.5 Determination of Economic Equivalence. The Board of Directors shall detennine, in good faith and acting reasonably (with the assistance of such reputable and qualified independent financial advisors and/or other experts as the Board of Directors may require), economic equivalence for the purposes of Sections 2.1, S.l and 5.21 and shall provide the Class A Shareholders with a copy of a written detennination of economic equivalence and the underlying calculations supporting such detennination and the final version of any written report provided by such financial advisors and/or other experts supporting such detennination, if requested. For greater certainty, the Board of Directors shall not be under any obligation to procure any such assistance in support of their detennination of economic equivalence for the purposes of Sections 2.1, 5.1 and 5.2. ARTICLE3 VOTING RIGHTS 3,1 The holders of the Class A Shares shall be entitled to receive notice of and to attend any meeting of the shareholders of the Corporation and shall be entitled to one vote in respect of each Class A Share held at such meetings, except a meeting of holders of a particular class or series of shares other than the Class A Shares who are entitled to vote separately as a class or series at such meeting. ARTICLE4 LIQUIDATION, DISSOLUTION OR WINDING-UP 4.1 In the event of Liquidation Event, the holders of the Class A Shares shal1, subject to the rights of the holders of the Class B Shares under Section 6.1 of Part 1 of these share provisions in respect of any such distribution on liquidation, dissolution or winding up of the Corporation or other distribution of its property or assets among its shareholders for the purpose of winding up its affairs, whether voluntary or involuntary (any such event, "Liquidation Event"), be entitled to receive ~e remaining property and assets of the Corporation, except that the holders of Class A Shares shall first be entitled to receive, on a pari passu basis with respect to that portion of the Liquidation Amount payable to the holders of Class B Shares under subsections (b) and (c) of the definition of Class B Share Consideration, the following amounts: (a) the sum of (i) unless corresponding equivalent dividends or distributions have already been declared and have been or will be paid on the Class A Share under Section 2. l(a) of this Part 11 prior to orat the effective time of any such Liquidation Event, the excess, if any, of (A) the aggregate amount of all cash dividends or other cash distributions declared and paid by Parent on a Parent Subordinate Voting Share prior to or at the effective time of such Liquidation Event, over (B) the aggregate amount of all cash dividends or other cash distributions declared and paid by the Corporation on the Class A Share under Section 2.1 (a) of this Part II prior to or at the effective time of such Liquidation Event; nl.Y! (ii) the amount of any cash dividends or other cash distributions on the Class A Share which have been declared but not yet paid as of the effective time of such Liquidation Event ( detennincd 22 |

| without duplication of amounts taken into account under clause (i), above), such sum payable in U.S. dollars or the Canadian Dollar Equivalent by means of a check payable at any branch of the bankers of the payor; plus (b) the sum of (i) unless corresponding equivalent dividends or distributions have already been declared and have been or will be paid on the Class A Share under Section 2.l(c) of this Patt Il prior to or at the effective time of any such Liquidation Event, the excess, if any, of (A) the aggregate fair market value of all declared and paid non-cash dividends or other non-cash distributions by Parent on a Parent Subordinate Voting Share prior to or at the effective time of such Liquidation Event, over (B) the aggregate fair market value of all non-cash dividends or other non-cash distributions declared and paid by the Corporation on the Class A Share under Section 2.l(c) of this Part II prior to or at the effective time of such Liquidation Event, RIJa (ii) the aggregate fair market value of any non-cash dividends or other non-cash distributions on the Class A Share which have been declared but not yet paid as of the effective time of such Liquidation Event (detennined without duplication of amounts taken into account under clause (i), above), such sum payable by means of a check payable at any branch of the bankers of the payor in U.S. dollars or the Canadian Dollar Equivalent or, at the option of the Board of Directors, payable by the delivery of non-cash items having a fair market value equal to the amount of such sum. The rights of holders of Class A Shares under this Section 4.1 to receive unpaid dividends and distributions shall rank pari passu with the rights of the holders of Class B Shares to receive unpaid dividends and distributions (as provided for in subsections (b) and (c) of the definition of Class B Share Consideration) under Section 6.1 of Part I of these share provisions. ARTICLES RECIPROCAL CHANGES, ETC. IN RESPECT OF PARENT SUBORDINATE VOTING SHARES 5.1 Except for the issuance of employee incentive stock-based compensation in accordance with the tenns of any employee stock option plan of the Corporation or Parent then in effect, in the event that Parent, without the prior approval of the Corporation and the prior approval of the holders of the Class A Shares, · (a) issues or distributes Parent Subordinate Voting Shares (or securities exchangeable for or convertible into or carrying rights to acquire Parent Subordinate Voting Shares) to the holders of the then outstanding Parent Subordinate Voting Shares, as applicable and without duplication, by way of stock dividend or other distri~ution, other than: (i) an issue of Parent Subordinate Voting Shares pursuant to a distribution to which Section 2.l(b) applies, or (ii) an issue of Parent Subordinate Voting Shares (or securities exchangeable for or convertible into _or carrying rights to acquire Parent Subordinate Voting 23 |